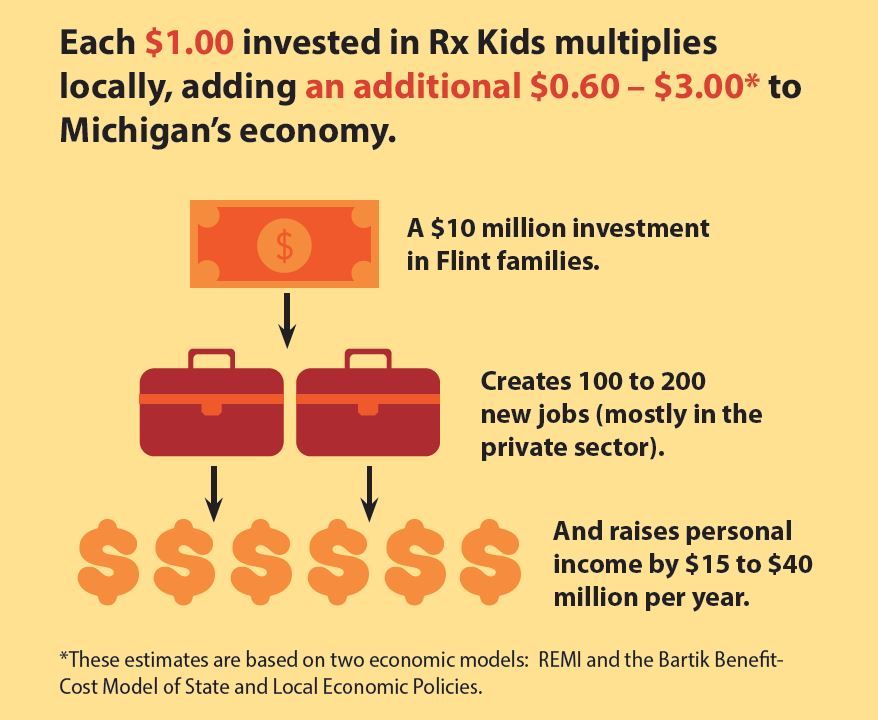

Senior Economist at Upjohn Institute, fan of "place-based policies" (or at least some of them!). https://www.upjohn.org/about/upjohn-team/staff/timothy-j-bartik

Timothy J. Bartik is an American economist who specializes in regional economics, public finance, urban economics, labor economics, and labor demand policies. He is a senior economist at the W.E. Upjohn Institute for Employment Research in Kalamazoo, Michigan. .. more

The grad is from China

Epstein and Summers referred to her by the codename "Peril"

Racism and sexual exploitation in one efficient package

bit.ly/3LHpin8

www.upjohn.org/research-hig...

Reposted by Timothy J. Bartik

www.upjohn.org/research-hig...