Forgetting the pre-GFC period leaves a very narrow set of plausible set of macro regimes that could drive asset prices ahead and far too much hope that stocks have reliable double digit returns when they don't.

Forgetting the pre-GFC period leaves a very narrow set of plausible set of macro regimes that could drive asset prices ahead and far too much hope that stocks have reliable double digit returns when they don't.

Last few years showed once again much better to 1) increase diversification and 2) hold cash to meet risk targets.

unlimitedfunds.com/diversified-...

Last few years showed once again much better to 1) increase diversification and 2) hold cash to meet risk targets.

unlimitedfunds.com/diversified-...

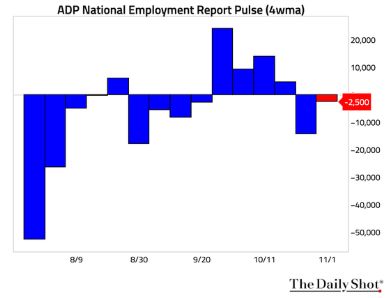

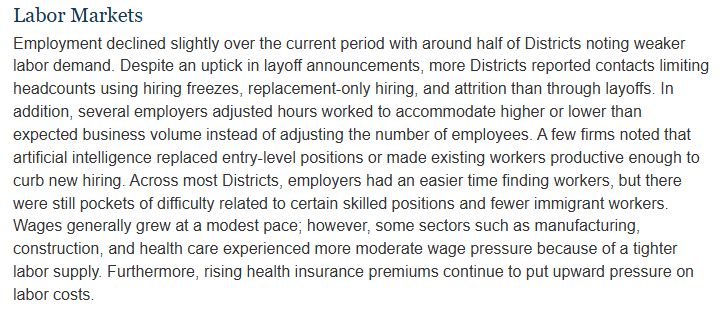

Headline Black Friday sales rose ~4%, but weakening e-commerce reads suggest a bit softer demand. With jobs flat and wages soft, the holiday season will test whether households can keep spending.

bobeunlimited.substack.com/p/squinting-...

Headline Black Friday sales rose ~4%, but weakening e-commerce reads suggest a bit softer demand. With jobs flat and wages soft, the holiday season will test whether households can keep spending.

bobeunlimited.substack.com/p/squinting-...

bobeunlimited.substack.com/p/continued-...

bobeunlimited.substack.com/p/continued-...

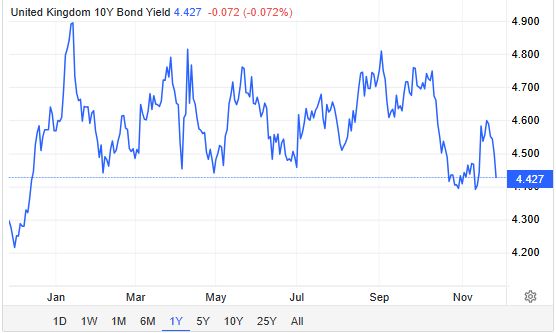

bobeunlimited.substack.com/p/the-uk-adj...

bobeunlimited.substack.com/p/the-uk-adj...

bobeunlimited.substack.com/p/australias...

bobeunlimited.substack.com/p/australias...

Apples, green grapes, walnuts, dates, marshmallows and a whole lotta mayo.

Apples, green grapes, walnuts, dates, marshmallows and a whole lotta mayo.

Weaker data has renewed hopes for easy money ahead. While assets bounced, the moves have been muted vs the October euphoria, suggesting the ‘bad news is good news’ trade may be running out of steam.

open.substack.com/pub/bobeunli...

Weaker data has renewed hopes for easy money ahead. While assets bounced, the moves have been muted vs the October euphoria, suggesting the ‘bad news is good news’ trade may be running out of steam.

open.substack.com/pub/bobeunli...

Lower mortgage rates aren’t reviving housing b/c prices remain too high, with ~15% price drop *and* 3% mortgage rates required for a cycle bottom. And with it neutering the Fed's top easing lever.

bobeunlimited.substack.com/p/us-house-p...

Lower mortgage rates aren’t reviving housing b/c prices remain too high, with ~15% price drop *and* 3% mortgage rates required for a cycle bottom. And with it neutering the Fed's top easing lever.

bobeunlimited.substack.com/p/us-house-p...

Takaichi’s modest stimulus is colliding with a tighter BoJ, pushing yields higher. With economic malaise endemic, Japan requires much more aggressive policy efforts to reach escape velocity.

bobeunlimited.substack.com/p/the-haunti...

Takaichi’s modest stimulus is colliding with a tighter BoJ, pushing yields higher. With economic malaise endemic, Japan requires much more aggressive policy efforts to reach escape velocity.

bobeunlimited.substack.com/p/the-haunti...

bobeunlimited.substack.com/p/europe-low...

bobeunlimited.substack.com/p/europe-low...

bobeunlimited.substack.com/p/housing-sl...

bobeunlimited.substack.com/p/housing-sl...

bobeunlimited.substack.com/p/the-uk-adj...

bobeunlimited.substack.com/p/the-uk-adj...

More here:

unlimitedfunds.com/elusive-pers...

More here:

unlimitedfunds.com/elusive-pers...

bobeunlimited.substack.com/p/the-ism-an...

bobeunlimited.substack.com/p/the-ism-an...

AI mania and easy-policy bets pushed assets to highs, but not even a good NVDA print and an employment report opening the door for a Dec easing could do enough to keep the euphoria from fading.

bobeunlimited.substack.com/p/boy-that-e...

AI mania and easy-policy bets pushed assets to highs, but not even a good NVDA print and an employment report opening the door for a Dec easing could do enough to keep the euphoria from fading.

bobeunlimited.substack.com/p/boy-that-e...