With the current housing data and data from the services sector, it is still a decent scenario, but everything is challenged here (including myself)

#MarketTrends #Economy #Finance

With the current housing data and data from the services sector, it is still a decent scenario, but everything is challenged here (including myself)

#MarketTrends #Economy #Finance

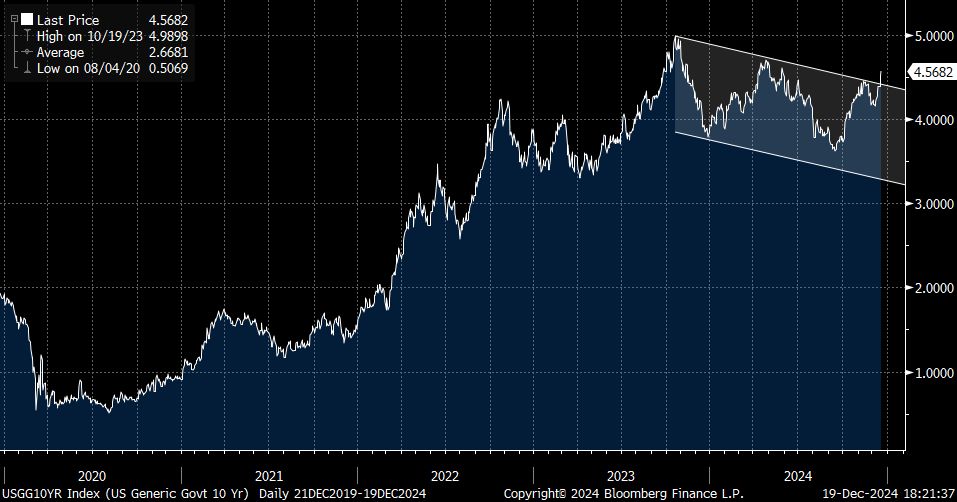

Inflation expectations (traded) are fairly muted this year

It is a massive repricing of real-rate since September

#Bonds #Inflation #BondYields #MarketAnalysis #Finance #Investing #RealRates #EconomicTrends #MacroEconomics

Inflation expectations (traded) are fairly muted this year

It is a massive repricing of real-rate since September

#Bonds #Inflation #BondYields #MarketAnalysis #Finance #Investing #RealRates #EconomicTrends #MacroEconomics

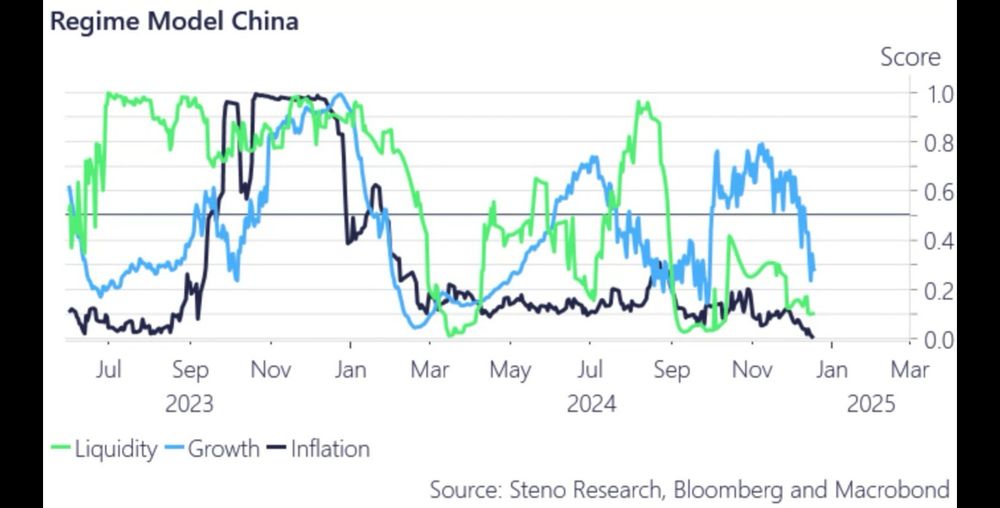

stenoresearch.com/the-drill-the-

#ChinaEconomy #Nowcasting #GlobalMarkets #EconomicOutlook #FinancialAnalysis #MarketTrends #GlobalEconomy #StenoResearch

stenoresearch.com/the-drill-the-

#ChinaEconomy #Nowcasting #GlobalMarkets #EconomicOutlook #FinancialAnalysis #MarketTrends #GlobalEconomy #StenoResearch