The consultation opens today, and closes last March.

The consultation opens today, and closes last March.

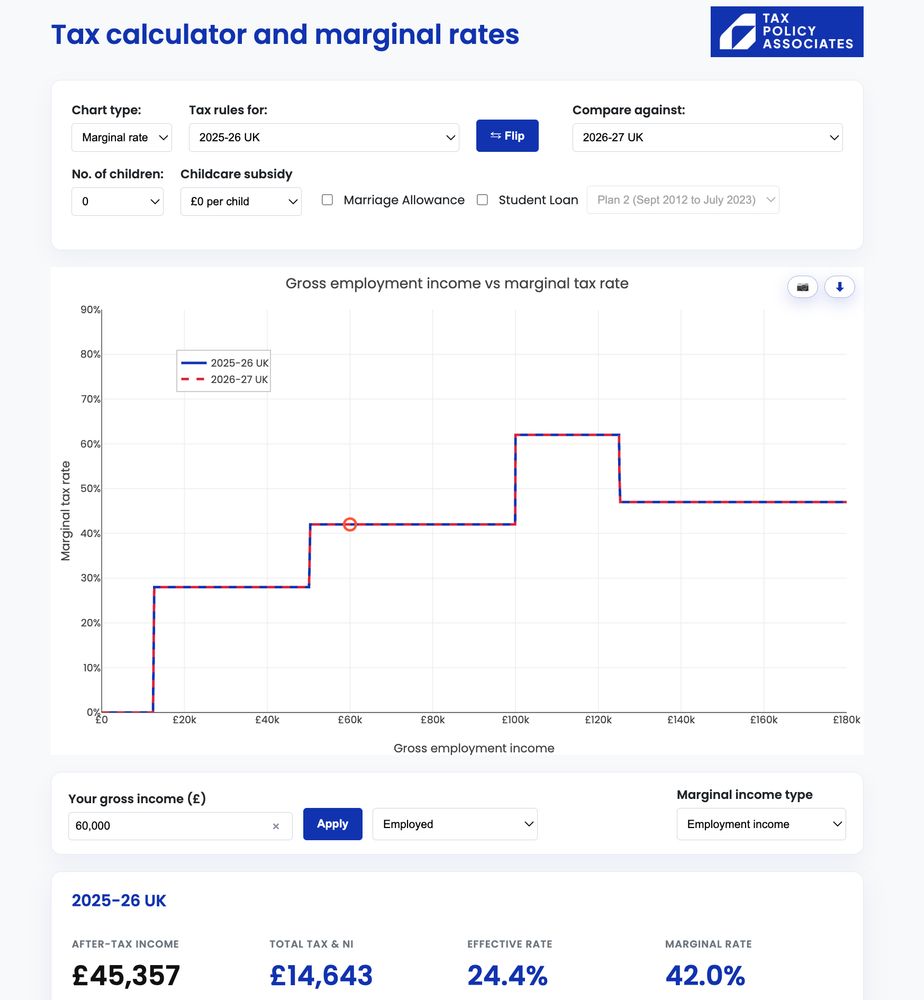

You'll see no change in the tax you pay in 2026/27 unless you're a landlord or receive interest/dividend income.

You'll see no change in the tax you pay in 2026/27 unless you're a landlord or receive interest/dividend income.

I expect we'd see: less tax on median earner. More tax on top decile. More welfare and benefit-in-kind at the higher deciles.

I expect we'd see: less tax on median earner. More tax on top decile. More welfare and benefit-in-kind at the higher deciles.

The bad: the Budget contained no significant tax reforms, and almost nothing in the way of pro-growth measures. The capital allowance change will reduce business investment - it's positively anti-growth.

The bad: the Budget contained no significant tax reforms, and almost nothing in the way of pro-growth measures. The capital allowance change will reduce business investment - it's positively anti-growth.

Probably somewhere between £150k and £375k.

So if you own a £5m house, you just lost money.

If you were planning to buy one, you haven't (because you'll pay the tax, but save on the purchase)

Probably somewhere between £150k and £375k.

So if you own a £5m house, you just lost money.

If you were planning to buy one, you haven't (because you'll pay the tax, but save on the purchase)

(It has to be renewed each year or it ceases to apply. Because it's a temporary tax, introduced to fund the Napoleonic wars)

(It has to be renewed each year or it ceases to apply. Because it's a temporary tax, introduced to fund the Napoleonic wars)

Some quick thoughts: buff.ly/1dW05S4

Some quick thoughts: buff.ly/1dW05S4

We'll be watching for these six:

We'll be watching for these six:

The map on the right shades by median house prices.

Very different maps. That's the problem with council tax.

The map on the right shades by median house prices.

Very different maps. That's the problem with council tax.

Budget happiness 100% guaranteed, or your money back.

(Okay, it's free, whether or not you're an FT subscriber. Registration: buff.ly/JqTpKLx )

Budget happiness 100% guaranteed, or your money back.

(Okay, it's free, whether or not you're an FT subscriber. Registration: buff.ly/JqTpKLx )

Budget happiness 100% guaranteed, or your money back.

(Okay, it's free, whether or not you're an FT subscriber. Registration: buff.ly/JqTpKLx )

Budget happiness 100% guaranteed, or your money back.

(Okay, it's free, whether or not you're an FT subscriber. Registration: buff.ly/JqTpKLx )

Yes. Here's how, and here's why: buff.ly/7HSGJij

Yes. Here's how, and here's why: buff.ly/7HSGJij

But here it looks improper. Laws may have been broken.

🧵

But here it looks improper. Laws may have been broken.

🧵

(Bribes are absolutely taxable income, but people tend not to declare them to HMRC...)

(Bribes are absolutely taxable income, but people tend not to declare them to HMRC...)

And here's an actual tax adviser explaining why they fail: buff.ly/2hyertH

And here's an actual tax adviser explaining why they fail: buff.ly/2hyertH

But here it looks improper. Laws may have been broken.

🧵

But here it looks improper. Laws may have been broken.

🧵

Any and all feedback gratefully received!

buff.ly/1Avp5U4

Any and all feedback gratefully received!

buff.ly/1Avp5U4