Posts to help manage & grow your finances

Investment ideas to build up your wealth

Tax-efficiency tips

UK-based, not financial advice

#PersonalFinance #Money #FinancialFreedom #Invest

#PersonalFinance #Money #FinancialFreedom #Invest

Shield your savings from further rate cuts.

Our pick of the week is from Virgin Money with 2 options:

1 Year Fixed Rate E-Bond, 4.31% AER

1 Year Fixed Rate Cash E-ISA, 4.10% AER

Get the best rate. Use your switching power!

#InterestRates #Money #Savings

Shield your savings from further rate cuts.

Our pick of the week is from Virgin Money with 2 options:

1 Year Fixed Rate E-Bond, 4.31% AER

1 Year Fixed Rate Cash E-ISA, 4.10% AER

Get the best rate. Use your switching power!

#InterestRates #Money #Savings

The UK Base Rate is now 4.25%.

There’s an expectation of another two 0.25% rate cuts in 2025.

Think about a switch to get the best deal on mortgages & savings.

#BuildUpYourWealth #MyDogReggie #InterestRates #PersonalFinance #Money #Mortgage

The UK Base Rate is now 4.25%.

There’s an expectation of another two 0.25% rate cuts in 2025.

Think about a switch to get the best deal on mortgages & savings.

#BuildUpYourWealth #MyDogReggie #InterestRates #PersonalFinance #Money #Mortgage

These 4 highly rated providers (Allica Bank, @monzo.com Starling Bank & Tide) offer banking benefits & interest on your cash held with them, either directly via instant access accounts or through linked savings accounts.

#BusinessBanking #Money

These 4 highly rated providers (Allica Bank, @monzo.com Starling Bank & Tide) offer banking benefits & interest on your cash held with them, either directly via instant access accounts or through linked savings accounts.

#BusinessBanking #Money

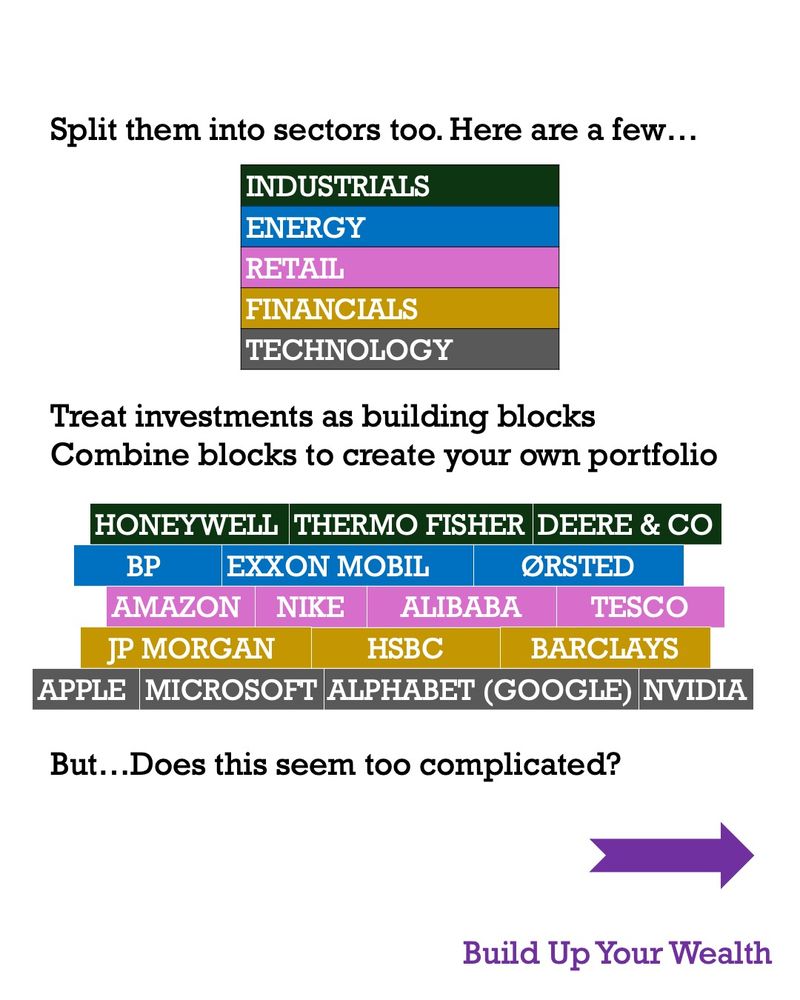

Once you have a strong foundation, pick your investments. Treat them like building blocks.

