Fox Castle

@foxcastle.bsky.social

Private investor. Likes family run companies. SFAF member.

Newsletter: http://frenchhiddenchampions.substack.com

Newsletter: http://frenchhiddenchampions.substack.com

Pinned

Fox Castle

@foxcastle.bsky.social

· Nov 29

Here is the Q&A thread. If you have questions put them here and I will answer to them gradually in this thread!

It is my way to celebrate my arrival on @bsky.app

It is my way to celebrate my arrival on @bsky.app

Saw a company which is trading at a 50% discount to NAV and is linked to the financial industry. Asked them why not just do a big tender offer?

Answer: we have nice projects so the

cash will go there.

Pass for me and the projects they are going after are complex.

Answer: we have nice projects so the

cash will go there.

Pass for me and the projects they are going after are complex.

May 15, 2025 at 6:59 AM

Saw a company which is trading at a 50% discount to NAV and is linked to the financial industry. Asked them why not just do a big tender offer?

Answer: we have nice projects so the

cash will go there.

Pass for me and the projects they are going after are complex.

Answer: we have nice projects so the

cash will go there.

Pass for me and the projects they are going after are complex.

The best set up to read annual reports!

May 14, 2025 at 7:21 AM

The best set up to read annual reports!

Canal+: there is one data that we never get: operational result of C+ France...

Lots of restructuring in the last couple of years and I think they are now getting positive results.

Lots of restructuring in the last couple of years and I think they are now getting positive results.

April 30, 2025 at 8:50 AM

Canal+: there is one data that we never get: operational result of C+ France...

Lots of restructuring in the last couple of years and I think they are now getting positive results.

Lots of restructuring in the last couple of years and I think they are now getting positive results.

Another value investing approach!

Bought some signed soccer cards with a 25% discount to their fair value (what the market is ready to pay for them!).

Value invesring+passion= having fun!

Bought some signed soccer cards with a 25% discount to their fair value (what the market is ready to pay for them!).

Value invesring+passion= having fun!

April 23, 2025 at 8:50 AM

Another value investing approach!

Bought some signed soccer cards with a 25% discount to their fair value (what the market is ready to pay for them!).

Value invesring+passion= having fun!

Bought some signed soccer cards with a 25% discount to their fair value (what the market is ready to pay for them!).

Value invesring+passion= having fun!

As soon as I saw these books I had to get them!

10 €!

10 €!

April 22, 2025 at 10:19 AM

As soon as I saw these books I had to get them!

10 €!

10 €!

Lagardère: even in a small village Hachette is there. As soon as you as you have a library in France, Hachette is there!

April 20, 2025 at 11:28 AM

Lagardère: even in a small village Hachette is there. As soon as you as you have a library in France, Hachette is there!

Agreed! Bolloré needs to boost the Bolloré share price to maximize the value of the self controlling loop.

After the refusal of AMF to allow the expropriations of Artois, Moncey, Cambodge, it may be of interest to circle back to this agenda item of "issuing 20% of BOL stock in exchange for other stocks"

Invitation to Bolloré SE AGM was published today. Points that I found interesting: Cyrille Bolloré's mandate is only to be extended by 1 year 🧐 Buyback ceiling still at 6.50€ per share. A proposal to issue up to 20% of stock in exchange for other stocks

www.journal-officiel.gouv.fr/telechargeme...

www.journal-officiel.gouv.fr/telechargeme...

April 20, 2025 at 11:28 AM

Agreed! Bolloré needs to boost the Bolloré share price to maximize the value of the self controlling loop.

Making sure that they are working hard!

April 18, 2025 at 8:06 AM

Making sure that they are working hard!

Bolloré galaxy: AMF says that the take out offers on the ex rivaud entities are non compliant !!

April 17, 2025 at 6:37 PM

Bolloré galaxy: AMF says that the take out offers on the ex rivaud entities are non compliant !!

Odet is buying back as well and more then last week...

Good again!

Good again!

April 16, 2025 at 2:49 PM

Odet is buying back as well and more then last week...

Good again!

Good again!

Bolloré buybacks at a record last week! good!

3,3 million shares bought back at 5,05 €.

Higher buybacks when prices are lower: good!

3,3 million shares bought back at 5,05 €.

Higher buybacks when prices are lower: good!

April 16, 2025 at 2:47 PM

Bolloré buybacks at a record last week! good!

3,3 million shares bought back at 5,05 €.

Higher buybacks when prices are lower: good!

3,3 million shares bought back at 5,05 €.

Higher buybacks when prices are lower: good!

The Fox Castle greats you!

April 16, 2025 at 2:46 PM

The Fox Castle greats you!

Bolloré a big buy back last week! 2,5 Million shares at a 5,59 €.

Good as they were a little timid the week before!!

Good as they were a little timid the week before!!

March 31, 2025 at 4:31 PM

Bolloré a big buy back last week! 2,5 Million shares at a 5,59 €.

Good as they were a little timid the week before!!

Good as they were a little timid the week before!!

Only two questions asked at an analyst presentation for the financial results of a big company. Yet there were 15 analysts...

March 27, 2025 at 11:18 AM

Only two questions asked at an analyst presentation for the financial results of a big company. Yet there were 15 analysts...

