b) Scientific communicator

c) Pharma analyst

d) All of the above

My newsletter: https://joannasadowska.substack.com/subscribe

SG&A (Selling, General, and Administrative) expenses in pharma cover the costs of running the business

These include marketing, sales, HR, legal fees, compliance costs, etc.

SG&A usually takes somewhere between 25-30% of the revenue

SG&A (Selling, General, and Administrative) expenses in pharma cover the costs of running the business

These include marketing, sales, HR, legal fees, compliance costs, etc.

SG&A usually takes somewhere between 25-30% of the revenue

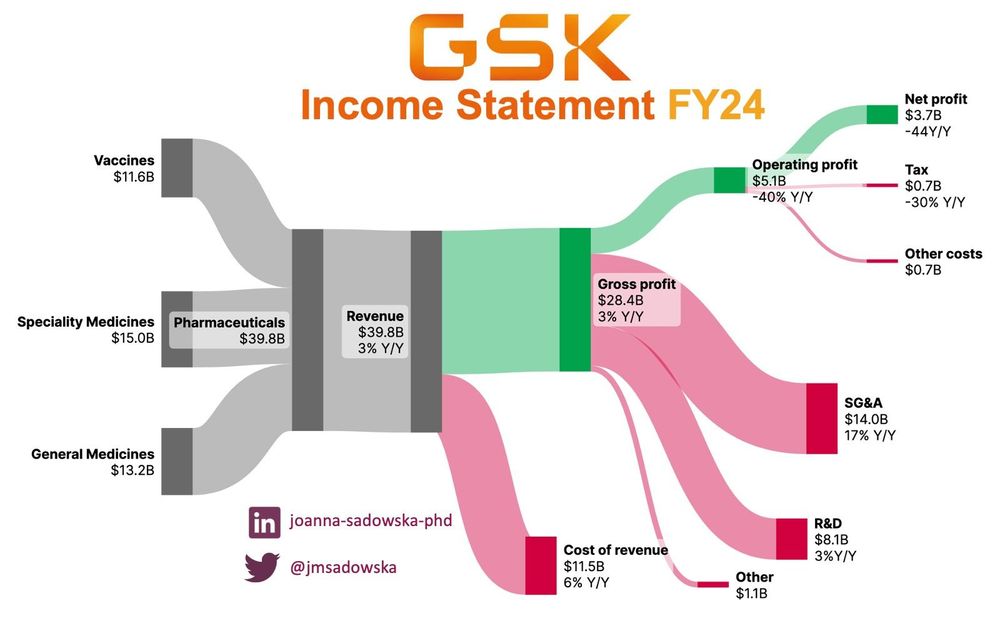

GSK released its financial statements showing steady growth in revenue but significant cost increases impacting profitability.

Here is a breakdown of how the company performed in FY24

GSK released its financial statements showing steady growth in revenue but significant cost increases impacting profitability.