One block or lots of blocks.

Combine them to help achieve your financial goals. #BuildUpYourWealth #Money #PersonalFinance #FinancialFreedom #Wealth

Once you have a strong foundation, pick your investments. Treat them like building blocks.

One block or lots of blocks.

Combine them to help achieve your financial goals. #BuildUpYourWealth #Money #PersonalFinance #FinancialFreedom #Wealth

1. Junior ISAs

2. Set up a pension for kids - a Junior SIPP

3. Children can learn about money using award-winning providers like Go Henry & Starling Bank

#BuildUpYourWealth #Money #PersonalFinance #FinancialFreedom #JuniorISA

1. Junior ISAs

2. Set up a pension for kids - a Junior SIPP

3. Children can learn about money using award-winning providers like Go Henry & Starling Bank

#BuildUpYourWealth #Money #PersonalFinance #FinancialFreedom #JuniorISA

1. Use the ISA allowance for tax-free capital gains & interest

2. Contribute more into a pension – workplace, SIPP or both

3. Use credit cards but pay the full balance every month

#FinancialPlan #PersonalFinance #Money #BuildUpYourWealth

1. Use the ISA allowance for tax-free capital gains & interest

2. Contribute more into a pension – workplace, SIPP or both

3. Use credit cards but pay the full balance every month

#FinancialPlan #PersonalFinance #Money #BuildUpYourWealth

When the blocks are in a messy pile, it’s impossible to make sense of them.

Investments need to be grouped to match specific goal. Sort investments by asset class, region & sector. Remember each asset has a particular risk.

#BuildUpYourWealth #Money

When the blocks are in a messy pile, it’s impossible to make sense of them.

Investments need to be grouped to match specific goal. Sort investments by asset class, region & sector. Remember each asset has a particular risk.

#BuildUpYourWealth #Money

Global markets have had a wobble.

