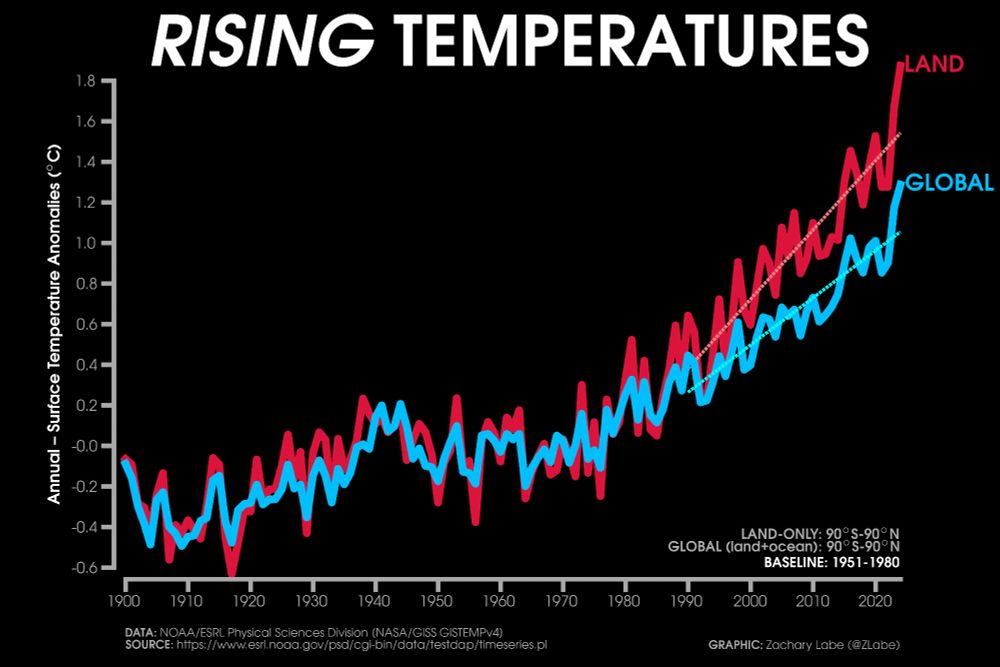

+ Data from NASA GISTEMPv4: data.giss.nasa.gov/gistemp/

+ Download graphic at: zacklabe.com/climate-chan...

x.com/globalmktobs...

x.com/globalmktobs...

It’s not clear that will happen this time. But, this chart suggests it will.

It’s not clear that will happen this time. But, this chart suggests it will.

This happened in 1990, 2000, and 2008 - all 3 times leading to sharp downturns.

This happened in 1990, 2000, and 2008 - all 3 times leading to sharp downturns.

#maruritywall #CRE #investing #economy

#maruritywall #CRE #investing #economy

bilello.blog/newsletter

Touch image for complete chart.

bilello.blog/newsletter

Touch image for complete chart.

“.. the action in energy and materials this month is hard to ignore with XLB the most oversold since the fall of '22. If they can't bounce here, when will they?!” 👀

“.. the action in energy and materials this month is hard to ignore with XLB the most oversold since the fall of '22. If they can't bounce here, when will they?!” 👀