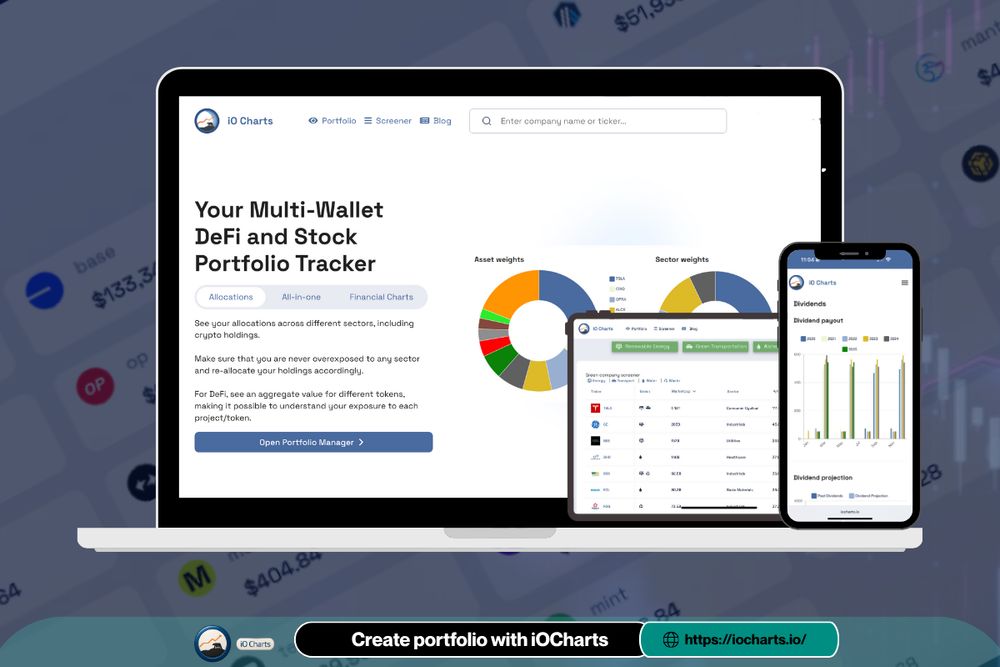

Visit iO Charts: https://iocharts.io/portfolio

Discord: https://discord.gg/34G5EAA9ZY

Half a trillion already booked for 2025–2026, yet $NVDA is still ~5% lower.

Wednesday’s catalysts:

• Data center revenue

• GPU demand

• AI spending

• 2026 capex

This report could move the entire AI sector.

Bullish or waiting?

Half a trillion already booked for 2025–2026, yet $NVDA is still ~5% lower.

Wednesday’s catalysts:

• Data center revenue

• GPU demand

• AI spending

• 2026 capex

This report could move the entire AI sector.

Bullish or waiting?

Mon — $RUN $SPHR high SI, early earnings $TCOM $XPEV.

Tue — Microsoft Ignite, $HD $BIDU, FDA on $ARWR.

Wed — $NVDA earnings, $PANW $LOW $TGT $TJX + Fed Minutes.

Thu — $WMT, $INTU $ROST, Home Sales.

Fri — Flash PMI, $BJ.

Big day is Wednesday — $NVDA + Fed Minutes

Mon — $RUN $SPHR high SI, early earnings $TCOM $XPEV.

Tue — Microsoft Ignite, $HD $BIDU, FDA on $ARWR.

Wed — $NVDA earnings, $PANW $LOW $TGT $TJX + Fed Minutes.

Thu — $WMT, $INTU $ROST, Home Sales.

Fri — Flash PMI, $BJ.

Big day is Wednesday — $NVDA + Fed Minutes

• Nasdaq -1.8%

• S&P 500 -1.3%

• $NVDA -3%, $AMD -4.9%, $TSLA & $PLTR down again

• $BTC back under $95K

AI fears, weak sentiment, and Fed uncertainty continue to pressure risk assets.

