Earlier this year we noticed that flows into the US, and particularly New York, had dropped off, years before the threat of tariffs

blog.gridstatus.io/more-hqs-tha...

Earlier this year we noticed that flows into the US, and particularly New York, had dropped off, years before the threat of tariffs

blog.gridstatus.io/more-hqs-tha...

Read more at Grid Status Insights:

www.gridstatus.io/insights/280...

Read more at Grid Status Insights:

www.gridstatus.io/insights/280...

this time we focus on SPP West, the undecideds, Canada, and risks in the West

blog.gridstatus.io/western-mark...

this time we focus on SPP West, the undecideds, Canada, and risks in the West

blog.gridstatus.io/western-mark...

Over the past 9 years, real-time load has underperformed almost all of PJM’s forecasts over the evening peak, precisely during prime trick-or-treating hours 🔌💡

Over the past 9 years, real-time load has underperformed almost all of PJM’s forecasts over the evening peak, precisely during prime trick-or-treating hours 🔌💡

blog.gridstatus.io/western-mark...

little 🧵

blog.gridstatus.io/western-mark...

little 🧵

short 🧵

short 🧵

A balancing question in play is whether large zones can continue to scale larger, or if small areas have the headroom to steal momentum in the datacenter race

A balancing question in play is whether large zones can continue to scale larger, or if small areas have the headroom to steal momentum in the datacenter race

Insights is a real-time feed of expert commentary on energy markets and the electric grid — straight from our team of talented analysts.

If you’ve enjoyed our blogs or social posts, you’re going to love this. Stay tuned 🔌💡

Insights is a real-time feed of expert commentary on energy markets and the electric grid — straight from our team of talented analysts.

If you’ve enjoyed our blogs or social posts, you’re going to love this. Stay tuned 🔌💡

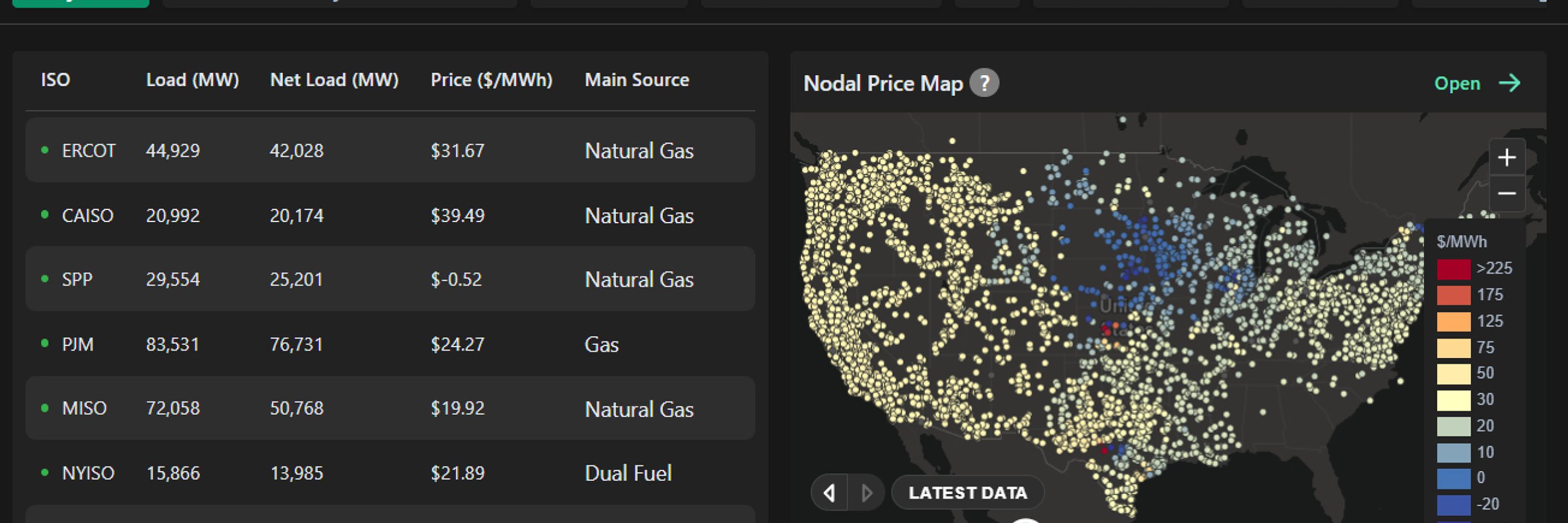

We built it with two key upgrades:

