Optimise Accountants specializes in international tax advisory services for American and British expats who move to or invest in the UK, US, or Spain

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

Free UK Tax eBooks👇

zurl.co/XqF3R

zurl.co/tKQ9w

Free UK Tax eBooks👇

zurl.co/XqF3R

zurl.co/tKQ9w

📥 Free UK Property Tax eBook: zurl.co/j0v1z

#UKTax #PropertyInvestment #TaxPlanning

📥 Free UK Property Tax eBook: zurl.co/j0v1z

#UKTax #PropertyInvestment #TaxPlanning

✅ Gifts 7+ yrs before death = tax-free

✅ 3-7 yrs = taper relief

✅ <3 yrs = 40% tax

Plan ahead!

🔗 Free Tax eBooks: zurl.co/NT42R

✅ Gifts 7+ yrs before death = tax-free

✅ 3-7 yrs = taper relief

✅ <3 yrs = 40% tax

Plan ahead!

🔗 Free Tax eBooks: zurl.co/NT42R

✔️ FICs: Tax-efficient, parents retain control

✔️ Trusts: Asset protection, IHT benefits, but tax hikes

👉 Get our free UK Property Tax eBook: zurl.co/9lPPM

#UKTax #EstatePlanning #FIC #Trusts

✔️ FICs: Tax-efficient, parents retain control

✔️ Trusts: Asset protection, IHT benefits, but tax hikes

👉 Get our free UK Property Tax eBook: zurl.co/9lPPM

#UKTax #EstatePlanning #FIC #Trusts

🔹 20-45% Income Tax on profits

🔹 Only 20% tax relief on mortgage interest

🔹 18-24% Capital Gains Tax when selling

📖 Free UK Property Tax eBook: zurl.co/dCzTy

#BuyToLet #LandlordTax

🔹 20-45% Income Tax on profits

🔹 Only 20% tax relief on mortgage interest

🔹 18-24% Capital Gains Tax when selling

📖 Free UK Property Tax eBook: zurl.co/dCzTy

#BuyToLet #LandlordTax

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

✅ Use the £325K Nil-Rate Band

✅ Gift assets early (7+ years rule)

✅ Use Trusts & Investment Companies

✅ Invest in IHT-free assets

📘 Free Tax eBook: zurl.co/2HgLA

#InheritanceTax #WealthPlanning #UKTax

✅ Use the £325K Nil-Rate Band

✅ Gift assets early (7+ years rule)

✅ Use Trusts & Investment Companies

✅ Invest in IHT-free assets

📘 Free Tax eBook: zurl.co/2HgLA

#InheritanceTax #WealthPlanning #UKTax

📲 Landlords & business owners, are you ready for HMRC’s digital crackdown? 💥 Read this 👇 zurl.co/DMTdl

#MakingTaxDigital #UKTax #LandlordTax #DigitalTax #HMRC #TaxAdvice #PropertyTax #AccountantsUK

📲 Landlords & business owners, are you ready for HMRC’s digital crackdown? 💥 Read this 👇 zurl.co/DMTdl

#MakingTaxDigital #UKTax #LandlordTax #DigitalTax #HMRC #TaxAdvice #PropertyTax #AccountantsUK

