Jessica Riedl

@jessicabriedl.bsky.social

8.2K followers

190 following

360 posts

Sr. Fellow @ManhattanInst. Past: Sen. Portman chief economist (2011-17), DC think tanker (2001-11), budget policy @ 4 prez campaigns. Independent. Formerly Brian Riedl. Views mine.🏳️🌈

Posts

Media

Videos

Starter Packs

Pinned

Jessica Riedl

@jessicabriedl.bsky.social

· Nov 21

Reposted by Jessica Riedl

Trump on Mamdani: "He should be very nice to me. He's off to a bad start. I think it's a very dangerous statement for him to make."

Reposted by Jessica Riedl

Jessica Riedl

@jessicabriedl.bsky.social

· Sep 17

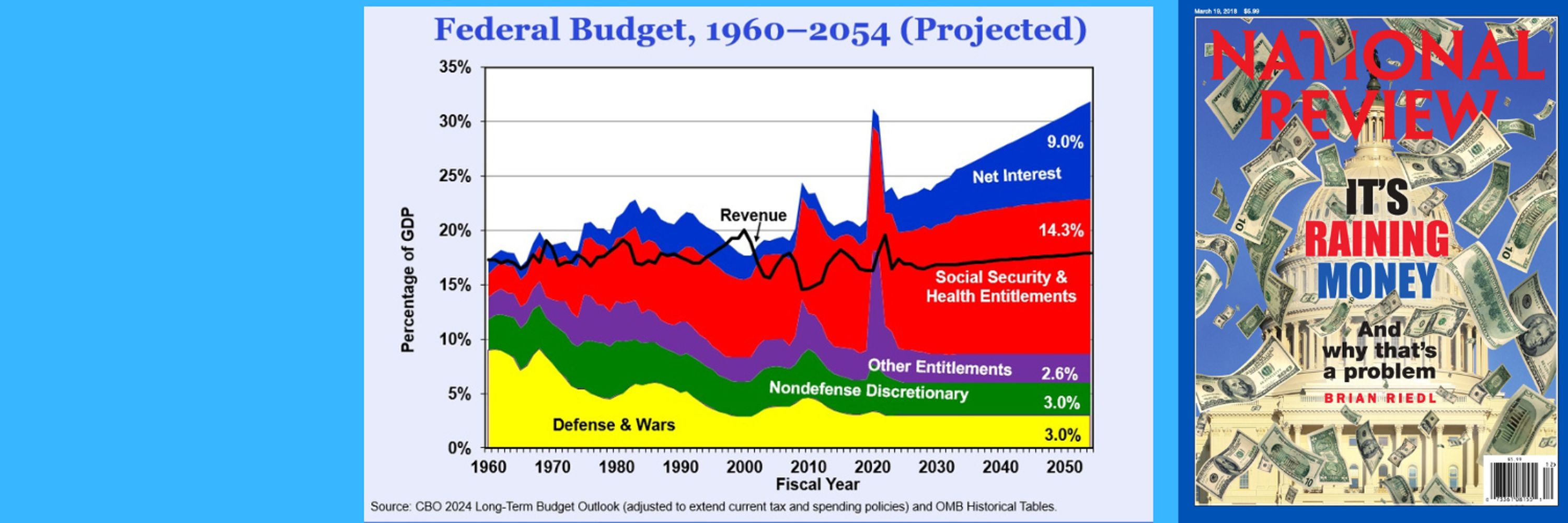

NEW from me. My new video for @reason.com says fine, tax the rich, but recognize that it cannot eliminate more than a small fraction of the soaring budget deficits. And no, those old 91% tax rates and the European tax systems do not prove otherwise.

www.youtube.com/watch?v=o0x1...

www.youtube.com/watch?v=o0x1...

The Uselessness of Taxing the Rich

YouTube video by ReasonTV

www.youtube.com