Martin Sartorius

@martinsartorius.bsky.social

Principal Economist at the CBI. Views are my own

The BoE's MPC kept Bank Rate at 4% today, as it waits to see further disinflationary progress.

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank of England’s Monetary Policy Committee (MPC) voted 5-4 to leave Bank Rate at 4%. The majority bloc voted to keep rates on hold due to concerns over inflation persistence, driven by higher inflation expectations and structural shifts which may have led to greater inflation persistence .

November 6, 2025 at 3:53 PM

The BoE's MPC kept Bank Rate at 4% today, as it waits to see further disinflationary progress.

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

The Bank's central forecast expects inflation to slow to 2% by H1 2027, based on market expectations that interest rates will fall to a terminal rate of 3.5% in H1 2026.

🧵👇

Reposted by Martin Sartorius

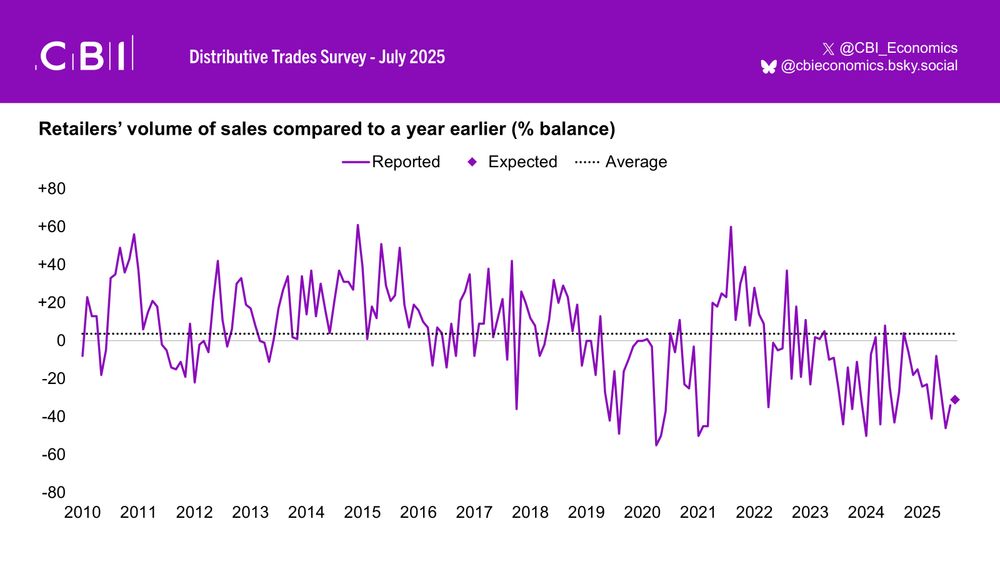

Year-on-year retail sales volumes fell at a strong rate in October amid weak consumer confidence and Budget concerns - according to the latest CBI DTS. Retailers expect the 13-month-long downturn to extend into November.

October 27, 2025 at 11:06 AM

Year-on-year retail sales volumes fell at a strong rate in October amid weak consumer confidence and Budget concerns - according to the latest CBI DTS. Retailers expect the 13-month-long downturn to extend into November.