Here is a breakdown of how the company performed in FY24

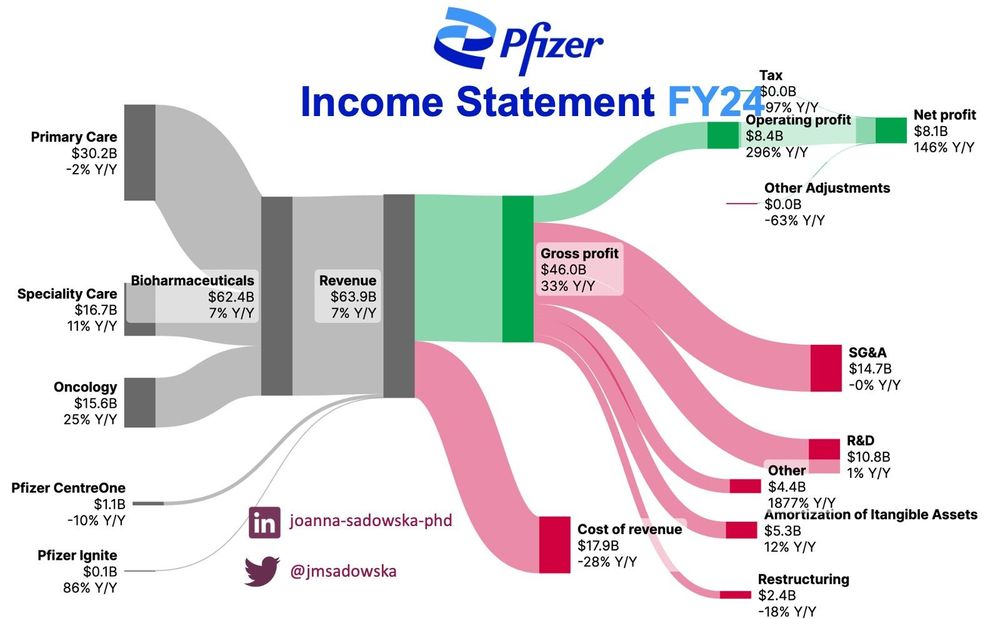

⚆ Pfizer reported $63.9 billion in revenue (7% Y/Y growth).

⚆ Comirnaty still generated over $3.36 billion in sales.

⚆ Pfizer allocated $10.8 billion to R&D - this is 16.9% of their revenue.

⚆ Pfizer reported $63.9 billion in revenue (7% Y/Y growth).

⚆ Comirnaty still generated over $3.36 billion in sales.

⚆ Pfizer allocated $10.8 billion to R&D - this is 16.9% of their revenue.

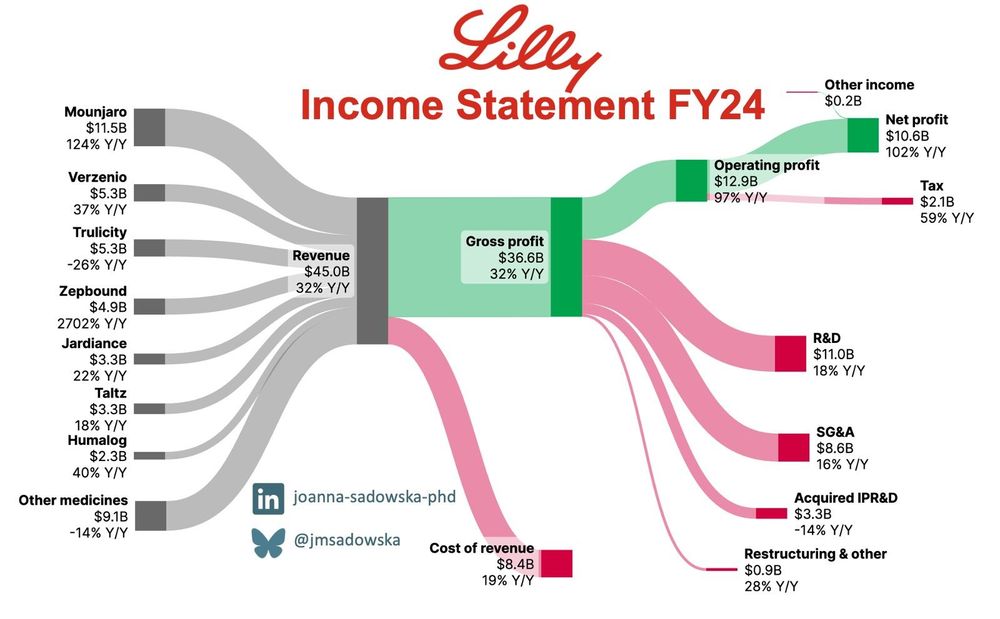

The financial reporting season is ongoing, and most pharma companies have now released their unaudited reports.

The pharma sector has shown year-on-year revenue growth, and 2024 is no exception.

The financial reporting season is ongoing, and most pharma companies have now released their unaudited reports.

The pharma sector has shown year-on-year revenue growth, and 2024 is no exception.

