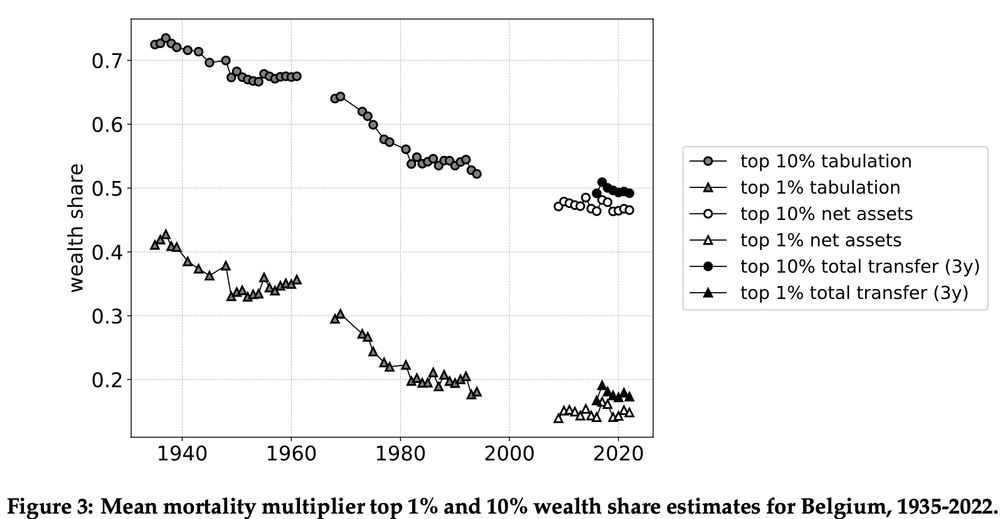

▸ Top 1 % owns ≈22 % of net wealth - same as bottom 75 %

▸ Inequality strongly declined last century, stabilised in recent years

PDF 👉 www.nbb.be/en/media/17695

#EconSky #Belgium #WealthInequality

Link: blog.uantwerpen.be/armoede-soci...

Link: blog.uantwerpen.be/armoede-soci...

of Belgian wealth inequality 1935-2022. Findings align with broader European trends: a marked decline over the 20th C, with levels remaining historically low today.

@nbb-bnb-fr.bsky.social

Link to paper: nbb.be/fr/media/17695

of Belgian wealth inequality 1935-2022. Findings align with broader European trends: a marked decline over the 20th C, with levels remaining historically low today.

@nbb-bnb-fr.bsky.social

Link to paper: nbb.be/fr/media/17695

▸ Top 1 % owns ≈22 % of net wealth - same as bottom 75 %

▸ Inequality strongly declined last century, stabilised in recent years

PDF 👉 www.nbb.be/en/media/17695

#EconSky #Belgium #WealthInequality

▸ Top 1 % owns ≈22 % of net wealth - same as bottom 75 %

▸ Inequality strongly declined last century, stabilised in recent years

PDF 👉 www.nbb.be/en/media/17695

#EconSky #Belgium #WealthInequality

I investigate wealth mobility in the United States using data from the Panel Study of Income Dynamics (PSID).

#EconSky #WealthMobility

I investigate wealth mobility in the United States using data from the Panel Study of Income Dynamics (PSID).

#EconSky #WealthMobility

Private businesses make up 50% of sales & profits and are the main wealth component of the wealthiest households. So, what is their value? Well, that's difficult, since they're not listed: their value is unobservable by definition!

My #EconJMP tackles this problem 1/

![Robust Estimation of Private Business Wealth*

Job Market Paper

Simon J. Toussaint†

November 14, 2024

[Most recent version here]

Abstract

Estimating the market value of private businesses is essential for understanding both aggregate firm dynamics and top wealth

inequality, yet these values are inherently unobservable. This paper introduces an econometric approach that treats the gap

between true market values and initial estimates as measurement error. I employ time-series restrictions on these errors as

moment conditions within a GMM framework, and use the fitted values from these estimations as error-free estimates of

private business wealth and capital stocks. Applying this method to Dutch administrative data linking the universe of firms

to their owners, I find that aggregate private business wealth increases by 30% of GDP initially, and is more stable than the

unadjusted series. Top 1% and 0.1% wealth shares increase by 3–5 percentage points, peaking at 38% and 20%, respectively.

Adjusted returns to firm wealth exhibit a steeper gradient across the wealth distribution than unadjusted returns, consistent

with models of return heterogeneity.](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:wus4g34bpbzjefp547irpkeu/bafkreibg34g2k7zwmjqytkllrcxfsj5tnov22hdny74qz7ks5jwa5csbou@jpeg)

Private businesses make up 50% of sales & profits and are the main wealth component of the wealthiest households. So, what is their value? Well, that's difficult, since they're not listed: their value is unobservable by definition!

My #EconJMP tackles this problem 1/

In this workshop, we present the results of a 4-year research project funded by BELSPO and carried out by the KU Leuven, the University of Antwerp and the ULB.

Registration via: feb.kuleuven.be/drc/Economic...

In this workshop, we present the results of a 4-year research project funded by BELSPO and carried out by the KU Leuven, the University of Antwerp and the ULB.

Registration via: feb.kuleuven.be/drc/Economic...