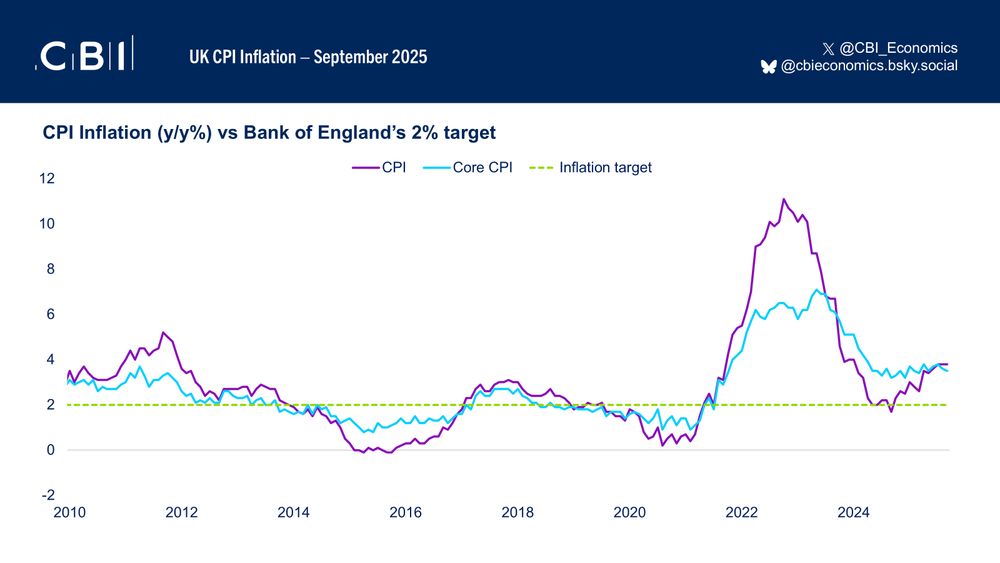

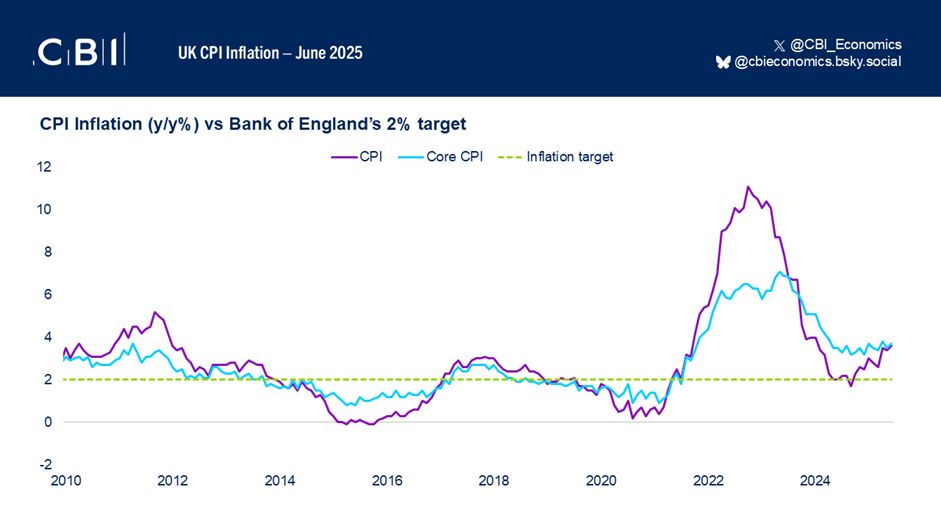

UK inflation came in lower than expected in September (at 3.8%), though it remains well above the BoE's 2% target. We expect inflation to slowly ease in the coming months, but we are unlikely to see a more substantial downshift until the first half of next year

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)

October 22, 2025 at 9:25 AM

UK inflation came in lower than expected in September (at 3.8%), though it remains well above the BoE's 2% target. We expect inflation to slowly ease in the coming months, but we are unlikely to see a more substantial downshift until the first half of next year

Reposted by Martin Sartorius

Private sector activity is weak, hiring plans remain soft, and the investment appetite is muted. 📊

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Economic deep dive Q3 2025 | CBI

Your quarterly guide to the UK economy; making sense of the key trends and what's driving them.

www.cbi.org.uk

October 1, 2025 at 8:32 AM

Private sector activity is weak, hiring plans remain soft, and the investment appetite is muted. 📊

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

Our Q3 Economic Deep Dive helps business leaders cut through the noise on demand, costs & labour markets. 🔍

Exclusive to CBI members🔒: www.cbi.org.uk/articles/eco...