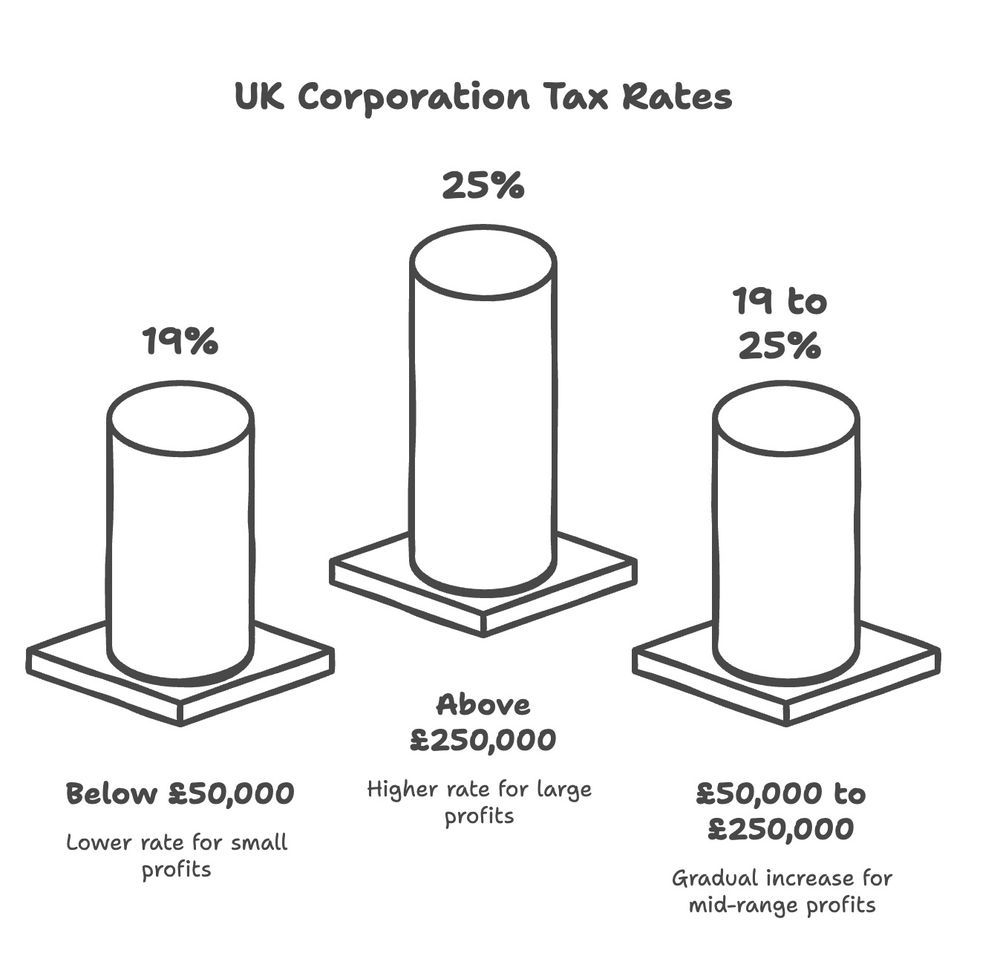

✔ Pay 25% corp tax vs 45% income tax

✔ Claim full mortgage interest relief

✔ Plan for inheritance tax efficiently

📖 Free eBook: zurl.co/EFSTZ #UKTax

✔ Pay 25% corp tax vs 45% income tax

✔ Claim full mortgage interest relief

✔ Plan for inheritance tax efficiently

📖 Free eBook: zurl.co/EFSTZ #UKTax

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

Use our FREE 🧮 Stamp Duty Calculator now and save £££! Quick, easy, and online! 🚀

👉 zurl.co/dwCQZ

#BuyToLet #StampDuty #UKProperty #LandlordTips #TaxCalculator 🏡💷

Use our FREE 🧮 Stamp Duty Calculator now and save £££! Quick, easy, and online! 🚀

👉 zurl.co/dwCQZ

#BuyToLet #StampDuty #UKProperty #LandlordTips #TaxCalculator 🏡💷

✅ £325,000 tax-free

✅ 40% tax on anything above (unless exempt)

✅ Boost to £500,000 with the Residence Nil Rate Band!

Plan ahead & save!

📖 Free Expat Tax eBook: zurl.co/lDpx8

#InheritanceTax #TaxPlanning #WealthManagement

✅ £325,000 tax-free

✅ 40% tax on anything above (unless exempt)

✅ Boost to £500,000 with the Residence Nil Rate Band!

Plan ahead & save!

📖 Free Expat Tax eBook: zurl.co/lDpx8

#InheritanceTax #TaxPlanning #WealthManagement

UK IHT is 40% on estates over £325K! Reduce your tax bill with:

✅ Family Investment Companies (FIC)

✅ Gifting assets early

✅ Trusts & life insurance

Get our free UK Property Tax eBook: zurl.co/r5Xbv

UK IHT is 40% on estates over £325K! Reduce your tax bill with:

✅ Family Investment Companies (FIC)

✅ Gifting assets early

✅ Trusts & life insurance

Get our free UK Property Tax eBook: zurl.co/r5Xbv

🔹 Review your setup—does it still work?

🔹 Optimise for tax savings.

🔹 Get expert advice to stay compliant.

📘 Free UK Property Tax eBook: zurl.co/6hVUq

#UKBusiness #TaxPlanning #BusinessGrowth

🔹 Review your setup—does it still work?

🔹 Optimise for tax savings.

🔹 Get expert advice to stay compliant.

📘 Free UK Property Tax eBook: zurl.co/6hVUq

#UKBusiness #TaxPlanning #BusinessGrowth

✔️ $325K + £175K tax-free amount

✔️ Pass your home to direct descendants

✔️ Plan early—secure your family’s wealth

📗 UK Property Tax eBook: zurl.co/f6Sgy

📘 Expat Tax eBook: zurl.co/F9Ztu

✔️ $325K + £175K tax-free amount

✔️ Pass your home to direct descendants

✔️ Plan early—secure your family’s wealth

📗 UK Property Tax eBook: zurl.co/f6Sgy

📘 Expat Tax eBook: zurl.co/F9Ztu

💷 £500K pension = £200K lost to tax! Act now to protect your legacy.

Calculate here: zurl.co/Ol8sA

#InheritanceTax #Pension #IHT #UKTax #TaxPlanning

💷 £500K pension = £200K lost to tax! Act now to protect your legacy.

Calculate here: zurl.co/Ol8sA

#InheritanceTax #Pension #IHT #UKTax #TaxPlanning

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

📘 Offer tax guides

🎤 Run expert-led training

💸 Earn referral income

✨ Add real value & credibility to your students' journey.

📩 DM us now for your free partner pack!

#PropertyTax #HMRC #Collaboration #TaxTraining

✅ Smart salary & dividend planning

✅ Strategic pension contributions

✅ Save thousands—optimize your tax today!

#UKTax #LimitedCompany #TaxSavings

📗 Free UK Property Tax eBook: zurl.co/usXSY

✅ Smart salary & dividend planning

✅ Strategic pension contributions

✅ Save thousands—optimize your tax today!

#UKTax #LimitedCompany #TaxSavings

📗 Free UK Property Tax eBook: zurl.co/usXSY

✅ Tax-efficient management

✅ Secure your legacy

✅ Ideal for families planning for IHT

#FamilyInvestmentCompany #UKTax #WealthPlanning #InheritanceTax

📗 Free UK Property Tax eBook: zurl.co/4aATE

✅ Tax-efficient management

✅ Secure your legacy

✅ Ideal for families planning for IHT

#FamilyInvestmentCompany #UKTax #WealthPlanning #InheritanceTax

📗 Free UK Property Tax eBook: zurl.co/4aATE