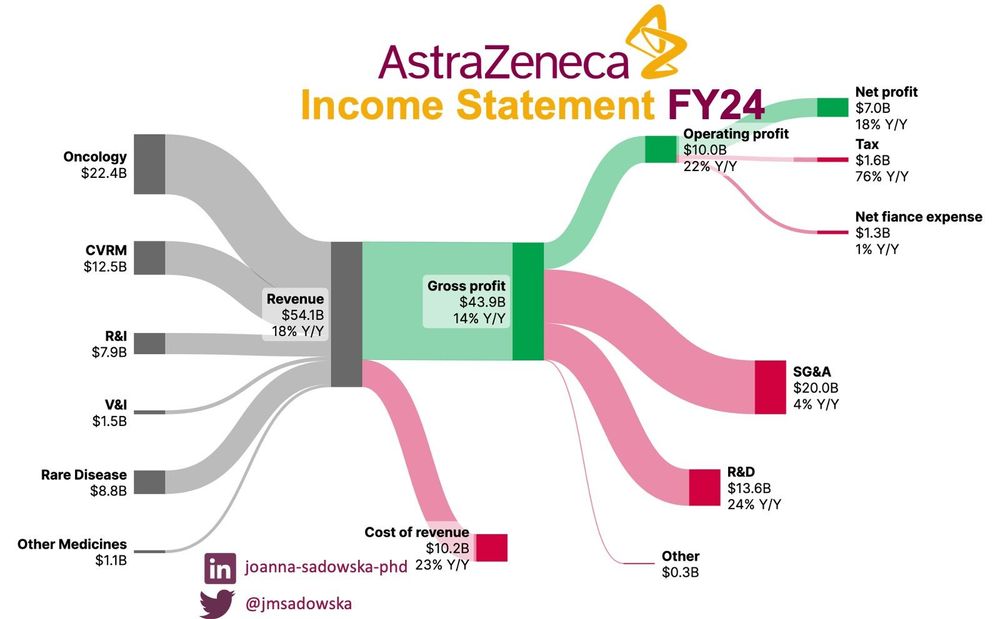

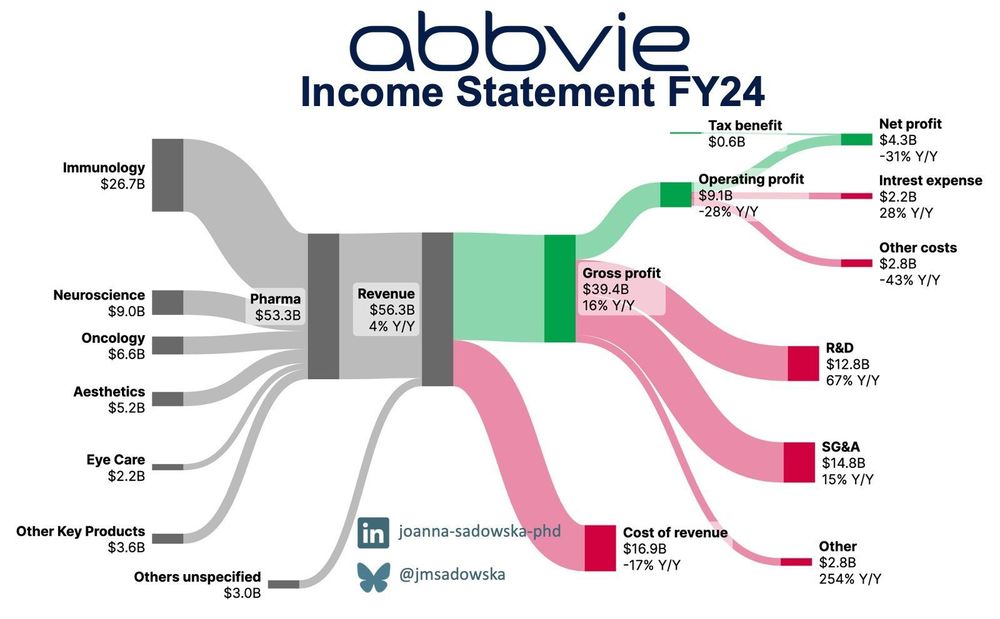

Here’s a quick breakdown of how the company performed in FY24.

