Website: www.stockopine.com

The dominace is staggering:

$NVDA: ~85% share

$AMD: 7.5% share

$INTC: 7.5% share

$AMD overtook $INTC and targets a double-digit share next. Can they pull it off against $NVDA ?

The dominace is staggering:

$NVDA: ~85% share

$AMD: 7.5% share

$INTC: 7.5% share

$AMD overtook $INTC and targets a double-digit share next. Can they pull it off against $NVDA ?

Thank you to Sophocles for the invitation and for continuously creating a space where thoughtful investment ideas are shared and challenged.

Looking forward to contributing my stock pitch.

Thank you to Sophocles for the invitation and for continuously creating a space where thoughtful investment ideas are shared and challenged.

Looking forward to contributing my stock pitch.

Enterprise SASE adoption rose to 15% (from 13% last qtr) showing both strong execution and plenty of runway ahead.

Full earnings review 👇.

#FTNT #Earnings #Cybersecurity #SASE

Enterprise SASE adoption rose to 15% (from 13% last qtr) showing both strong execution and plenty of runway ahead.

Full earnings review 👇.

#FTNT #Earnings #Cybersecurity #SASE

Get into our latest earnings review of LVMH.

$MC.PA $EL $CFR.SW $KER.PA

Get into our latest earnings review of LVMH.

$MC.PA $EL $CFR.SW $KER.PA

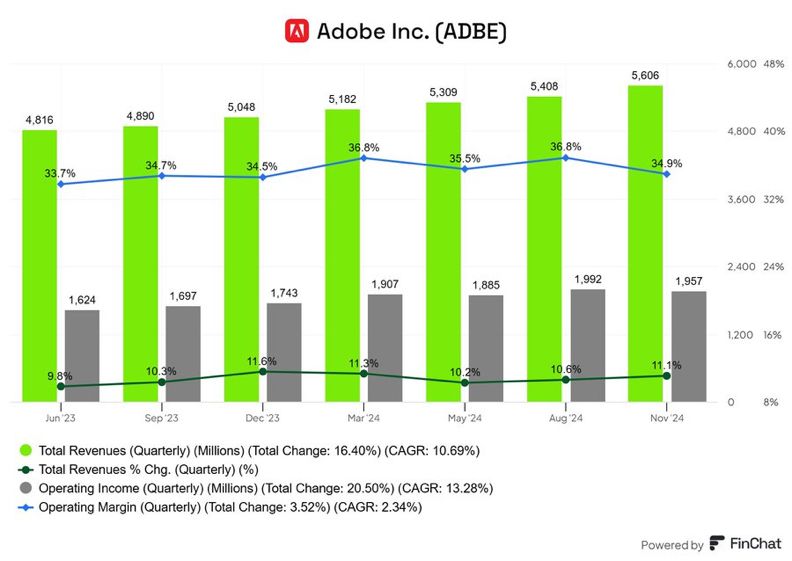

In comparison, Adobe $ADBE, with a market cap of $192.5 billion and FY24 revenue of $21.51 billion, trades at a multiple of ~9x, making it relatively less expensive.

In comparison, Adobe $ADBE, with a market cap of $192.5 billion and FY24 revenue of $21.51 billion, trades at a multiple of ~9x, making it relatively less expensive.

Key highlights for the quarter:

- Revenue: $5.61B (up 11.1% YoY) Vs $5.54B expected

- Non-GAAP EPS: $4.81 up 12.6% YoY) Vs $4.67 expected

Key highlights for the quarter:

- Revenue: $5.61B (up 11.1% YoY) Vs $5.54B expected

- Non-GAAP EPS: $4.81 up 12.6% YoY) Vs $4.67 expected

Can they succeed? With Waymo's progress as proof, why not?

$GOOGL

Can they succeed? With Waymo's progress as proof, why not?

$GOOGL

Here’s a chart (@KoyfinCharts ) of S&P 500 companies with positive FCF margins & NTM EV/EBITDA < 30.

A few standouts: $AMP, $MO, $CPAY, $GEN.

💡 Which ones catch your eye? Let’s discuss!

Here’s a chart (@KoyfinCharts ) of S&P 500 companies with positive FCF margins & NTM EV/EBITDA < 30.

A few standouts: $AMP, $MO, $CPAY, $GEN.

💡 Which ones catch your eye? Let’s discuss!

“Zoom AI Companion monthly active users growing 59% quarter-over-quarter.”

“And the number of Zoom Contact Center customers surpassed 1,250, up more than 82% year-over-year.”

“A number of Workvivo customers grew 72% year-over-year”

“Zoom AI Companion monthly active users growing 59% quarter-over-quarter.”

“And the number of Zoom Contact Center customers surpassed 1,250, up more than 82% year-over-year.”

“A number of Workvivo customers grew 72% year-over-year”

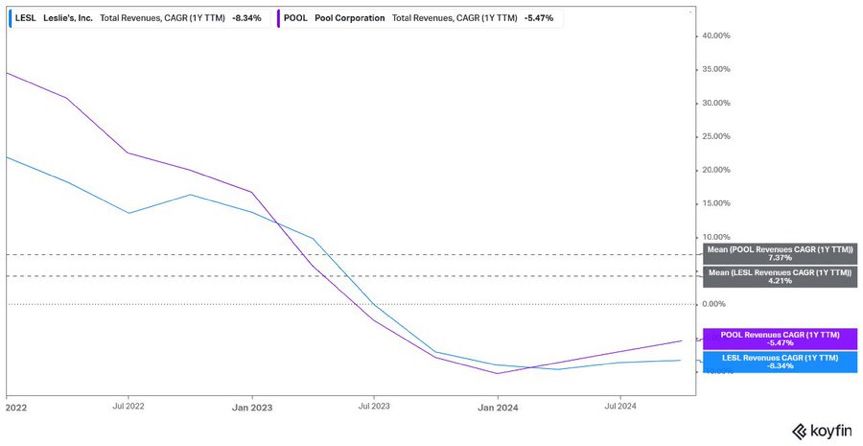

Now, higher rates 📈 + return-to-office 🏢 = tough comps for $POOL & $LESL

Still, the pool industry remains resilient. Clean pools + a growing installed base = long-term demand

Now, higher rates 📈 + return-to-office 🏢 = tough comps for $POOL & $LESL

Still, the pool industry remains resilient. Clean pools + a growing installed base = long-term demand

Is this the best use of capital?

- $CARR trades at 16x EV/EBITDA NTM, above its historical average of 14x.

Is this the best use of capital?

- $CARR trades at 16x EV/EBITDA NTM, above its historical average of 14x.

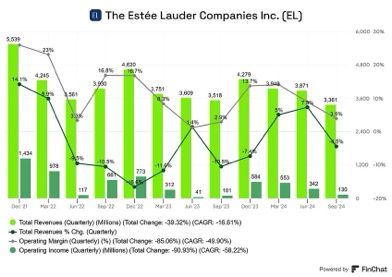

Is $EL on the verge of a turnaround? 📈

Read our full analysis here 👇

www.stockopine.com/p/estee-laud...

Is $EL on the verge of a turnaround? 📈

Read our full analysis here 👇

www.stockopine.com/p/estee-laud...

We provide in-depth research on quality companies—those with strong market presence and sustainable competitive advantages that make them prime candidates for long-term investment.

Our analysis offers you an understanding of a company's business model and industry position.

Say 👋

We provide in-depth research on quality companies—those with strong market presence and sustainable competitive advantages that make them prime candidates for long-term investment.

Our analysis offers you an understanding of a company's business model and industry position.

Say 👋