Tech | Econ Dev | Investing | China/APAC

https://www.readwriteinvest.com/

In '24, China will consume around ~10,000 TWh.

So this is equivalent to ~0.5% of total power consumption in China a year.

This compares with est. ~78 TWh for the entire light NEV fleet.

In '24, China will consume around ~10,000 TWh.

So this is equivalent to ~0.5% of total power consumption in China a year.

This compares with est. ~78 TWh for the entire light NEV fleet.

A fully packed EV can be nearly as efficient as HSR but cars are most often used by a single person/driver.

A fully packed EV can be nearly as efficient as HSR but cars are most often used by a single person/driver.

An EV with two passengers would be ~105 watt-hours per px-km.

An EV with two passengers would be ~105 watt-hours per px-km.

The typical ~348 km trip takes up ~13.2 kWh, or around half a days worth of typical power consumption.

The typical ~348 km trip takes up ~13.2 kWh, or around half a days worth of typical power consumption.

Amortized across 124B passenger rides comes out to $8 per ride and 2.3 cents per km.

Avg. mfg. wage is ~$8/hour today, so the amortized upfront build cost per ride is about 1 hour's worth of avg. mfg. work today.

Amortized across 124B passenger rides comes out to $8 per ride and 2.3 cents per km.

Avg. mfg. wage is ~$8/hour today, so the amortized upfront build cost per ride is about 1 hour's worth of avg. mfg. work today.

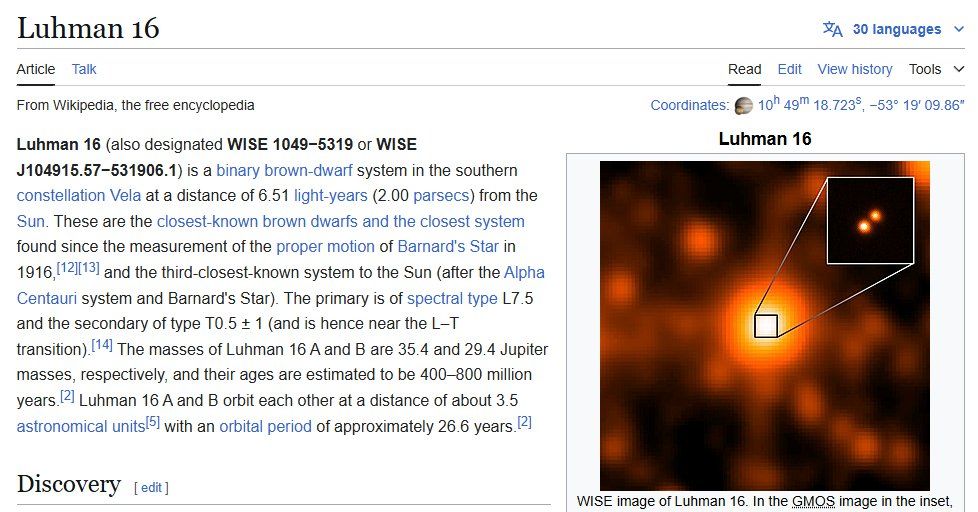

This gets you to Luhman 16, the third-closest known star.

This gets you to Luhman 16, the third-closest known star.

We just have to get their in one piece so we can deliver it to them.

We just have to get their in one piece so we can deliver it to them.

Where this ends up is a much harder question to resolve but as long as people don't get so emotional and nasty about it, I am confident we will be able to collectively figure it out.

Where this ends up is a much harder question to resolve but as long as people don't get so emotional and nasty about it, I am confident we will be able to collectively figure it out.

The world will need to find a new equilibrium point — and new (or modified) organizational structures.

The world will need to find a new equilibrium point — and new (or modified) organizational structures.

Levelheaded recognition of this reality (i.e. not freaking out about it) is key to managing a peaceful transition.

Levelheaded recognition of this reality (i.e. not freaking out about it) is key to managing a peaceful transition.

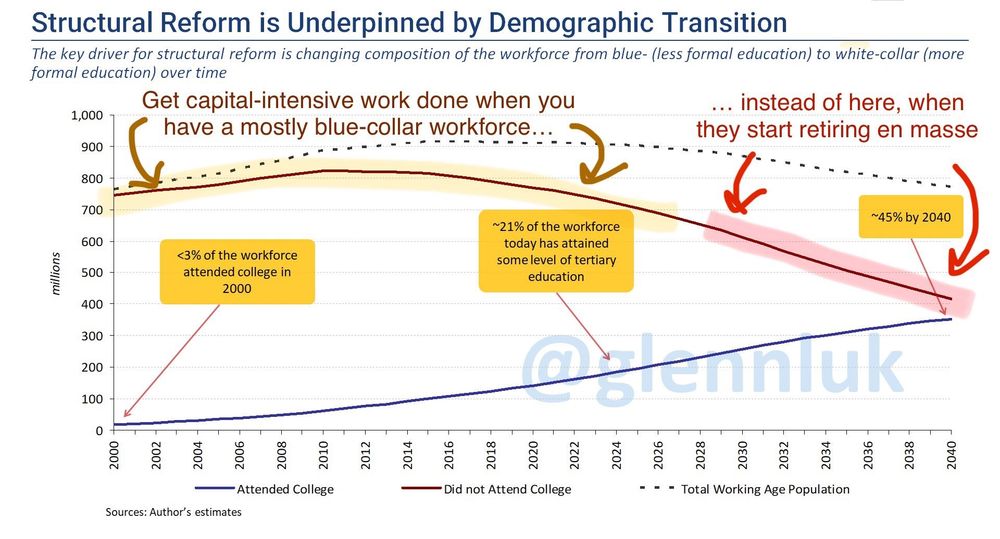

Its blue-collar labor pool is shrinking and becoming more of a precious commodity and wages rising, commensurately.

Its blue-collar labor pool is shrinking and becoming more of a precious commodity and wages rising, commensurately.

While various reasons are given (reciprocity, blanket "national security"), economic competition is really at the heart of it.

While various reasons are given (reciprocity, blanket "national security"), economic competition is really at the heart of it.

Understandably, 🇺🇸 did not want to give up the economic "high ground" that powered a comfortable life for the vast majority of citizens.

Also understandably, 🇨🇳 wanted to bring such a life to its billion-plus citizens.

Understandably, 🇺🇸 did not want to give up the economic "high ground" that powered a comfortable life for the vast majority of citizens.

Also understandably, 🇨🇳 wanted to bring such a life to its billion-plus citizens.

China had a large, productive and inexpensive labor pool.

The U.S. had the largest modern consumer market, leading technology and advanced human capital.

China had a large, productive and inexpensive labor pool.

The U.S. had the largest modern consumer market, leading technology and advanced human capital.

The lesson isn't that GM should have never entered China.

It earned tens of billions of incremental dollars for doing almost no work and putting very little capital at risk.

The lesson isn't that GM should have never entered China.

It earned tens of billions of incremental dollars for doing almost no work and putting very little capital at risk.

And once EV technology came of age, the writing was on the wall in China. It was only a matter of time.

And once EV technology came of age, the writing was on the wall in China. It was only a matter of time.