Water insecurity is on the map of forthcoming national security risks, together with food shortages. Rather than addressing the root causes of water insecurity, many of which are political, 1/5

Water insecurity is on the map of forthcoming national security risks, together with food shortages. Rather than addressing the root causes of water insecurity, many of which are political, 1/5

#ShiftHarmfulSubsidies #NoNeedForNatureCredits

www.sustainableviews.com/for-every-1-...

#ShiftHarmfulSubsidies #NoNeedForNatureCredits

www.sustainableviews.com/for-every-1-...

👀👇

Climate - Prof Kevin Anderson @kevinclimate.bsky.social

National Emergency Briefing

11 Dec 2025

www.youtube.com/watch?v=rI8z...

@cducsueuropa.bsky.social @spdeuropa.bsky.social @spdfraktion.de @gruene-bundestag.de @dielinkebt.de @reuters.com

👀👇

Climate - Prof Kevin Anderson @kevinclimate.bsky.social

National Emergency Briefing

11 Dec 2025

www.youtube.com/watch?v=rI8z...

@cducsueuropa.bsky.social @spdeuropa.bsky.social @spdfraktion.de @gruene-bundestag.de @dielinkebt.de @reuters.com

carbon-pulse.com/464775/?site...

carbon-pulse.com/464775/?site...

A growing movement in Brussels is spreading the message that asking business to follow rules leads to economic death. They're working hard to destroy EU environmental + chemical protections.

A growing movement in Brussels is spreading the message that asking business to follow rules leads to economic death. They're working hard to destroy EU environmental + chemical protections.

eur-lex.europa.eu/legal-conten...

eur-lex.europa.eu/legal-conten...

carbon-pulse.com/398453/?utm_...

carbon-pulse.com/398453/?utm_...

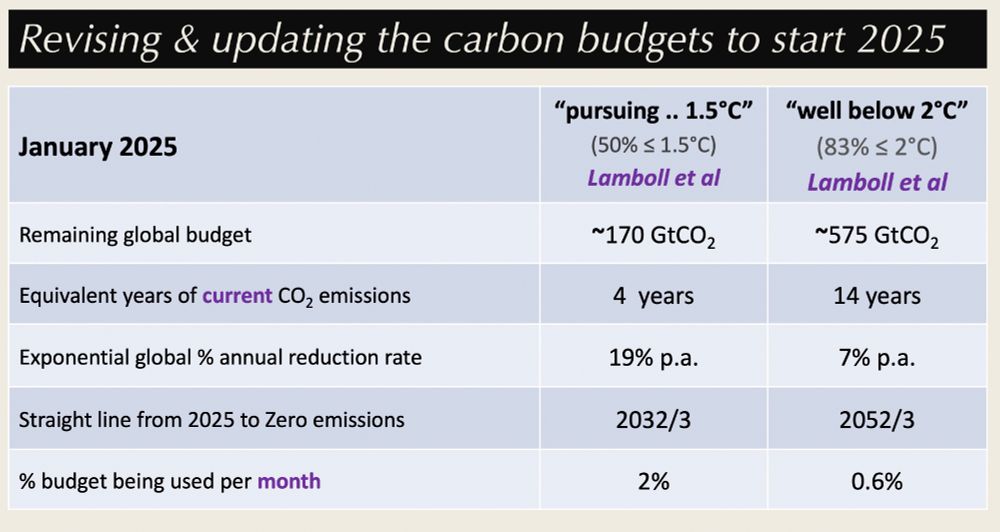

As for the budgets, updated to start from January 2025.

For a 50% chance of not exceeding 1.5°C it is ~170GtCO2

For an 83% chance of not exceeding 2°C it is ~575GtCO2

Attached table may be of interest.

As for the budgets, updated to start from January 2025.

For a 50% chance of not exceeding 1.5°C it is ~170GtCO2

For an 83% chance of not exceeding 2°C it is ~575GtCO2

Attached table may be of interest.

This week's column.

www.theguardian.com/commentisfre...

This week's column.

www.theguardian.com/commentisfre...