Clara Bachorz

@clarabachorz.bsky.social

640 followers

130 following

10 posts

Energy systems modeling PhD student @ Potsdam Institute for Climate Impact Research | Hydrogen, e-fuels, industry

Posts

Media

Videos

Starter Packs

Clara Bachorz

@clarabachorz.bsky.social

· Apr 29

Clara Bachorz

@clarabachorz.bsky.social

· Apr 29

Clara Bachorz

@clarabachorz.bsky.social

· Apr 29

Clara Bachorz

@clarabachorz.bsky.social

· Apr 29

Clara Bachorz

@clarabachorz.bsky.social

· Apr 29

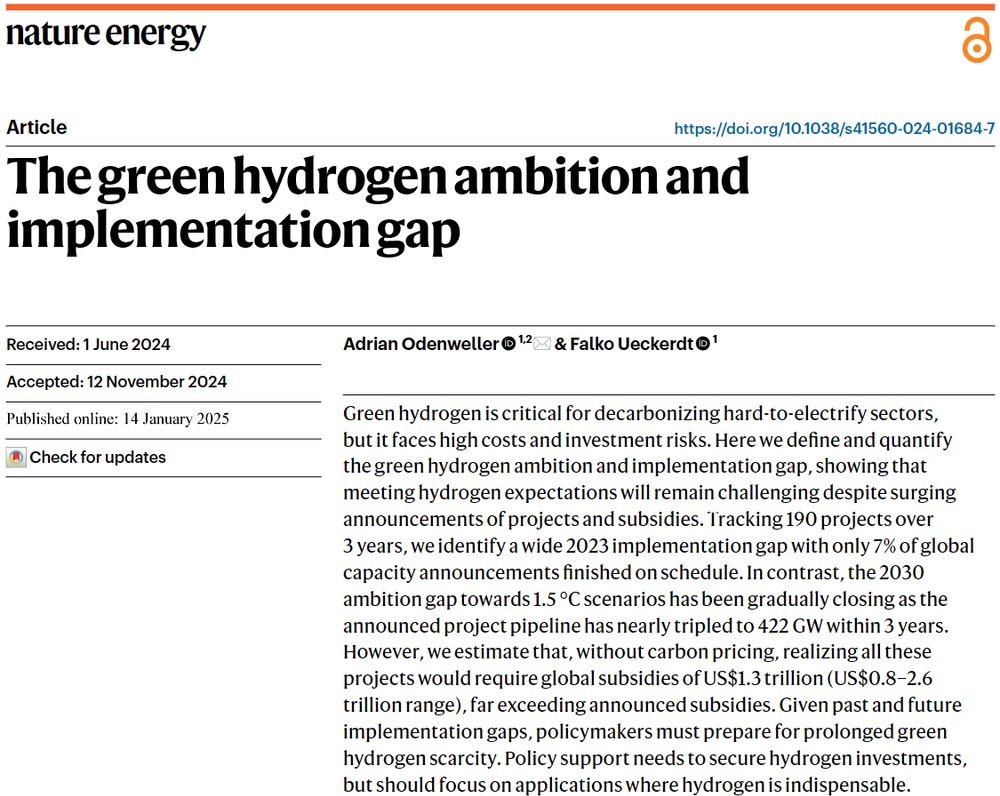

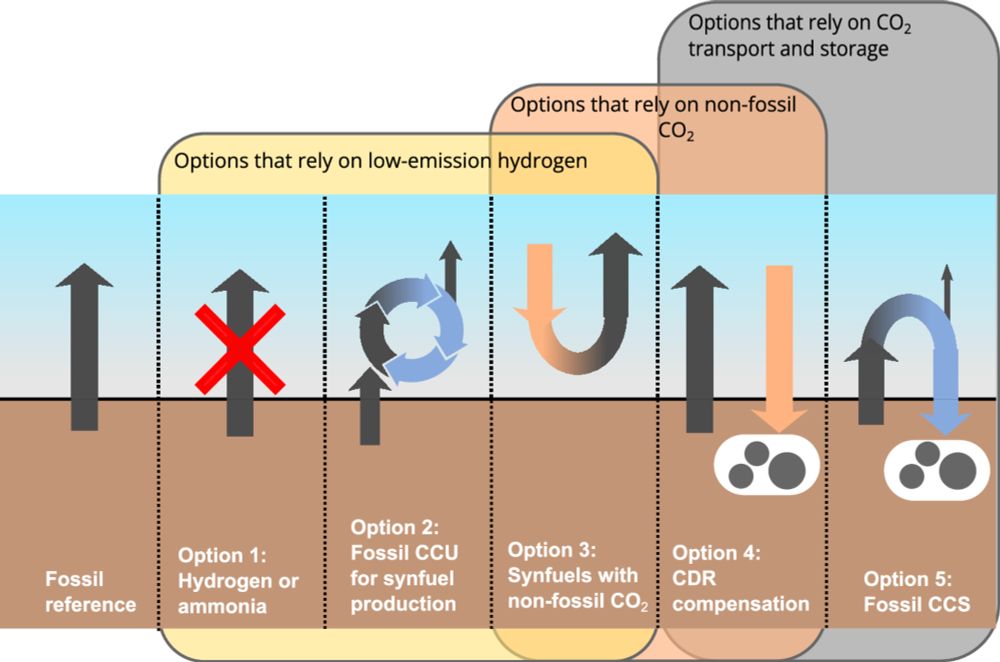

Exploring techno-economic landscapes of abatement options for hard-to-electrify sectors

Nature Communications - Abatement options for hard-to-electrify sectors (e.g., steel, aviation) face uncertainty in future costs and feasibility. This techno-economic analysis shows that despite...

rdcu.be

Reposted by Clara Bachorz

Reposted by Clara Bachorz

Clara Bachorz

@clarabachorz.bsky.social

· Dec 11