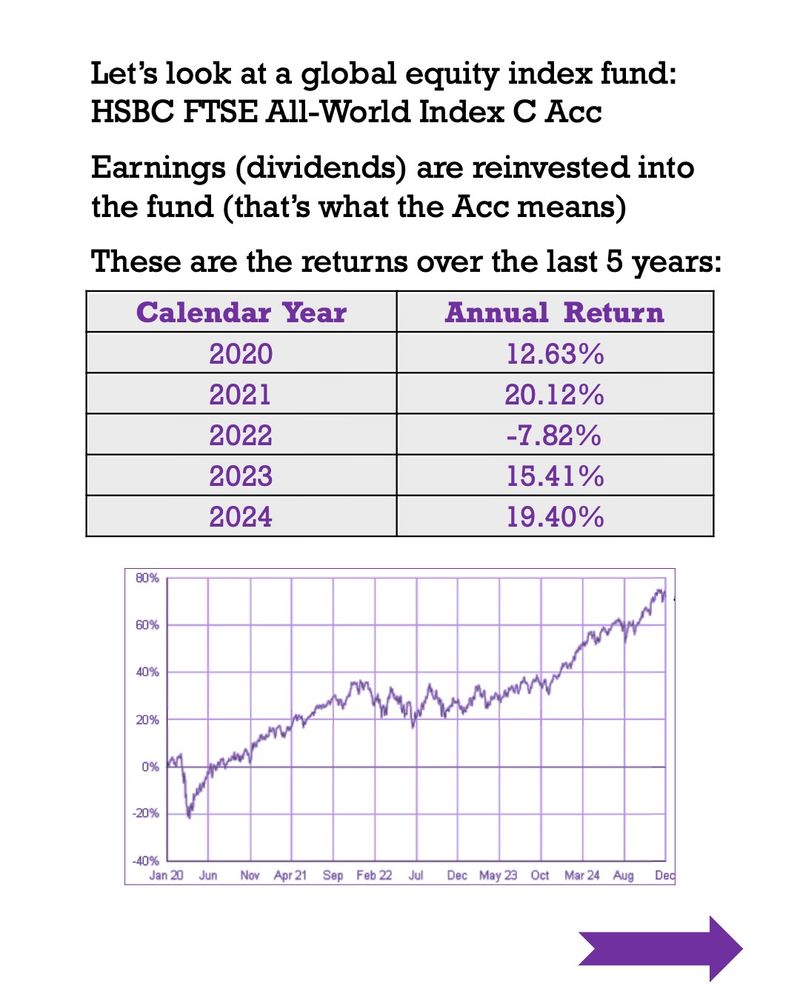

Here's the 5-year performance of a global equity index fund.

It’s important to put short-term events into perspective, and focus on time in the market.

DM me with any questions.

#PersonalFinance #Money #Tariff #Invest

Global markets have had a wobble.

Here's the 5-year performance of a global equity index fund.

It’s important to put short-term events into perspective, and focus on time in the market.

DM me with any questions.

#PersonalFinance #Money #Tariff #Invest

Investors have been impacted.

How can we build up any wealth?

Well, it’s difficult in the short term. Take a long-term view of investing. Select low-cost, diversified index funds.

#FinancialPlan #FinancialFreedom #PersonalFinance #TaxEfficient #Investing #tariffs #trump

Investors have been impacted.

How can we build up any wealth?

Well, it’s difficult in the short term. Take a long-term view of investing. Select low-cost, diversified index funds.

#FinancialPlan #FinancialFreedom #PersonalFinance #TaxEfficient #Investing #tariffs #trump

That’s less than two flat whites a week.

Take some time to think about your financial goals, review your ISA and pensions, and build up your wealth.

That’s less than two flat whites a week.

Take some time to think about your financial goals, review your ISA and pensions, and build up your wealth.

The concept isn’t magic but it is pretty magical.

In the stock market, compound growth allows your initial investment to grow on both the original amount invested and any accumulated earnings (dividends).

#FinancialFreedom #PersonalFinance #CompoundGrowth

The concept isn’t magic but it is pretty magical.

In the stock market, compound growth allows your initial investment to grow on both the original amount invested and any accumulated earnings (dividends).

#FinancialFreedom #PersonalFinance #CompoundGrowth

Track your income & expenses

Invest in ISAs

Plan your pension

Use tax relief to build up your pension pot.

#FinancialPlan #FinancialFreedom #PersonalFinance #Budget #TaxEfficient

Track your income & expenses

Invest in ISAs

Plan your pension

Use tax relief to build up your pension pot.

#FinancialPlan #FinancialFreedom #PersonalFinance #Budget #TaxEfficient

The Bank of England pays interest to high street banks that hold money with them. Their rate determines lending & savings rates. It's also used to control inflation.

#FinancialFreedom #InterestRates #BankofEngland #PersonalFinance #Inflation

The Bank of England pays interest to high street banks that hold money with them. Their rate determines lending & savings rates. It's also used to control inflation.

#FinancialFreedom #InterestRates #BankofEngland #PersonalFinance #Inflation

Is it delivering good outcomes for you?

Why not review your pension options?

Get to know what your fund invests in.

Understand performance & charges.

Switch if appropriate.

Take more control of your investments.

#Pension #FinancialFreedom

Is it delivering good outcomes for you?

Why not review your pension options?

Get to know what your fund invests in.

Understand performance & charges.

Switch if appropriate.

Take more control of your investments.

#Pension #FinancialFreedom

Which will you choose, a Cash ISA or a Stocks & Shares ISA?

You can hold both, as long as your contributions to both types of ISA don’t exceed £20,000.

Invest according to your own attitude to risk.

#financialfreedom #personalfinance #ISA

Which will you choose, a Cash ISA or a Stocks & Shares ISA?

You can hold both, as long as your contributions to both types of ISA don’t exceed £20,000.

Invest according to your own attitude to risk.

#financialfreedom #personalfinance #ISA

#financialfreedom #personalfinance #financialcoach #buildwealth

#financialfreedom #personalfinance #financialcoach #buildwealth