• Nasdaq -1.8%

• S&P 500 -1.3%

• $NVDA -3%, $AMD -4.9%, $TSLA & $PLTR down again

• $BTC back under $95K

AI fears, weak sentiment, and Fed uncertainty continue to pressure risk assets.

- 80% AI CAGR

- 35% total revenue CAGR

- Tens of billions in 2027 data center sales

AI is now the growth engine driving semiconductors.

Deep-dive charts on iocharts.io/

Let’s see how those numbers hold up in Q4. 📈

- 80% AI CAGR

- 35% total revenue CAGR

- Tens of billions in 2027 data center sales

AI is now the growth engine driving semiconductors.

Deep-dive charts on iocharts.io/

Let’s see how those numbers hold up in Q4. 📈

SoftBank sold 32.1M $NVDA shares to fund a $22.5B OpenAI investment.

Not bearish - just capital rotation.

💡 Big money isn’t leaving AI, it’s going deeper.

📊 Track $NVDA trends at iocharts.io/

SoftBank sold 32.1M $NVDA shares to fund a $22.5B OpenAI investment.

Not bearish - just capital rotation.

💡 Big money isn’t leaving AI, it’s going deeper.

📊 Track $NVDA trends at iocharts.io/

Wall Street cooled off as profit-taking hit tech.

$SPX -1.1% | $NASDAQ -1.9% | $DJI -0.8%

- $NVDA & $AMD slipped from highs

- $PLTR crushed earnings

- Oil > $66, gold steady near $4K

Next up: $AMD, $UBER & $COIN earnings + inflation data.

👉 Track it all on iocharts.io/portfolio

Wall Street cooled off as profit-taking hit tech.

$SPX -1.1% | $NASDAQ -1.9% | $DJI -0.8%

- $NVDA & $AMD slipped from highs

- $PLTR crushed earnings

- Oil > $66, gold steady near $4K

Next up: $AMD, $UBER & $COIN earnings + inflation data.

👉 Track it all on iocharts.io/portfolio

Revenue: $1.27B vs $1.21B est

EPS: $0.61 vs $0.53 est

ARPU: $191 (+82% YoY)

Assets: $333B (+119% YoY)

Gold Subs: 3.9M (+77% YoY)

Robinhood’s not just a meme broker anymore - it’s scaling fast.

Can $HOOD keep this momentum into 2026?

📊 Track performance on iocharts.io/

Revenue: $1.27B vs $1.21B est

EPS: $0.61 vs $0.53 est

ARPU: $191 (+82% YoY)

Assets: $333B (+119% YoY)

Gold Subs: 3.9M (+77% YoY)

Robinhood’s not just a meme broker anymore - it’s scaling fast.

Can $HOOD keep this momentum into 2026?

📊 Track performance on iocharts.io/

Everyone tracks returns differently some by % gain, others by portfolio value or income flow.

At iOCharts, I focus on realized vs unrealized returns + allocation weight to see what’s really working.

How do you measure performance?

Everyone tracks returns differently some by % gain, others by portfolio value or income flow.

At iOCharts, I focus on realized vs unrealized returns + allocation weight to see what’s really working.

How do you measure performance?

OpenAI just signed a $38B multi-year deal with Amazon Web Services to use NVIDIA-powered cloud infrastructure for its next-gen AI models.

💡 AWS strengthens its AI dominance.

📈 $AMZN jumped +5%.

Who’s winning the AI cloud race now Amazon or Microsoft?

OpenAI just signed a $38B multi-year deal with Amazon Web Services to use NVIDIA-powered cloud infrastructure for its next-gen AI models.

💡 AWS strengthens its AI dominance.

📈 $AMZN jumped +5%.

Who’s winning the AI cloud race now Amazon or Microsoft?

Tech leads again SK Hynix +11%, Samsung +3.4%, Hang Seng +1.1%.

$NVDA partnership chatter + AI optimism keep momentum alive.

Oil steadies - Brent $65.26 | WTI $61.44

Gold holds near $4,000.

S&P 500 eyes new highs after 6 straight winning months.

Tech leads again SK Hynix +11%, Samsung +3.4%, Hang Seng +1.1%.