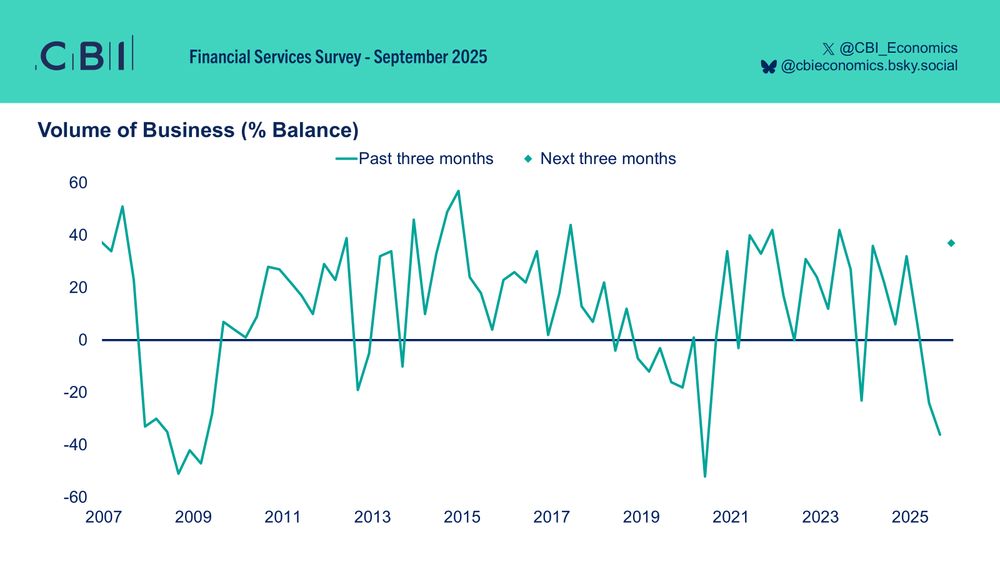

Activity in the FS sector dropped at its quickest rate in five years in Q3, but firms expect a strong rebound next quarter.

Check out the findings from the survey 👇🧵

Check out the findings from the survey 👇🧵

Business volumes in the financial services sector fell at the fastest rate since June 2020 in Q3 2025. However, firms expect volumes growth to make a strong recovery next quarter, according to the latest CBI Financial Services Survey.

October 2, 2025 at 9:06 AM

Activity in the FS sector dropped at its quickest rate in five years in Q3, but firms expect a strong rebound next quarter.

Check out the findings from the survey 👇🧵

Check out the findings from the survey 👇🧵

September marked the twelfth straight month of falling annual retail sales, according to our latest DTS. Weak demand conditions are weighing on sales, while US tariffs are adding pressure for some retailers.

Check out the results of the survey 👇

Check out the results of the survey 👇

#Retail sales volumes fell year-on-year for the 12th month in a row in September, highlighting persistently weak demand conditions in the sector, according to the latest CBI DTS. Sales are expected to decline at a slightly faster rate next month.

September 25, 2025 at 10:09 AM

September marked the twelfth straight month of falling annual retail sales, according to our latest DTS. Weak demand conditions are weighing on sales, while US tariffs are adding pressure for some retailers.

Check out the results of the survey 👇

Check out the results of the survey 👇

Reposted by Martin Sartorius

Since last year’s Autumn Budget hiked labour costs, UK businesses have faced a tough balancing act. How are they responding?

Read our latest blog 👉

www.cbi.org.uk/articles/the...

Read our latest blog 👉

www.cbi.org.uk/articles/the...

The business impact of the NICs increase | CBI

We analyse business responses collected from our regular surveys about the impact of the hikes in National Insurance Contributions.

www.cbi.org.uk

September 19, 2025 at 11:13 AM

Since last year’s Autumn Budget hiked labour costs, UK businesses have faced a tough balancing act. How are they responding?

Read our latest blog 👉

www.cbi.org.uk/articles/the...

Read our latest blog 👉

www.cbi.org.uk/articles/the...

Reposted by Martin Sartorius

#Retail sales volumes rose by 0.5% m/m in August (from 0.5% in July), marking a third consecutive month of growth. Underlying momentum was more muted, however, with sales falling by 0.1% over the three months to August.

September 19, 2025 at 9:03 AM

#Retail sales volumes rose by 0.5% m/m in August (from 0.5% in July), marking a third consecutive month of growth. Underlying momentum was more muted, however, with sales falling by 0.1% over the three months to August.

