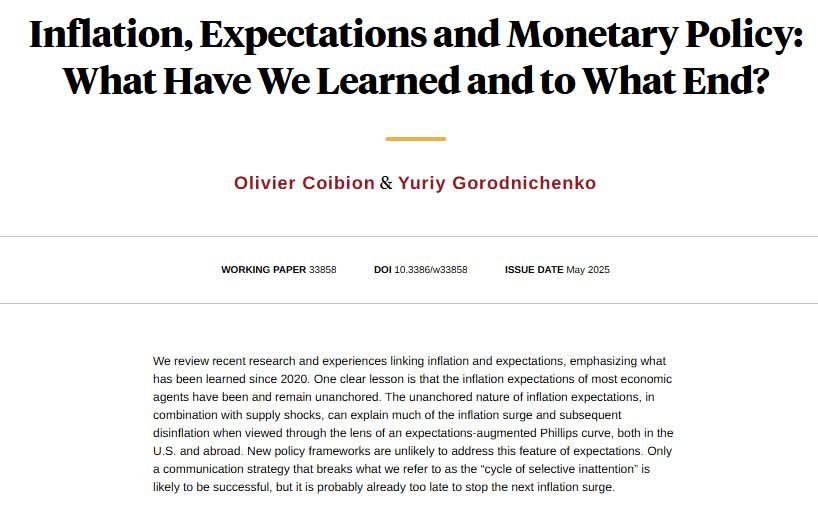

Empirical Macroeconomics Policy Center of Texas

@empctmacrotx.bsky.social

340 followers

280 following

61 posts

Empirical Macroeconomics Policy Center of Texas (EMPCT): empirical macroeconomic research for academia, policy, the media and the public

https://sites.utexas.edu/macro/

Posts

Media

Videos

Starter Packs

Reposted by Empirical Macroeconomics Policy Center of Texas

Reposted by Empirical Macroeconomics Policy Center of Texas

Reposted by Empirical Macroeconomics Policy Center of Texas