1. A new database that runs on-demand analysis of years of data in seconds

2. An enhanced process for organizing the metadata for 75k+ locations

We built it with two key upgrades:

1. A new database that runs on-demand analysis of years of data in seconds

2. An enhanced process for organizing the metadata for 75k+ locations

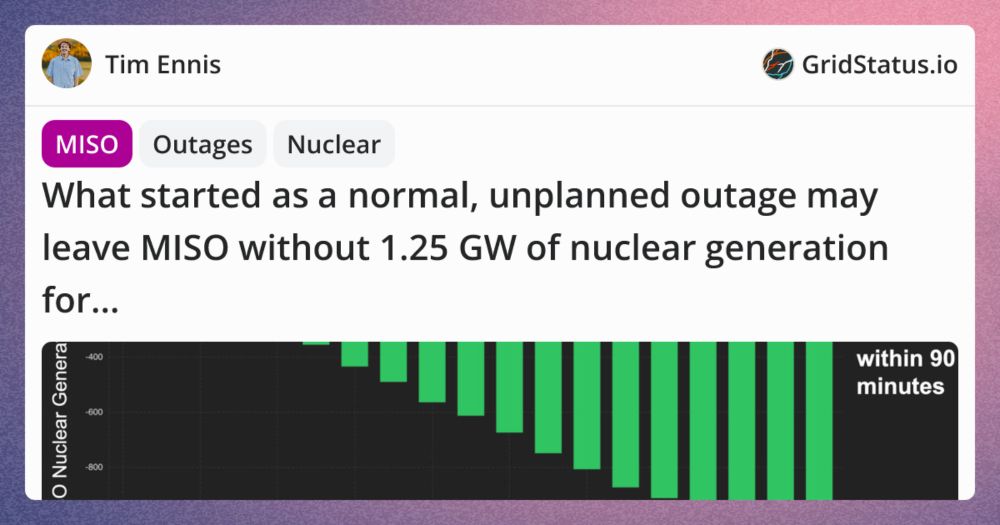

In decades past, the fall shoulder season left time for autumn fun like apple picking and the pumpkin patch. Today, new metrics like net load drive markets, and they can be most volatile when outages rise and weather varies

In decades past, the fall shoulder season left time for autumn fun like apple picking and the pumpkin patch. Today, new metrics like net load drive markets, and they can be most volatile when outages rise and weather varies

TSAs are called when enough lightning strikes the Hudson Valley area in a short amount of time. This triggers line limits on the 345kV system flowing into NYC, to avoid conditions 1977 blackout conditions

blog.gridstatus.io/breaking-dow... /1

TSAs are called when enough lightning strikes the Hudson Valley area in a short amount of time. This triggers line limits on the 345kV system flowing into NYC, to avoid conditions 1977 blackout conditions

blog.gridstatus.io/breaking-dow... /1

Wind was low onshore, and the MW level approximately matches Vineyard Wind's possible output 🔌💡

Wind was low onshore, and the MW level approximately matches Vineyard Wind's possible output 🔌💡

Wildfire impacts are now a regular, if unwelcome guest during Northeastern summers, with smoke affecting both solar output and load patterns in New York and New England.

blog.gridstatus.io/canadian-wil...

Wildfire impacts are now a regular, if unwelcome guest during Northeastern summers, with smoke affecting both solar output and load patterns in New York and New England.

blog.gridstatus.io/canadian-wil...

