Chye-Ching Huang

@dashching.bsky.social

4K followers

480 following

150 posts

Executive Director @taxlawcenter.org

Tax, law, policy, budget, economy. US & NZ.

Former Senior Director for Economic Policy @centeronbudget.bsky.social.

Posts

Media

Videos

Starter Packs

Pinned

Chye-Ching Huang

@dashching.bsky.social

· Aug 28

Reposted by Chye-Ching Huang

Reposted by Chye-Ching Huang

Reposted by Chye-Ching Huang

Reposted by Chye-Ching Huang

Reposted by Chye-Ching Huang

makena kelly

@makenakelly.bsky.social

· Jul 17

DOGE Put Free Tax Filing Tool on Chopping Block After One Meeting With Lobbyists

A key operative from DOGE initiated plans to potentially kill Direct File, the free tax filing tool developed by the IRS, after offering assurances it would be spared from cuts.

www.wired.com

Reposted by Chye-Ching Huang

ProPublica

@propublica.org

· Jul 15

The IRS Is Building a Vast System to Share Millions of Taxpayers’ Data With ICE

ProPublica has obtained the blueprint for the Trump administration’s unprecedented plan to turn over IRS records to Homeland Security in order to speed up the agency’s mass deportation efforts.

www.propublica.org

Reposted by Chye-Ching Huang

Chye-Ching Huang

@dashching.bsky.social

· Jul 10

Chye-Ching Huang

@dashching.bsky.social

· Jul 10

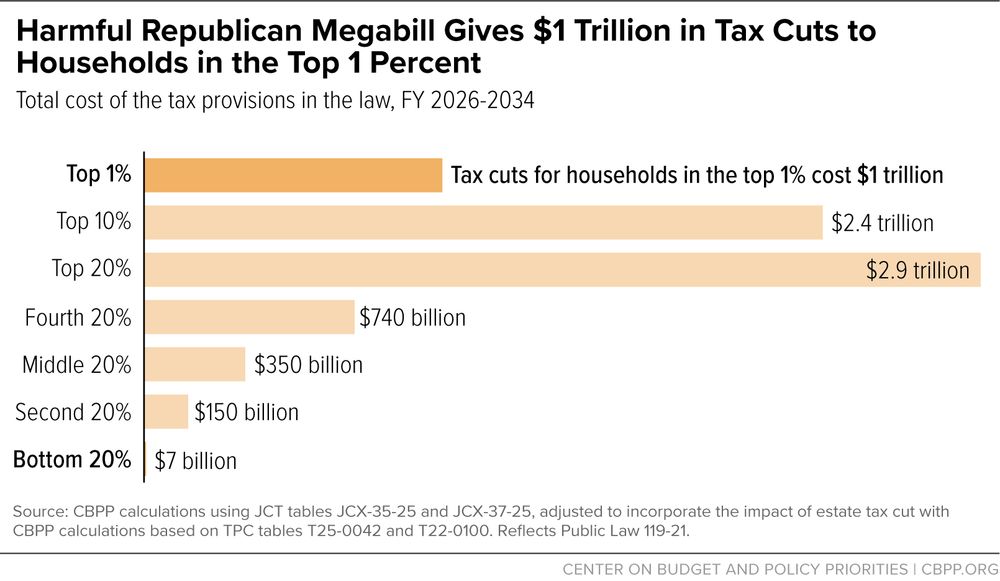

Beware of “deregulatory” efforts that add to deficits and tilt the tax system to the wealthy

As the Department of Government Efficiency (“DOGE”) seeks drastic changes to the federal government in the name of saving money, reporters and commentators have noted that many claimed savings are dub...

taxlawcenter.org

Chye-Ching Huang

@dashching.bsky.social

· Jul 10

Chye-Ching Huang

@dashching.bsky.social

· Jul 10

Beware of “deregulatory” efforts that add to deficits and tilt the tax system to the wealthy

As the Department of Government Efficiency (“DOGE”) seeks drastic changes to the federal government in the name of saving money, reporters and commentators have noted that many claimed savings are dub...

taxlawcenter.org