www.investors.com/market-trend...

www.investors.com/market-trend...

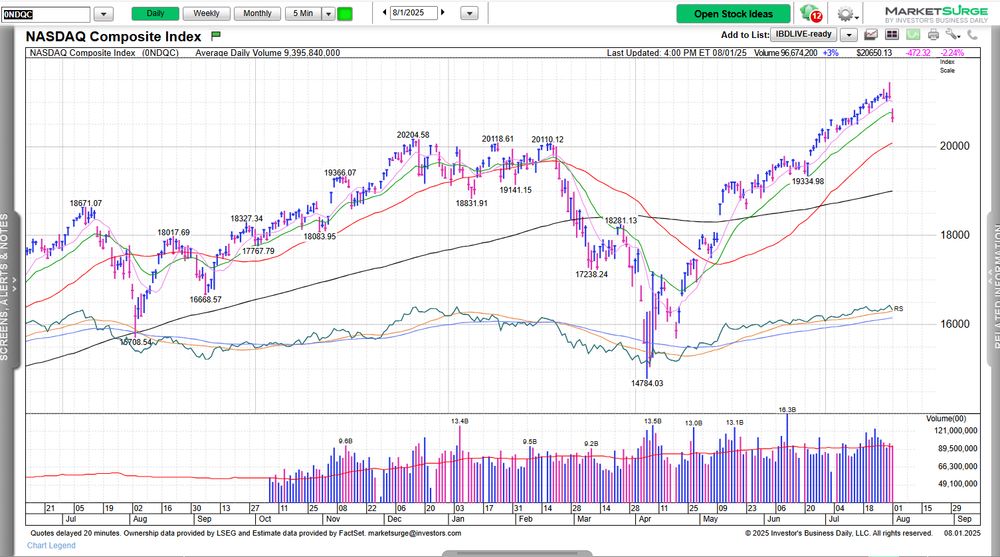

Investors should have limited exposure. 1/

Investors should have limited exposure. 1/

Oracle AI World starts Monday. JPMorgan, Goldman Sachs and Taiwan Semi earnings are this week.

Tesla tumbled, but the chart may be constructive. 2/2

Oracle AI World starts Monday. JPMorgan, Goldman Sachs and Taiwan Semi earnings are this week.

Tesla tumbled, but the chart may be constructive. 2/2

Palantir, Nvidia lead 5 stocks near buy points.

www.investors.com/market-trend...

Palantir, Nvidia lead 5 stocks near buy points.

www.investors.com/market-trend...

The U.S. economy has lost 142,200 jobs over the last four months excluding health care & social assistance.

In the four months to February, before tariffs kicked in, the U.S. added 523,100 jobs ex health care/social assistance.

The U.S. economy has lost 142,200 jobs over the last four months excluding health care & social assistance.

In the four months to February, before tariffs kicked in, the U.S. added 523,100 jobs ex health care/social assistance.

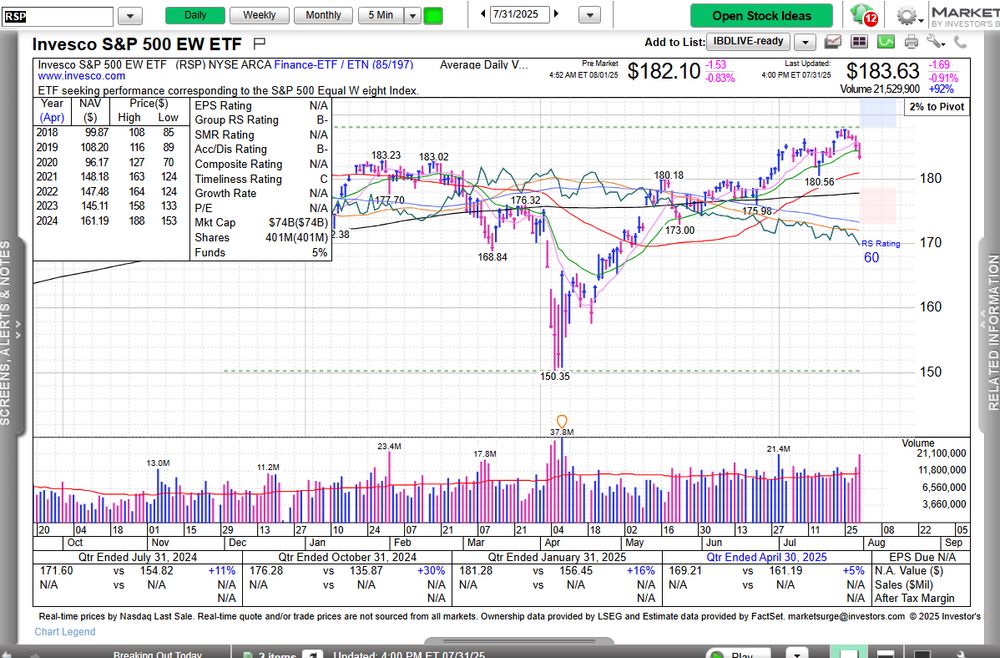

Earlier, the S&P 500 hit a new high while small caps led again.

www.investors.com/market-trend...

Earlier, the S&P 500 hit a new high while small caps led again.

www.investors.com/market-trend...

www.investors.com/news/7500-ev...

www.investors.com/news/7500-ev...

The major indexes rebounded well off lows. So did growth leaders like Palantir. But PLTR is still down sharply for the week.

www.investors.com/market-trend...

The major indexes rebounded well off lows. So did growth leaders like Palantir. But PLTR is still down sharply for the week.

www.investors.com/market-trend...

www.investors.com/market-trend...

www.investors.com/market-trend...

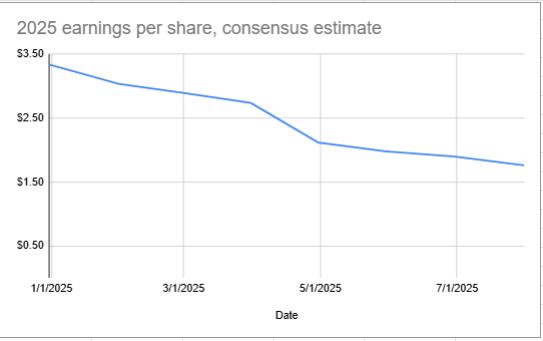

It's frankly ludicrous that analysts have Q4 estimates higher than Q3 - given the end of the IRA credits on Sept. 30.

Should see estimates for Q4-Q2 come down substantially. 2/2

It's frankly ludicrous that analysts have Q4 estimates higher than Q3 - given the end of the IRA credits on Sept. 30.

Should see estimates for Q4-Q2 come down substantially. 2/2