This miss was not even, downstate zones, home to >50% ofload, hewed more closely to the forecast, while upstate zones saw large swings 🔌💡

This miss was not even, downstate zones, home to >50% ofload, hewed more closely to the forecast, while upstate zones saw large swings 🔌💡

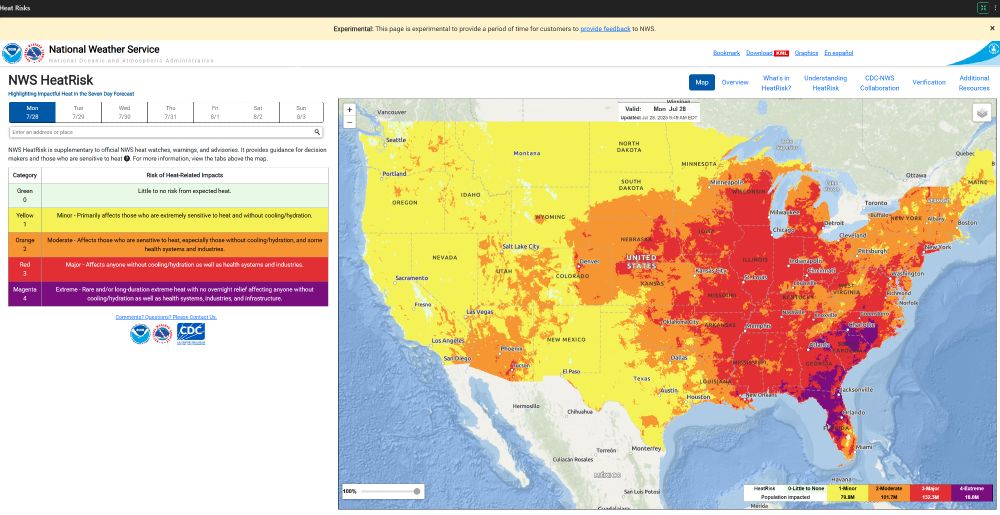

~5 markets look to beat last summer's peak, while 3 seem likely to exceed this summer's forecast peak

You can track the outlook on our summer hazards dashboard: www.gridstatus.io/dashboards/e...

~5 markets look to beat last summer's peak, while 3 seem likely to exceed this summer's forecast peak

You can track the outlook on our summer hazards dashboard: www.gridstatus.io/dashboards/e...