$NVDA partnership chatter + AI optimism keep momentum alive.

Oil steadies - Brent $65.26 | WTI $61.44

Gold holds near $4,000.

S&P 500 eyes new highs after 6 straight winning months.

Volatility, rotation & new highs.

S&P 500 hit records, pulled back, then rebounded on oil + AI strength.

$NVDA, $AMZN, $META held firm; $XOM surged; $BTC broke $126K.

Investors shifting from hype to fundamentals, yield, energy & AI leading

👉 Build your Q4 portfolio on iocharts.io/

Volatility, rotation & new highs.

S&P 500 hit records, pulled back, then rebounded on oil + AI strength.

$NVDA, $AMZN, $META held firm; $XOM surged; $BTC broke $126K.

Investors shifting from hype to fundamentals, yield, energy & AI leading

👉 Build your Q4 portfolio on iocharts.io/

Strong week - Fed cut, tech earnings, new highs.

$NVDA hit $5T market cap

$AMZN launched Project Rainier

$CAT +91% in 6 months

$NBIS tripled Finland data center capacity

Yields down, small caps and energy rising, smart money’s rotating quietly.

Strong week - Fed cut, tech earnings, new highs.

$NVDA hit $5T market cap

$AMZN launched Project Rainier

$CAT +91% in 6 months

$NBIS tripled Finland data center capacity

Yields down, small caps and energy rising, smart money’s rotating quietly.

But these underrated names might 5x while no one’s looking:

$NBIS

$HIMS

$IREN

$ZETA

$DUOL

$ROOT

$OSCR

$SOFI

$RXRX

Small caps. Real products. Growing revenues.

👉 Which one’s your dark horse pick?

But these underrated names might 5x while no one’s looking:

$NBIS

$HIMS

$IREN

$ZETA

$DUOL

$ROOT

$OSCR

$SOFI

$RXRX

Small caps. Real products. Growing revenues.

👉 Which one’s your dark horse pick?

NVIDIA will power the U.S.’s largest AI supercomputer, Solstice, at Argonne National Lab, featuring 100,000 Blackwell GPUs and 2,200 exaflops of performance.

A $1B leap for U.S. scientific AI and NVIDIA’s global dominance.

Track $NVDA and $ORCL on iocharts.io/

NVIDIA will power the U.S.’s largest AI supercomputer, Solstice, at Argonne National Lab, featuring 100,000 Blackwell GPUs and 2,200 exaflops of performance.

A $1B leap for U.S. scientific AI and NVIDIA’s global dominance.

Track $NVDA and $ORCL on iocharts.io/

$TSLA gained +4.3% Monday as investors weighed Musk’s potential $1T pay deal, tied to an $8.5T market cap goal.

Despite controversy, Tesla holds strong momentum, expanding from EVs to AI, energy, and robotics.

📊 Track $TSLA on iocharts.io/

$TSLA gained +4.3% Monday as investors weighed Musk’s potential $1T pay deal, tied to an $8.5T market cap goal.

Despite controversy, Tesla holds strong momentum, expanding from EVs to AI, energy, and robotics.

📊 Track $TSLA on iocharts.io/

Tech and crypto leading again while energy lags.

Mixed earnings, steady sentiment.

Where are you leaning, offense or defense?

Get your iOCharts portfolio ready for Monday’s open.

Tech and crypto leading again while energy lags.

Mixed earnings, steady sentiment.

Where are you leaning, offense or defense?

Get your iOCharts portfolio ready for Monday’s open.

WTI $61.66 | Brent $66.12 (+0.39%)

Trade optimism between 🇺🇸 & 🇨🇳 boosts demand hopes but OPEC+ supply keeps gains capped.

Energy stocks stay muted:

$XOM 115.39 (-0.5%)

$CVX 155.56 (-0.6%)

Eyes on Thursday’s Trump–Xi meeting.

WTI $61.66 | Brent $66.12 (+0.39%)

Trade optimism between 🇺🇸 & 🇨🇳 boosts demand hopes but OPEC+ supply keeps gains capped.

