That’s not late — that’s the new normal.

Fewer buyers.

Longer renters.

Bigger opportunities for investors.

Homeownership is aging up.

Rental demand is leveling up.

Smart investors are paying attention.

That’s not late — that’s the new normal.

Fewer buyers.

Longer renters.

Bigger opportunities for investors.

Homeownership is aging up.

Rental demand is leveling up.

Smart investors are paying attention.

According to Apollo’s Chief Economist, companies like Amazon, Microsoft, and Google are now spending 60% of their operating cash flow on capex—a record high.

According to Apollo’s Chief Economist, companies like Amazon, Microsoft, and Google are now spending 60% of their operating cash flow on capex—a record high.

On paper, it lowers monthly payments.

In practice, it slows equity growth—and currently violates Dodd-Frank rules.

On paper, it lowers monthly payments.

In practice, it slows equity growth—and currently violates Dodd-Frank rules.

At JKAM, we’re already putting AI to work:

• Analyzing deals faster

• Spotting market trends sooner

• Delivering smarter investor insights

At JKAM, we’re already putting AI to work:

• Analyzing deals faster

• Spotting market trends sooner

• Delivering smarter investor insights

Step by step.

Slow. Precise. Intentional.

Step by step.

Slow. Precise. Intentional.

Pending sales in San Francisco are up 17%, and homes are selling in half the time of the national average.

Rising incomes, lower rates, and tighter supply are pushing the Bay Area market into high gear again.

Smart investors are already watching closely.

Pending sales in San Francisco are up 17%, and homes are selling in half the time of the national average.

Rising incomes, lower rates, and tighter supply are pushing the Bay Area market into high gear again.

Smart investors are already watching closely.

Grocery-anchored strip centers are proving it—95% leased, strong returns, and built around one thing: convenience.

Smart investors are already paying attention.

Want to know how JKAM is positioning around this trend? Message us.

Grocery-anchored strip centers are proving it—95% leased, strong returns, and built around one thing: convenience.

Smart investors are already paying attention.

Want to know how JKAM is positioning around this trend? Message us.

Strong year. Fragile balance.

Message us to diversify your portfolio!

Strong year. Fragile balance.

Message us to diversify your portfolio!

After the Fed’s latest rate cut, more buyers are choosing ARMs for one reason: lower initial payments. Some are saving nearly a full percentage point compared to 30-year fixed loans.

After the Fed’s latest rate cut, more buyers are choosing ARMs for one reason: lower initial payments. Some are saving nearly a full percentage point compared to 30-year fixed loans.

But Powell made it clear the next move is uncertain.

But Powell made it clear the next move is uncertain.

But here’s the truth — over 80% of U.S. production comes from small business operators.

In our latest podcast, we talk about how to avoid risky oil and gas deals and what real due diligence looks like.

But here’s the truth — over 80% of U.S. production comes from small business operators.

In our latest podcast, we talk about how to avoid risky oil and gas deals and what real due diligence looks like.

Zillow reports 37% of rentals offered concessions in September — the highest level ever recorded.

Free rent. Free parking. Free perks.

Not generosity. A warning sign.

Zillow reports 37% of rentals offered concessions in September — the highest level ever recorded.

Free rent. Free parking. Free perks.

Not generosity. A warning sign.

𝘑𝘗𝘔𝘰𝘳𝘨𝘢𝘯 𝘊𝘩𝘢𝘴𝘦 analysts estimate that the global stablecoin market could drive $𝟭.𝟰 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in new demand for the U.S. dollar by 2027.

𝘑𝘗𝘔𝘰𝘳𝘨𝘢𝘯 𝘊𝘩𝘢𝘴𝘦 analysts estimate that the global stablecoin market could drive $𝟭.𝟰 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 in new demand for the U.S. dollar by 2027.

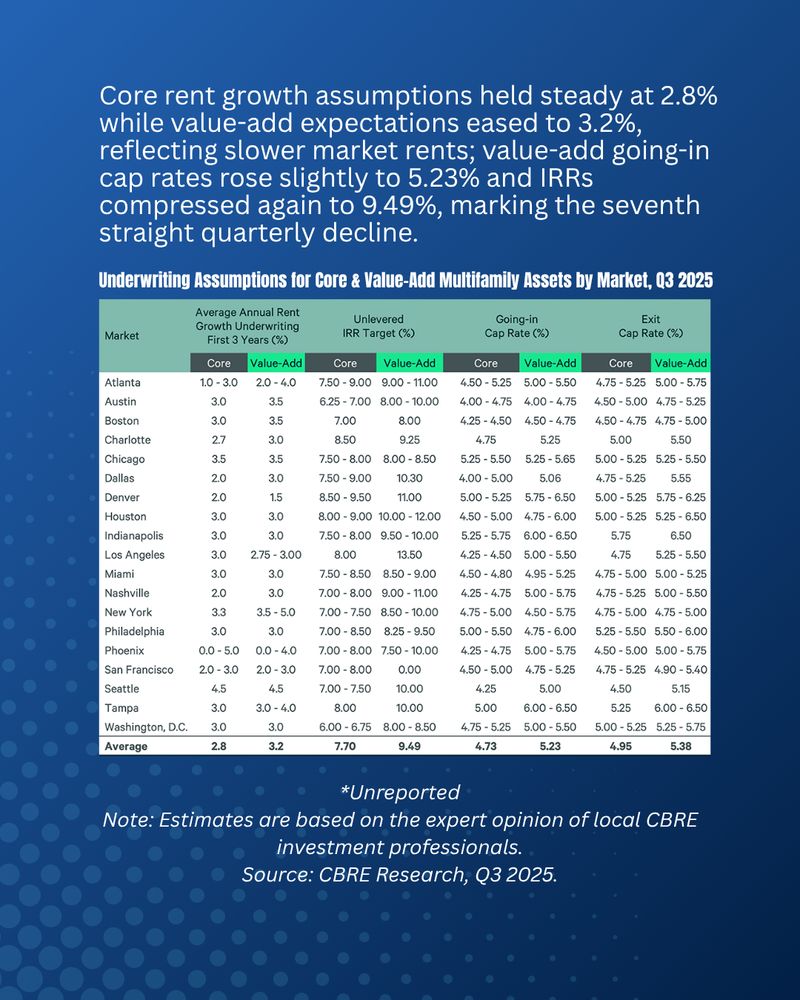

For the first time this year, multifamily buyer sentiment is turning positive.

CBRE’s Q3 2025 report shows what many investors have been waiting for — a shift in confidence.

For the first time this year, multifamily buyer sentiment is turning positive.

CBRE’s Q3 2025 report shows what many investors have been waiting for — a shift in confidence.

My weight.

And my investments.

Both require consistency.

Both reward patience.

Both compound quietly.

In February 2024, I promised myself to get consistent, not just in the gym, but in every part of life.

My weight.

And my investments.

Both require consistency.

Both reward patience.

Both compound quietly.

In February 2024, I promised myself to get consistent, not just in the gym, but in every part of life.

In our latest JKAM Podcast, Dave Wolcott shares how cycling and pickleball helped him lose 60 pounds and gain sharper focus in life and investing.

In our latest JKAM Podcast, Dave Wolcott shares how cycling and pickleball helped him lose 60 pounds and gain sharper focus in life and investing.

Wellness isn’t just a lifestyle trend anymore. It’s driving 𝗿𝗲𝗮𝗹 𝗲𝘀𝘁𝗮𝘁𝗲 𝗽𝗿𝗲𝗺𝗶𝘂𝗺𝘀.

Wellness isn’t just a lifestyle trend anymore. It’s driving 𝗿𝗲𝗮𝗹 𝗲𝘀𝘁𝗮𝘁𝗲 𝗽𝗿𝗲𝗺𝗶𝘂𝗺𝘀.

They’re all part of the playbook the ultra-wealthy are using right now — and Jack breaks it down with Dave Wolcott of Pantheon Investments.

🎧 New episode out now → Link in comments

#AlternativeInvestorMastermind #PassiveIncome #AIWealth

They’re all part of the playbook the ultra-wealthy are using right now — and Jack breaks it down with Dave Wolcott of Pantheon Investments.

🎧 New episode out now → Link in comments

#AlternativeInvestorMastermind #PassiveIncome #AIWealth

More listings, lower prices, and less competition = a rare sweet spot for homebuyers.

For buyers ready to move, this week could deliver real choices and savings when the market is most forgiving.

More listings, lower prices, and less competition = a rare sweet spot for homebuyers.

For buyers ready to move, this week could deliver real choices and savings when the market is most forgiving.

Markets may pause, but smart investors prepare.

At JKAM, we focus on stability, resilience, and opportunity even when Washington hits pause.

Markets may pause, but smart investors prepare.

At JKAM, we focus on stability, resilience, and opportunity even when Washington hits pause.

That’s the highest share in 5 years.

Institutional players are scaling back, but small and mid-sized investors are stepping up — especially in the Midwest and South where affordability still drives demand.

That’s the highest share in 5 years.

Institutional players are scaling back, but small and mid-sized investors are stepping up — especially in the Midwest and South where affordability still drives demand.

A $275B shortfall by 2030 + 87% occupancy = massive demand ahead.

At JKAM, we’re focusing where demographics & stability align. #RealEstate #Investing

A $275B shortfall by 2030 + 87% occupancy = massive demand ahead.

At JKAM, we’re focusing where demographics & stability align. #RealEstate #Investing

Job openings are down, profits are up, and the disruption is hitting white-collar work this time.

Like every revolution, it’ll create new opportunities too — in data, energy, infrastructure, and beyond. The key? Adapt early.

#AI #FutureOfWork #Investing #JKAM

Job openings are down, profits are up, and the disruption is hitting white-collar work this time.

Like every revolution, it’ll create new opportunities too — in data, energy, infrastructure, and beyond. The key? Adapt early.

#AI #FutureOfWork #Investing #JKAM

Lessen's AIden AI's next wave isn’t about replacing people — it’s removing friction.

Smarter workflows → faster turns → better NOI.

The future edge in real estate isn’t who owns the most doors — it’s who runs them best.

Lessen's AIden AI's next wave isn’t about replacing people — it’s removing friction.

Smarter workflows → faster turns → better NOI.

The future edge in real estate isn’t who owns the most doors — it’s who runs them best.

Designed for strong cash flow and structured for serious investors.

📩 DM us for details or visit JKAMInvestments.com to get access.

Designed for strong cash flow and structured for serious investors.

📩 DM us for details or visit JKAMInvestments.com to get access.