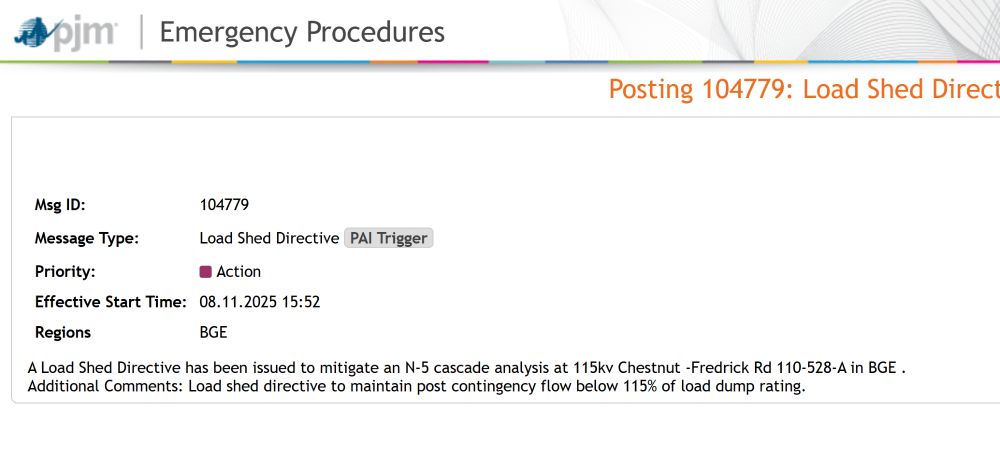

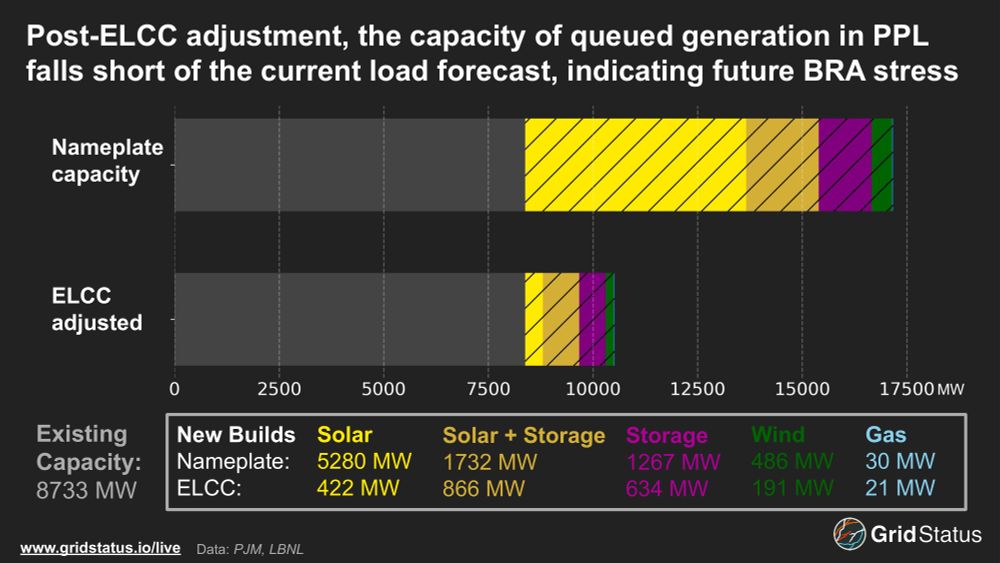

Digging further into the PPL zone in PJM and capacity constraints in general

blog.gridstatus.io/pjm-ppl-capa...

a few notes: 🧵

Digging further into the PPL zone in PJM and capacity constraints in general

blog.gridstatus.io/pjm-ppl-capa...

a few notes: 🧵

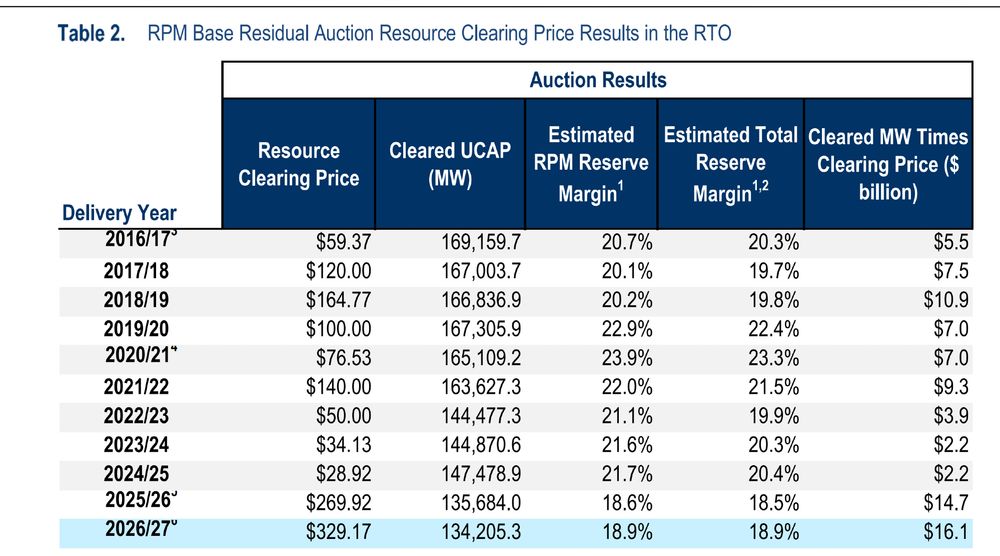

signaling no end to Big Tech’s insatiable demand for datacenter power

Look for a blog from us later this week on recent PPA action in PPL and PJM's tight capacity conditions. 🔌💡

signaling no end to Big Tech’s insatiable demand for datacenter power

Look for a blog from us later this week on recent PPA action in PPL and PJM's tight capacity conditions. 🔌💡