BoE MPC’s rate hold today was widely expected. A noteworthy nod to data dependency in the minutes, alongside unchanged forward guidance, suggests upcoming inflation and labour market data will be key to a possible Q4 cut

September 18, 2025 at 11:38 AM

BoE MPC’s rate hold today was widely expected. A noteworthy nod to data dependency in the minutes, alongside unchanged forward guidance, suggests upcoming inflation and labour market data will be key to a possible Q4 cut

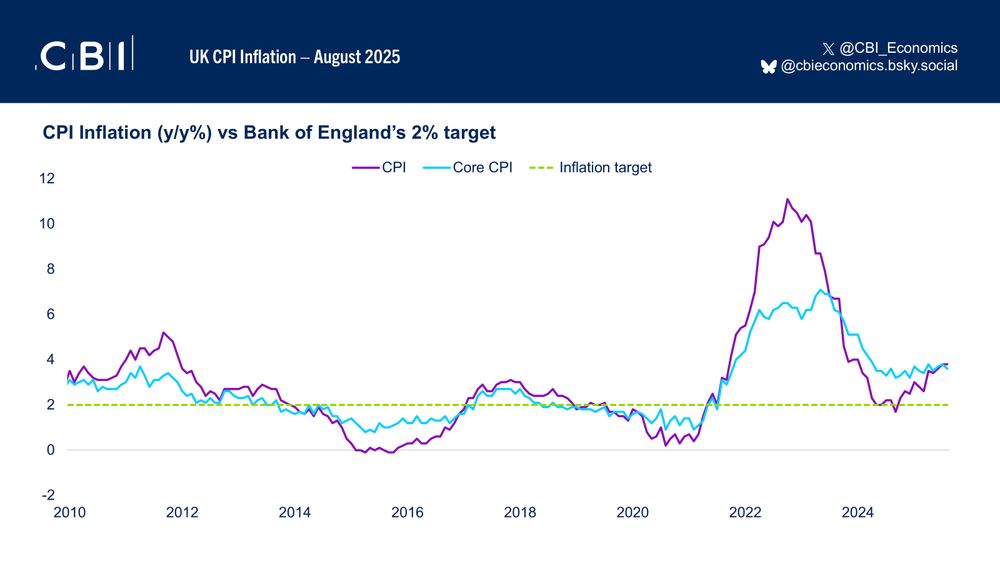

UK inflation remained elevated in August at 3.8%. Higher food and energy prices, alongside passthrough from increased labour costs, will continue putting upward pressure on prices in the near term

UK CPI #inflation remained steady at 3.8% in the year to August (unchanged from July), in line with consensus expectations. Core CPI inflation (excl. energy, food, alcohol, and tobacco) rose by 3.6% (down from 3.8% in July)

September 17, 2025 at 10:03 AM

UK inflation remained elevated in August at 3.8%. Higher food and energy prices, alongside passthrough from increased labour costs, will continue putting upward pressure on prices in the near term