Here’s a quick breakdown of how the company performed in FY24.

In 2023, two gene therapies were approved for SCD, but only a few patients have accessed them so far.

These therapies are finally reaching patients.

In 2023, two gene therapies were approved for SCD, but only a few patients have accessed them so far.

These therapies are finally reaching patients.

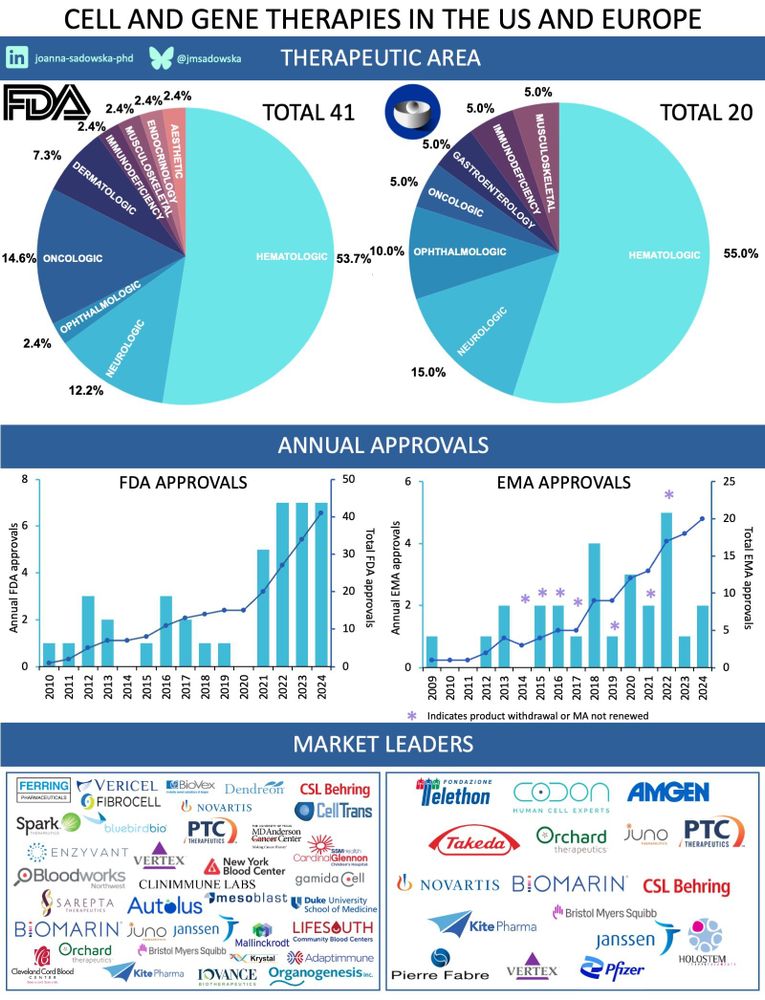

2024 is over. This has been a good year for cell and gene therapies, especially in the US market, where 9 new CGT products* were approved.

2024 is over. This has been a good year for cell and gene therapies, especially in the US market, where 9 new CGT products* were approved.