Energy stocks stay muted:

$XOM 115.39 (-0.5%)

$CVX 155.56 (-0.6%)

Eyes on Thursday’s Trump–Xi meeting.

$NVDA, $MSFT, $AAPL & others drive $SPX to record highs, yet small businesses face tariffs, high costs & weak demand.

GDP +3.8% | Manufacturing –7 months | Gen Z spending –34% YoY

📈 Track the AI vs real-world gap on iocharts.io/

$NVDA, $MSFT, $AAPL & others drive $SPX to record highs, yet small businesses face tariffs, high costs & weak demand.

GDP +3.8% | Manufacturing –7 months | Gen Z spending –34% YoY

📈 Track the AI vs real-world gap on iocharts.io/

Brent ~$65 | WTI <$62

Watch: $XOM, $CVX, $BP, $SHEL, $INSW, $STNG, $SLB, $HAL

Brent ~$65 | WTI <$62

Watch: $XOM, $CVX, $BP, $SHEL, $INSW, $STNG, $SLB, $HAL

Sales slump, stock down 65% since 2021. New CEO aims to streamline and revive growth.

Sales slump, stock down 65% since 2021. New CEO aims to streamline and revive growth.

AI infrastructure demand still on fire:

• Sales +29%

• Orders +60%

• EPS +122%

• Raised 2025 guidance

Cooling, power, performance, they own the AI backbone.

AI infrastructure demand still on fire:

• Sales +29%

• Orders +60%

• EPS +122%

• Raised 2025 guidance

Cooling, power, performance, they own the AI backbone.

Netflix & Comcast reportedly interested.

$40B debt still heavy, but HBO, DC & Harry Potter are prime assets.

Could this spark a new media consolidation wave?

📊 Track on iocharts.io/

Netflix & Comcast reportedly interested.

$40B debt still heavy, but HBO, DC & Harry Potter are prime assets.

Could this spark a new media consolidation wave?

📊 Track on iocharts.io/

📦 $AMZN (Oct 24) – AWS rebound

⚙️ $TSLA (Oct 23) – Demand & margins

🎬 $NFLX (Oct 22) – Subs & ads

🏦 $V / $MA (Oct 25 / 24) – Spending pulse

AI, payments & energy lead this week’s tone.

Which report moves markets?

Track them on iocharts.io/

📦 $AMZN (Oct 24) – AWS rebound

⚙️ $TSLA (Oct 23) – Demand & margins

🎬 $NFLX (Oct 22) – Subs & ads

🏦 $V / $MA (Oct 25 / 24) – Spending pulse

AI, payments & energy lead this week’s tone.

Which report moves markets?

Track them on iocharts.io/

Big names, big moves ahead

$AMZN – AWS recovery & margins

$TSLA – Demand & energy growth

$NFLX – Subs & ad-tier updates

$V / $MA – Spending trends

AI, payments and energy lead this week’s earnings tone.

Which report moves the market most?

Track it live on iocharts.io/

Big names, big moves ahead

$AMZN – AWS recovery & margins

$TSLA – Demand & energy growth

$NFLX – Subs & ad-tier updates

$V / $MA – Spending trends

AI, payments and energy lead this week’s earnings tone.

Which report moves the market most?

Track it live on iocharts.io/

🔥 Monday Watch: $AMZN $CLF $BA $AGNC

$AMZN faces AWS outage recovery ⚙️

$CLF +9% on strong rev & lower capex 💰

$BA +1.4% as union talks resume ✈️

$AGNC reports Q3 today (EPS est. $0.39) 🏠

Also watch $STLD $ZION $WRB.

Track earnings live on iocharts.io/

🔥 Monday Watch: $AMZN $CLF $BA $AGNC

$AMZN faces AWS outage recovery ⚙️

$CLF +9% on strong rev & lower capex 💰

$BA +1.4% as union talks resume ✈️

$AGNC reports Q3 today (EPS est. $0.39) 🏠

Also watch $STLD $ZION $WRB.

Track earnings live on iocharts.io/