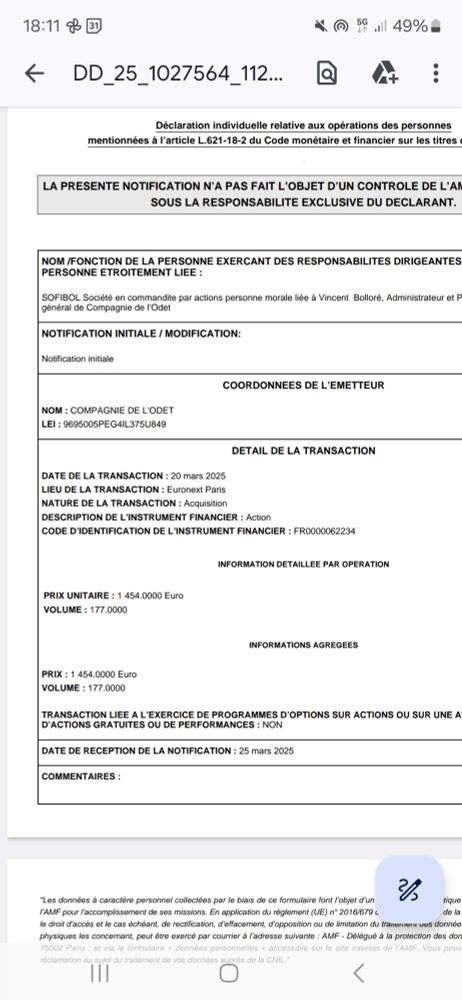

Sofibol still at it and buying Odet.

177 shares at 1 454 €

177 shares at 1 454 €

March 26, 2025 at 5:14 PM

Sofibol still at it and buying Odet.

177 shares at 1 454 €

177 shares at 1 454 €

Sofibol buying more Odet. Good!

March 25, 2025 at 5:07 PM

Sofibol buying more Odet. Good!

Sofibol buying soome Odet. There are back at it!This is good.

1079 ODet bought at an average of 1 458€.

Let us see if this is a beginning or not.

1079 ODet bought at an average of 1 458€.

Let us see if this is a beginning or not.

March 24, 2025 at 5:37 PM

Sofibol buying soome Odet. There are back at it!This is good.

1079 ODet bought at an average of 1 458€.

Let us see if this is a beginning or not.

1079 ODet bought at an average of 1 458€.

Let us see if this is a beginning or not.

Bolloré: bought back 1,7 Million shares last week. Was expecting more! My bet was 3 M shares.

March 24, 2025 at 5:06 PM

Bolloré: bought back 1,7 Million shares last week. Was expecting more! My bet was 3 M shares.

Bolloré: 10,8 Million shares exchanged during the week.

Let's say Bolloré bought 30% of the volumes. More than 3 M shares bought back! We will see monday night! 3% of the shares they got through the 2023 tender offer in 1 week not too bad!!!

Let's say Bolloré bought 30% of the volumes. More than 3 M shares bought back! We will see monday night! 3% of the shares they got through the 2023 tender offer in 1 week not too bad!!!

March 21, 2025 at 5:41 PM

Bolloré: 10,8 Million shares exchanged during the week.

Let's say Bolloré bought 30% of the volumes. More than 3 M shares bought back! We will see monday night! 3% of the shares they got through the 2023 tender offer in 1 week not too bad!!!

Let's say Bolloré bought 30% of the volumes. More than 3 M shares bought back! We will see monday night! 3% of the shares they got through the 2023 tender offer in 1 week not too bad!!!

Interesting point! Depending on companies some like to take their holdings private (Fairfax) but also public (Fairfax India). Bolloré is more on the publicly quoted side.

I would say that they are all just very pragmatic! The aim is to have the best valuation.

I would say that they are all just very pragmatic! The aim is to have the best valuation.

Just curious: why do you expect this to be listed? Seems like HAL prefers things to be private? Or would this be for the founder to cash out his stake?

March 21, 2025 at 8:14 AM

Interesting point! Depending on companies some like to take their holdings private (Fairfax) but also public (Fairfax India). Bolloré is more on the publicly quoted side.

I would say that they are all just very pragmatic! The aim is to have the best valuation.

I would say that they are all just very pragmatic! The aim is to have the best valuation.

Good approach! In fact there are also 300 M€ of cash pledged for the ex rivaud taxe outs! And then some non significative investments!

We have explained the delta!

We have explained the delta!

If you take the difference of cash balances at Bolloré SE between H1 and FY24, substract the amount for additional UMG buys and share buybacks, it is very possible that >400m€ have been put to work in december 24 to buy LHG,C+ or Havas shares... 🤫

March 20, 2025 at 10:09 AM

Good approach! In fact there are also 300 M€ of cash pledged for the ex rivaud taxe outs! And then some non significative investments!

We have explained the delta!

We have explained the delta!

I am sure that Bolloré is buying back shares like a maniac. We will see on monday night how many shares he got his hands on!

March 20, 2025 at 8:24 AM

I am sure that Bolloré is buying back shares like a maniac. We will see on monday night how many shares he got his hands on!

I am ready! Let us see what happens or not!

March 17, 2025 at 4:23 PM

I am ready! Let us see what happens or not!

Bolloré for the ex-rivaud take out offers, it seems that there is a big difference between what the independant expert (IE) valued Vivendi and the true value...

Vivendi: IE valued it 2,32 € but Vivendi just gave it's NAV today which is 4,69€... oopsy daisy!

1/

Vivendi: IE valued it 2,32 € but Vivendi just gave it's NAV today which is 4,69€... oopsy daisy!

1/

March 7, 2025 at 9:07 PM

Bolloré for the ex-rivaud take out offers, it seems that there is a big difference between what the independant expert (IE) valued Vivendi and the true value...

Vivendi: IE valued it 2,32 € but Vivendi just gave it's NAV today which is 4,69€... oopsy daisy!

1/

Vivendi: IE valued it 2,32 € but Vivendi just gave it's NAV today which is 4,69€... oopsy daisy!

1/