Ben Carlson

@bencarlson007.bsky.social

5.5K followers

75 following

860 posts

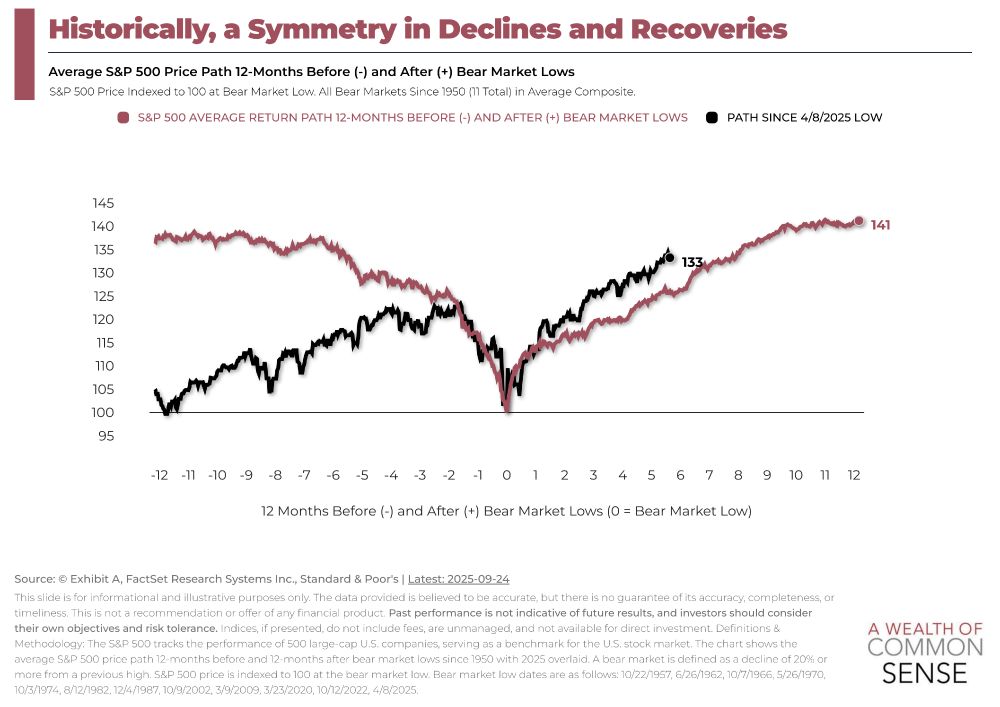

www.awealthofcommonsense.com

Posts

Media

Videos

Starter Packs