#Africa #SovereignRatings #EconomicResearch

#Africa #SovereignRatings #EconomicResearch

#Finance #CostOfCapital #Development

#Finance #CostOfCapital #Development

🔗 Read here (in French) 👇

legrandcontinent.eu/fr/2025/05/2...

🔗 Read here (in French) 👇

legrandcontinent.eu/fr/2025/05/2...

👀 via le @grandcontinent.bsky.social

legrandcontinent.eu/fr/2025/05/2...

👀 via le @grandcontinent.bsky.social

legrandcontinent.eu/fr/2025/05/2...

mailchi.mp/findevlab/ne...

mailchi.mp/findevlab/ne...

📚The Expert Review on Debt, Nature & Climate Report is now available: ☘️ 💰"Healthy Debt on a Healthy Planet"

@findevlab.bsky.social was proud to participate in the Review's Secretariat alongside @odi.global ACET and #UN #ECLAC

📚The Expert Review on Debt, Nature & Climate Report is now available: ☘️ 💰"Healthy Debt on a Healthy Planet"

@findevlab.bsky.social was proud to participate in the Review's Secretariat alongside @odi.global ACET and #UN #ECLAC

🔗 Register here 👇

debtnatureclimate.org/news/launch-...

🔗 Register here 👇

debtnatureclimate.org/news/launch-...

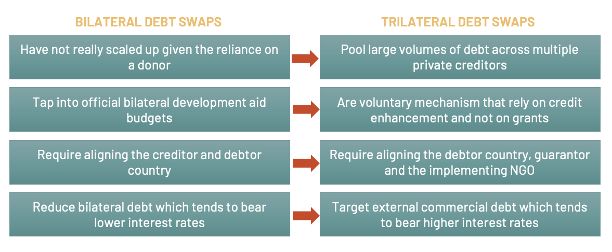

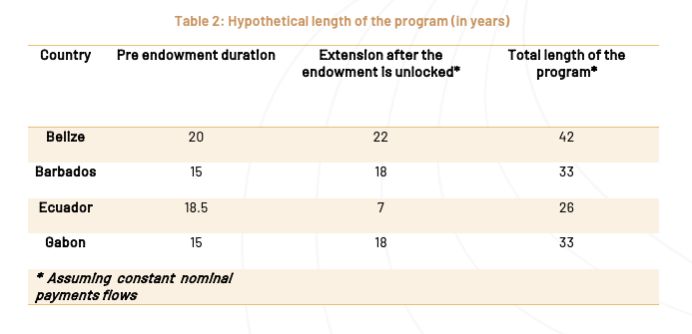

#DebtRestructuring #DevelopmentFinance #SovereignDebt

#DebtRestructuring #DevelopmentFinance #SovereignDebt

✅ Senior Economist/Research Economist (PhD)

✅ Economists/Research Analysts (Master's level)

Are you interested in joining a dynamic team striving for a more equitable international financial system? APPLY NOW on our website!

✅ Senior Economist/Research Economist (PhD)

✅ Economists/Research Analysts (Master's level)

Are you interested in joining a dynamic team striving for a more equitable international financial system? APPLY NOW on our website!

📢 "HOW THE UK CAN PLUG THE ODA HOLE?"

➡️ On February 28, 2025, PM Keir Starmer announced a significant ODA reduction from 0.5% to 0.3% of GNI, translating to a projected £6.2 billion cut to the UK's aid budget!

📢 "HOW THE UK CAN PLUG THE ODA HOLE?"

➡️ On February 28, 2025, PM Keir Starmer announced a significant ODA reduction from 0.5% to 0.3% of GNI, translating to a projected £6.2 billion cut to the UK's aid budget!

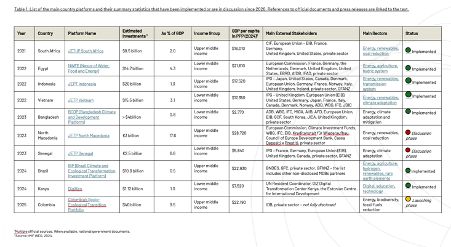

#ClimateAction #SustainableDevelopment #FinanceForDevelopment #CountryPlatforms

#ClimateAction #SustainableDevelopment #FinanceForDevelopment #CountryPlatforms