Reposted by Martin Sartorius

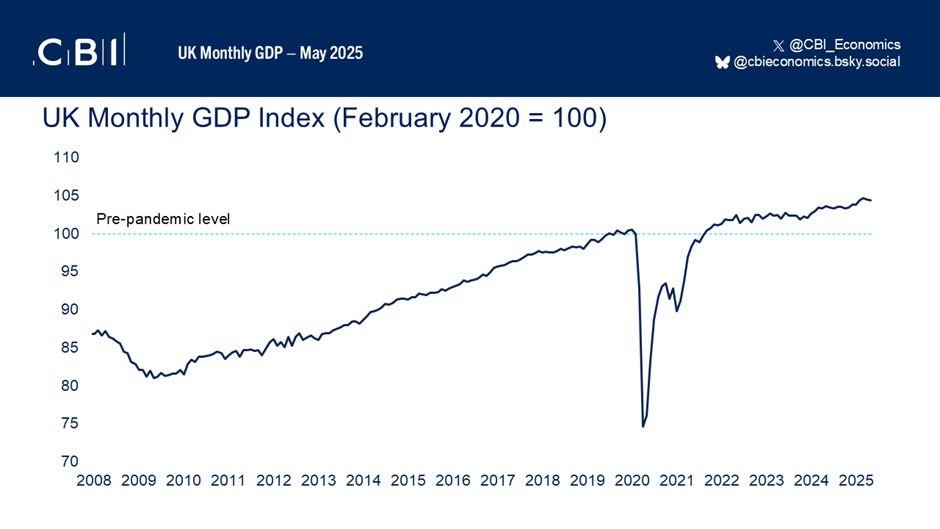

UK GDP was flat in July, in line with market expectations, after a robust 0.4% rise in June. GDP rose 0.2% in the three months to July, and is 1.4% higher than in July 2024, painting the picture of an economy that is growing, if only moderately.

September 12, 2025 at 8:55 AM

UK GDP was flat in July, in line with market expectations, after a robust 0.4% rise in June. GDP rose 0.2% in the three months to July, and is 1.4% higher than in July 2024, painting the picture of an economy that is growing, if only moderately.

Reposted by Martin Sartorius

#Retail sales volumes fell at a strong pace in the year to August – the eleventh month in a row of decline – according to the CBI’s latest quarterly Distributive Trades Survey. Retailers expect the pace of decline to ease in September.

August 27, 2025 at 10:02 AM

#Retail sales volumes fell at a strong pace in the year to August – the eleventh month in a row of decline – according to the CBI’s latest quarterly Distributive Trades Survey. Retailers expect the pace of decline to ease in September.

Reposted by Martin Sartorius

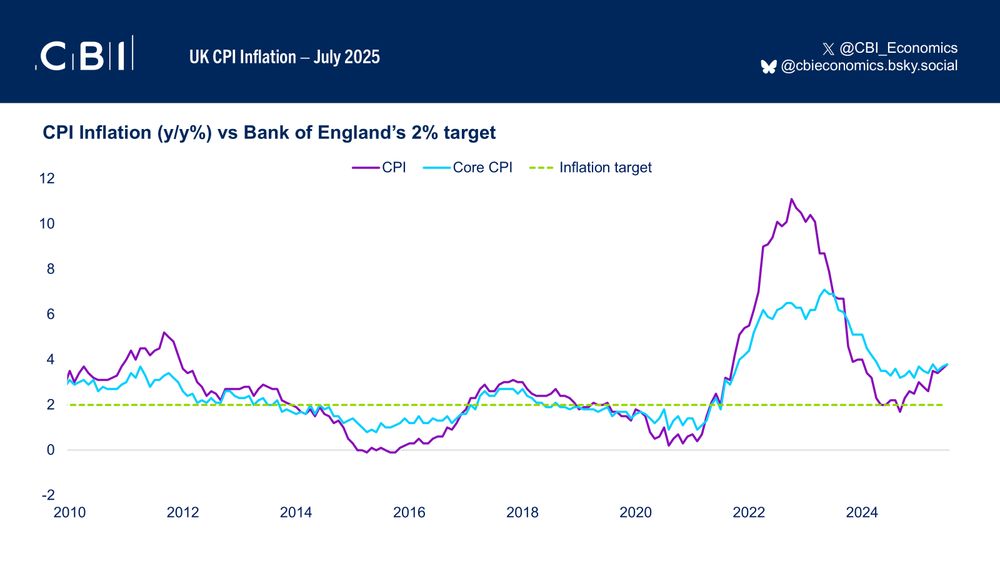

UK #CPI inflation rose by 3.8% in the year to July (from 3.6% in June), slightly above consensus expectations. Core CPI inflation (excl. energy, food, alcohol and tobacco) ticked up to 3.8% (from 3.7% in June)

August 20, 2025 at 9:15 AM

UK #CPI inflation rose by 3.8% in the year to July (from 3.6% in June), slightly above consensus expectations. Core CPI inflation (excl. energy, food, alcohol and tobacco) ticked up to 3.8% (from 3.7% in June)

GDP growth in Q2 (0.3% q/q) was slightly stronger than expected in our latest forecast (0.2%). Under the hood, though, growth was mostly driven government spending, while private demand was weak

UK GDP grew by 0.3% q/q in Q2 2025, beating consensus estimates of 0.1%. Nonetheless, this marked a slowdown from the 0.7% growth seen over Q1 2025.

August 14, 2025 at 9:50 AM

GDP growth in Q2 (0.3% q/q) was slightly stronger than expected in our latest forecast (0.2%). Under the hood, though, growth was mostly driven government spending, while private demand was weak

One interesting nugget from today's MPC minutes is that there were two rounds of voting to reach a decision. From what I can gather, this is the first time the MPC has held two votes on interest rates since the BoE became independent - underlining just how finely balanced the decision to cut was

August 7, 2025 at 11:55 AM

One interesting nugget from today's MPC minutes is that there were two rounds of voting to reach a decision. From what I can gather, this is the first time the MPC has held two votes on interest rates since the BoE became independent - underlining just how finely balanced the decision to cut was

The BoE MPC voted to reduce rates to 4% today, in line with our latest forecast's expectations. The story of the Bank's projections was broadly unchanged from May, with GDP growth remaining subdued and inflation gradually returning to the 2% target after this year's bump

🧵 of key takeaways 👇

🧵 of key takeaways 👇

The Bank of England’s MPC voted 5-4 to cut Bank Rate by 25bp to 4.00%. The majority bloc voted for an interest rate reduction due to signs of disinflationary pressures stemming from weak activity and cooling labour market conditions

August 7, 2025 at 11:44 AM

The BoE MPC voted to reduce rates to 4% today, in line with our latest forecast's expectations. The story of the Bank's projections was broadly unchanged from May, with GDP growth remaining subdued and inflation gradually returning to the 2% target after this year's bump

🧵 of key takeaways 👇

🧵 of key takeaways 👇

Reposted by Martin Sartorius

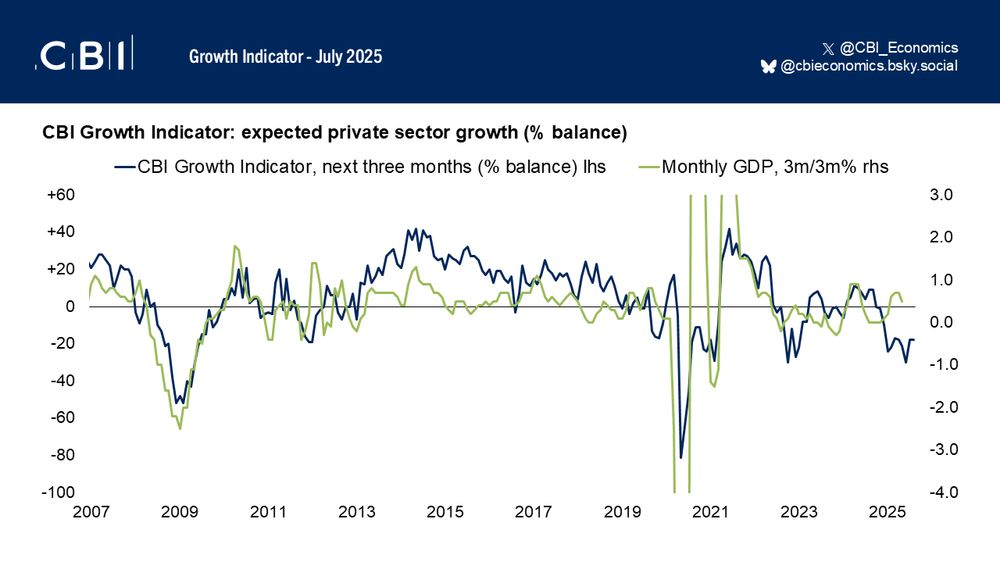

📉 Private sector firms expect activity to fall again through October.

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

July 30, 2025 at 8:05 AM

📉 Private sector firms expect activity to fall again through October.

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

Reposted by Martin Sartorius

#Retail sales volumes fell strongly in the year to July, according to the latest CBI Distributive Trades Survey. Retailers expect the ongoing downturn to extend into August.

July 28, 2025 at 10:06 AM

#Retail sales volumes fell strongly in the year to July, according to the latest CBI Distributive Trades Survey. Retailers expect the ongoing downturn to extend into August.

UK #inflation picked up to 3.6% in June (from 3.4% in May), mostly reflecting fuel pump price base effects. Price pressures are expected to remain firm this year, due to higher household energy prices and the passthrough of increased labour costs

UK CPI inflation rose by a stronger-than-expected 3.6% in June (from 3.4% in May), marking the highest rate since January 2024. Core CPI inflation also increased to 3.7%, from 3.5% in the previous month

July 16, 2025 at 9:43 AM

UK #inflation picked up to 3.6% in June (from 3.4% in May), mostly reflecting fuel pump price base effects. Price pressures are expected to remain firm this year, due to higher household energy prices and the passthrough of increased labour costs

Reposted by Martin Sartorius

UK GDP contracted by 0.1% in May, marking the second consecutive monthly decline after a 0.3% fall in April, though this follows a surprisingly strong first quarter. GDP grew by 0.5% in the three months to May.

July 11, 2025 at 9:20 AM

UK GDP contracted by 0.1% in May, marking the second consecutive monthly decline after a 0.3% fall in April, though this follows a surprisingly strong first quarter. GDP grew by 0.5% in the three months to May.

Annual sales volumes fell at a fast pace in the retail and broader distribution sector, according to our latest DTS. Many firms continue to report that consumer caution is holding back sales

Key takeaways from the survey 🧵👇

Key takeaways from the survey 🧵👇

#Retail sales volumes fell at a sharp rate in the year to June, according to the latest CBI Distributive Trades Survey. Retailers expect sales to decline rapidly again next month.

June 26, 2025 at 11:10 AM

Annual sales volumes fell at a fast pace in the retail and broader distribution sector, according to our latest DTS. Many firms continue to report that consumer caution is holding back sales

Key takeaways from the survey 🧵👇

Key takeaways from the survey 🧵👇

Reposted by Martin Sartorius

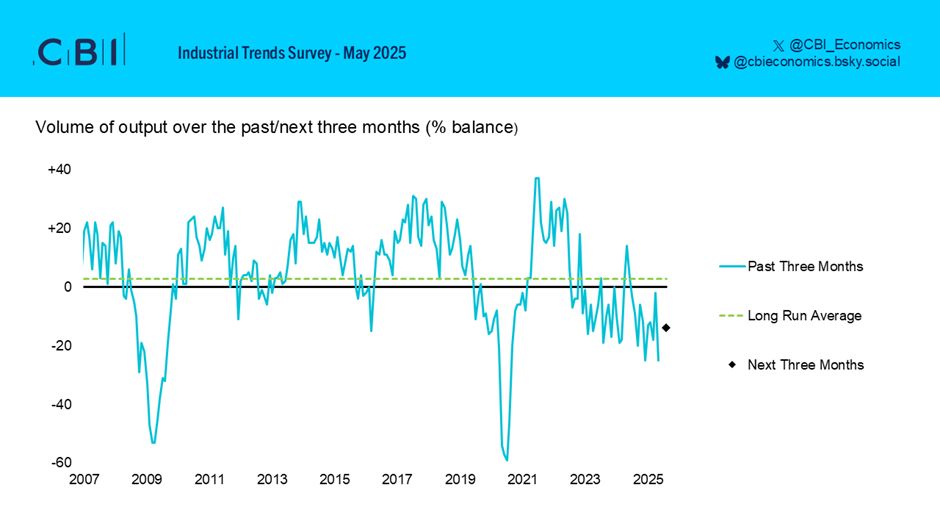

The latest CBI Industrial Trends Survey found that #manufacturing output volumes fell in the three months to June, at a similarly steep pace to the three months to May. Looking ahead, firms anticipate that the pace of decline will slow over the next three months

June 24, 2025 at 10:01 AM

The latest CBI Industrial Trends Survey found that #manufacturing output volumes fell in the three months to June, at a similarly steep pace to the three months to May. Looking ahead, firms anticipate that the pace of decline will slow over the next three months

Our latest UK forecast has been released! Check out the below thread for the key takeaways from our projections for GDP, inflation, interest rates, and more

🚨 New UK economic forecast is out! 🚨

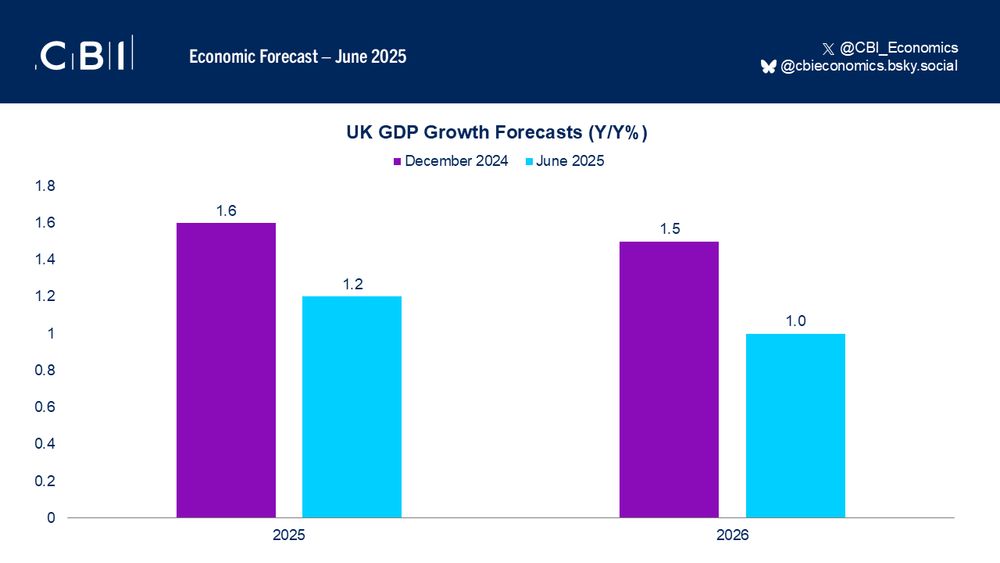

We project that the UK will see modest GDP growth of 1.2% in 2025 and 1.0% in 2026. The economy is facing stiff domestic & international headwinds that will weigh on activity.

Here’s what you need to know 👇🧵

#UKeconomy #Econsky #Econ

We project that the UK will see modest GDP growth of 1.2% in 2025 and 1.0% in 2026. The economy is facing stiff domestic & international headwinds that will weigh on activity.

Here’s what you need to know 👇🧵

#UKeconomy #Econsky #Econ

June 18, 2025 at 9:12 AM

Our latest UK forecast has been released! Check out the below thread for the key takeaways from our projections for GDP, inflation, interest rates, and more

Reposted by Martin Sartorius

The latest CBI Industrial Trends Survey found that #manufacturing output volumes fell in the three months to May, at the joint-steepest pace since August 2020. Looking ahead, manufacturers expect output to decline over the next three months

May 22, 2025 at 10:02 AM

The latest CBI Industrial Trends Survey found that #manufacturing output volumes fell in the three months to May, at the joint-steepest pace since August 2020. Looking ahead, manufacturers expect output to decline over the next three months

Inflation rose to 3.5% in April, driven by a perfect storm of price pressures such as the hike in the Ofgem price cap, higher employer NICs, and the National Living Wage increase. We expect that these factors will keep inflation elevated this year.

UK CPI #inflation rose to 3.5% in April (from 2.6% in March), broadly in line with Bank of England expectations. This marked the highest rate of inflation since January 2024. Core CPI inflation also picked up to 3.8%, from 3.4% last month

May 21, 2025 at 9:41 AM

Inflation rose to 3.5% in April, driven by a perfect storm of price pressures such as the hike in the Ofgem price cap, higher employer NICs, and the National Living Wage increase. We expect that these factors will keep inflation elevated this year.