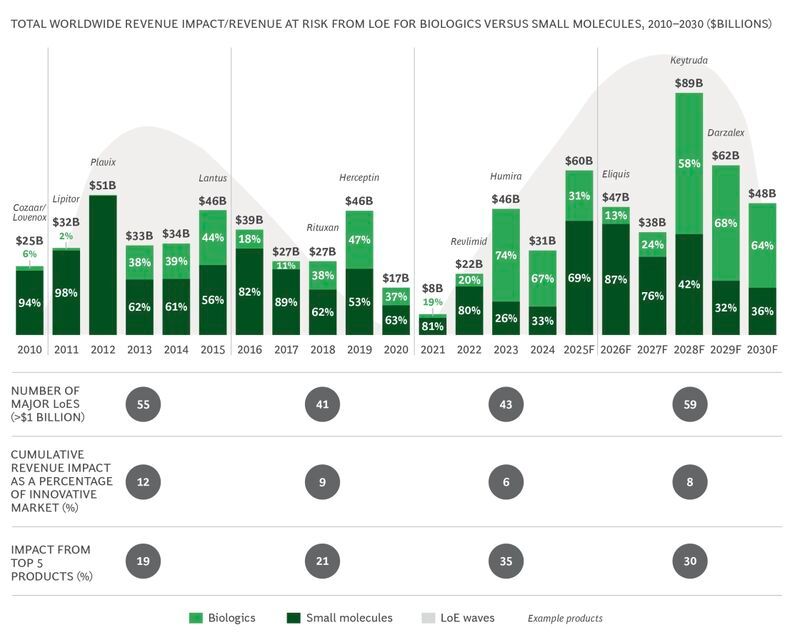

The patent cliff is approaching fast, with drugs representing $350 billion in annual worldwide revenues set to lose their exclusivity by 2030. The top 20 pharma companies account for 80% of this revenue loss.

The patent cliff is approaching fast, with drugs representing $350 billion in annual worldwide revenues set to lose their exclusivity by 2030. The top 20 pharma companies account for 80% of this revenue loss.

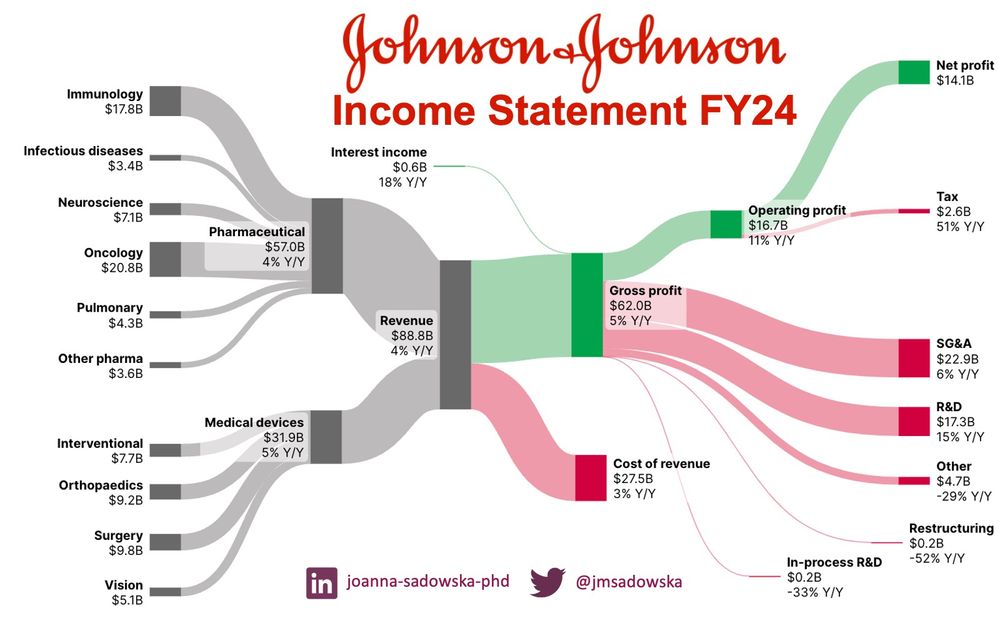

Pharmaceutical companies have started releasing their financial statements for 2024. One of the first to do so is Johnson & Johnson, which announced its results earlier this week.

Here is the graphic of their FY24 Income Statement

Pharmaceutical companies have started releasing their financial statements for 2024. One of the first to do so is Johnson & Johnson, which announced its results earlier this week.

Here is the graphic of their FY24 Income Statement