The market still said no.

Oracle’s numbers looked strong, but the cash burn and debt math told a different story.

AI demand isn’t in question.

AI economics are.

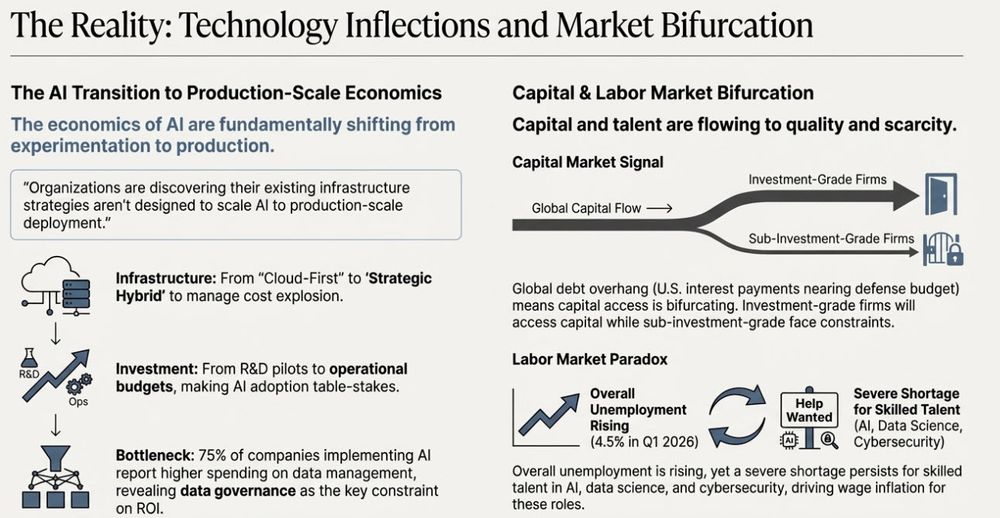

This graphic shows why the market flinched.

#Oracle #AIInfrastructure #CreditMarkets #Earnings

The market still said no.

Oracle’s numbers looked strong, but the cash burn and debt math told a different story.

AI demand isn’t in question.

AI economics are.

This graphic shows why the market flinched.

#Oracle #AIInfrastructure #CreditMarkets #Earnings

#AIInfrastructure #CreditQuality #Investing #Analysis

#AIInfrastructure #CreditQuality #Investing #Analysis

#EarningsBeat #MarketSignals #CDS #Risk

#EarningsBeat #MarketSignals #CDS #Risk

#Software #Cloud #CreditMarkets #Finance

#Software #Cloud #CreditMarkets #Finance

#Revenue #Backlog #Debt #Analysis

#Revenue #Backlog #Debt #Analysis

#Oracle #CDS #CreditRisk #MarketInsights

#Oracle #CDS #CreditRisk #MarketInsights

#AI #CapEx #Credit #Markets

#AI #CapEx #Credit #Markets

#Earnings #CreditAnalysis #Investing #Risk

#Earnings #CreditAnalysis #Investing #Risk

#CDS #FixedIncome #TechEarnings #DebtMarkets

#CDS #FixedIncome #TechEarnings #DebtMarkets

#FixedIncome #Earnings #Oracle #Insight

#FixedIncome #Earnings #Oracle #Insight

#Oracle #CreditRisk #AIInfrastructure #Finance

#Oracle #CreditRisk #AIInfrastructure #Finance

#Semiconductors #Innovation #Leadership #TechPolicy

#Semiconductors #Innovation #Leadership #TechPolicy

#SupplyChainRisk #TSMC #CHIPSAct #AdvancedManufacturing

#SupplyChainRisk #TSMC #CHIPSAct #AdvancedManufacturing

#Semiconductors #Geopolitics #AIInfrastructure #NationalSecurity buff.ly/ib62yZD

#Semiconductors #Geopolitics #AIInfrastructure #NationalSecurity buff.ly/ib62yZD

#AIInvestment #BondMarkets #TechMacro #RiskSignals

#AIInvestment #BondMarkets #TechMacro #RiskSignals

michaelkeen1.substack.com/p/ai-infrast...

michaelkeen1.substack.com/p/ai-infrast...

#Camus #Compassion #Humanity #Rebellion

#Camus #Compassion #Humanity #Rebellion

#Camus #Democracy #HumanCrisis #Violence

#Camus #Democracy #HumanCrisis #Violence

#Camus #PoliticalViolence #Humanity #HumanCrisis

#Camus #PoliticalViolence #Humanity #HumanCrisis

#Camus #Rebellion #Humanity #Compassion

#Camus #Rebellion #Humanity #Compassion

#Camus #HumanCrisis #Violence #Democracy

#Camus #HumanCrisis #Violence #Democracy