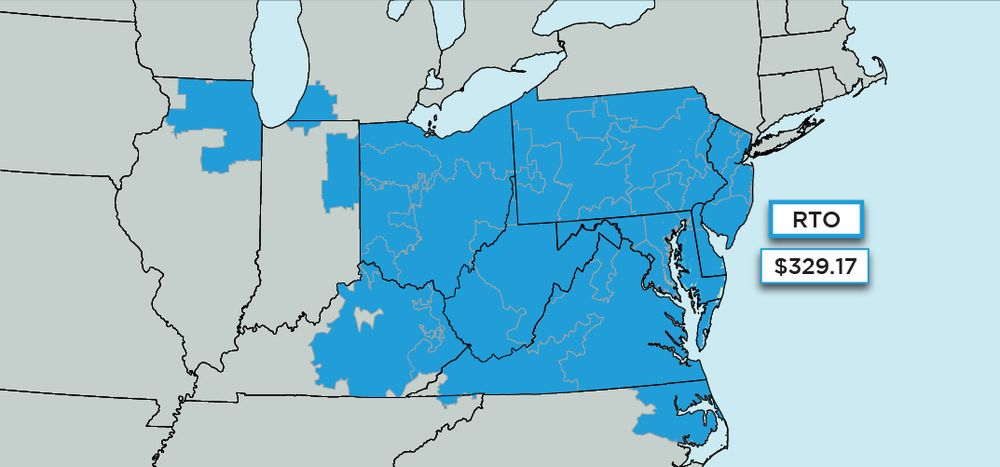

oh, wait, the entire RTO cleared at the cap 🥴

funny map from PJM 🔌💡

oh, wait, the entire RTO cleared at the cap 🥴

funny map from PJM 🔌💡

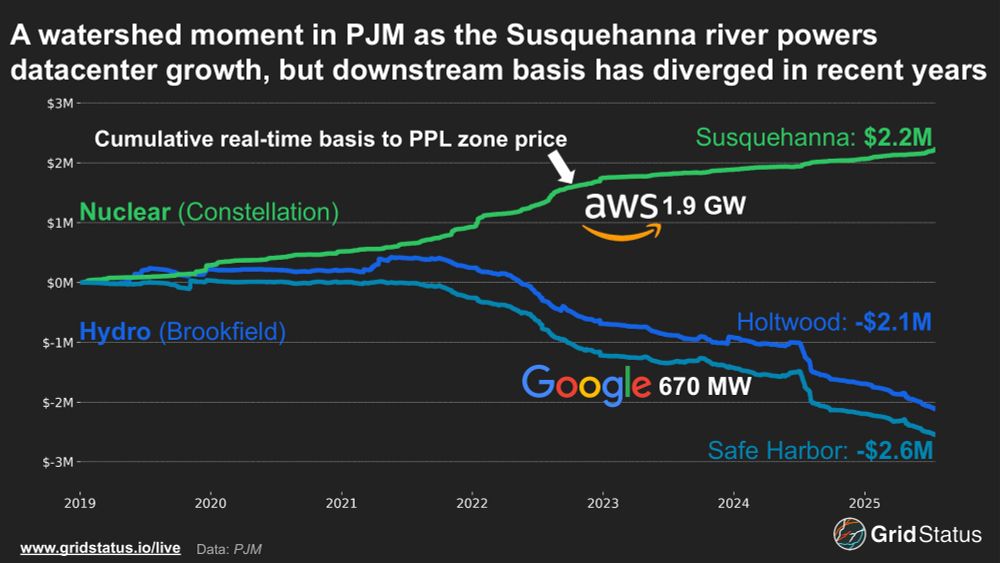

Also in the PPL zone, Amazon’s attempt to take Talen’s Susquehanna nuclear plant behind-the-meter has been in the news since last year

Over 2.5 GW of data center PPAs signed in a single zone

🔌💡

Also in the PPL zone, Amazon’s attempt to take Talen’s Susquehanna nuclear plant behind-the-meter has been in the news since last year

Over 2.5 GW of data center PPAs signed in a single zone

🔌💡

🔌💡

🔌💡

With triple-digit heat indices from the Gulf of Maine to the Gulf of Mexico, here’s what we expect to see across the different grid operators this week:

With triple-digit heat indices from the Gulf of Maine to the Gulf of Mexico, here’s what we expect to see across the different grid operators this week: