Christian Schmidt

@financeschmidt.bsky.social

$IMB.AX

Approximately $6 million of the $12 million in refinancing costs relates to the PIK component of the previous debt facility, so this should have been anticipated. However, $6 million in additional refinancing costs remains materially high.

The overall tone...

Approximately $6 million of the $12 million in refinancing costs relates to the PIK component of the previous debt facility, so this should have been anticipated. However, $6 million in additional refinancing costs remains materially high.

The overall tone...

April 29, 2025 at 6:32 AM

$IMB.AX

Approximately $6 million of the $12 million in refinancing costs relates to the PIK component of the previous debt facility, so this should have been anticipated. However, $6 million in additional refinancing costs remains materially high.

The overall tone...

Approximately $6 million of the $12 million in refinancing costs relates to the PIK component of the previous debt facility, so this should have been anticipated. However, $6 million in additional refinancing costs remains materially high.

The overall tone...

1/2 Good quarter by $KLNG. Consistent messaging across 10-K, PR, and call. Strong order book, limited tariff impact.

“While we celebrate the results from 2024, we are very excited for our future. In 2025, our team will remain focused on growing the company and delivering on our...

“While we celebrate the results from 2024, we are very excited for our future. In 2025, our team will remain focused on growing the company and delivering on our...

April 15, 2025 at 2:45 PM

1/2 Good quarter by $KLNG. Consistent messaging across 10-K, PR, and call. Strong order book, limited tariff impact.

“While we celebrate the results from 2024, we are very excited for our future. In 2025, our team will remain focused on growing the company and delivering on our...

“While we celebrate the results from 2024, we are very excited for our future. In 2025, our team will remain focused on growing the company and delivering on our...

$NOW.V An incredibly strong earnings call in every imaginable aspect. A few key takeaways you won’t find in the financial statements:

– Cross-selling efforts are progressing well

– No capital raise planned

– Positive discussions around alternative financing options, if needed

– Cross-selling efforts are progressing well

– No capital raise planned

– Positive discussions around alternative financing options, if needed

April 2, 2025 at 3:09 PM

$NOW.V An incredibly strong earnings call in every imaginable aspect. A few key takeaways you won’t find in the financial statements:

– Cross-selling efforts are progressing well

– No capital raise planned

– Positive discussions around alternative financing options, if needed

– Cross-selling efforts are progressing well

– No capital raise planned

– Positive discussions around alternative financing options, if needed

2/2 Just keep in mind these are my unaudited returns—so I’m likely down about 20% year-to-date.

March 31, 2025 at 8:12 PM

2/2 Just keep in mind these are my unaudited returns—so I’m likely down about 20% year-to-date.

1/2 Performance YTD: 1,2%

Performance since 01.01.2017:

IRR: 32,83%

TTWROR: 509,86%

I just published a detailed quarterly report with all buys and sells.

open.substack.com/pub/tridento...

Performance since 01.01.2017:

IRR: 32,83%

TTWROR: 509,86%

I just published a detailed quarterly report with all buys and sells.

open.substack.com/pub/tridento...

March 31, 2025 at 8:12 PM

1/2 Performance YTD: 1,2%

Performance since 01.01.2017:

IRR: 32,83%

TTWROR: 509,86%

I just published a detailed quarterly report with all buys and sells.

open.substack.com/pub/tridento...

Performance since 01.01.2017:

IRR: 32,83%

TTWROR: 509,86%

I just published a detailed quarterly report with all buys and sells.

open.substack.com/pub/tridento...

$IMB.AX Another 5 million shares for MAF. Now, 60% is in the hands of the three biggest institutional investors. At some point, Black Crane will have to sell down if IMB really wants to get into the ASX.

March 10, 2025 at 6:53 AM

$IMB.AX Another 5 million shares for MAF. Now, 60% is in the hands of the three biggest institutional investors. At some point, Black Crane will have to sell down if IMB really wants to get into the ASX.

$IVFH As expected, revenue improved significantly due to the cheese business, but margins are still affected by the ramp-up. I have a few questions for the call

March 7, 2025 at 1:18 PM

$IVFH As expected, revenue improved significantly due to the cheese business, but margins are still affected by the ramp-up. I have a few questions for the call

$IVFH expands into airline catering with a first-class cheese program for a major international airline, expecting ~$700K in first-year revenue.

Doesn’t seem like much, but all these small steps can eventually build a big company while leveraging their existing assets.

Doesn’t seem like much, but all these small steps can eventually build a big company while leveraging their existing assets.

February 27, 2025 at 6:00 PM

$IVFH expands into airline catering with a first-class cheese program for a major international airline, expecting ~$700K in first-year revenue.

Doesn’t seem like much, but all these small steps can eventually build a big company while leveraging their existing assets.

Doesn’t seem like much, but all these small steps can eventually build a big company while leveraging their existing assets.

In the latest Experian M&A review (FY 2024), $DSW.L shows gains in the volume ranking, moving from 19th to 15th.

t.co/Aab66pRtPm

t.co/Aab66pRtPm

February 26, 2025 at 2:28 PM

In the latest Experian M&A review (FY 2024), $DSW.L shows gains in the volume ranking, moving from 19th to 15th.

t.co/Aab66pRtPm

t.co/Aab66pRtPm

$COV.V In line with my expectations, but too early to get back in, in my opinion, if we take everything at face value without further comments.

Currently no position.

Currently no position.

February 21, 2025 at 12:14 PM

$COV.V In line with my expectations, but too early to get back in, in my opinion, if we take everything at face value without further comments.

Currently no position.

Currently no position.

$IVFH Expands Gourmet Cheese Program

Major retail partner expands store count by 35% & doubles SKU count.

Major retail partner expands store count by 35% & doubles SKU count.

February 19, 2025 at 6:04 PM

$IVFH Expands Gourmet Cheese Program

Major retail partner expands store count by 35% & doubles SKU count.

Major retail partner expands store count by 35% & doubles SKU count.

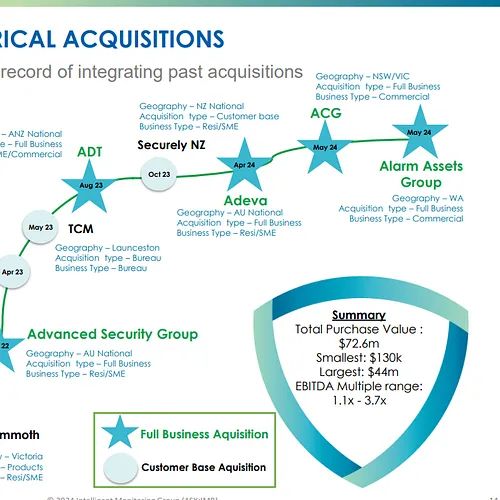

4/4... recent acquisitions and their locations. They were, in my opinion, more about the people than the technology or anything else.

February 17, 2025 at 8:01 PM

4/4... recent acquisitions and their locations. They were, in my opinion, more about the people than the technology or anything else.

3/4... rationale? Because they’ve mentioned it several times before, and they specifically highlighted the area where they increased staff.

Also, take a look at their...

Also, take a look at their...

February 17, 2025 at 8:01 PM

3/4... rationale? Because they’ve mentioned it several times before, and they specifically highlighted the area where they increased staff.

Also, take a look at their...

Also, take a look at their...

1/4 After receiving several questions about the announced #$IMB.AX acquisition, I want to share a few brief thoughts:

Yes, the recurring revenue portion is small, but that’s not the focus of their current plans. They aren’t looking to acquire recurring revenues. The industry is...

Yes, the recurring revenue portion is small, but that’s not the focus of their current plans. They aren’t looking to acquire recurring revenues. The industry is...

February 17, 2025 at 8:01 PM

1/4 After receiving several questions about the announced #$IMB.AX acquisition, I want to share a few brief thoughts:

Yes, the recurring revenue portion is small, but that’s not the focus of their current plans. They aren’t looking to acquire recurring revenues. The industry is...

Yes, the recurring revenue portion is small, but that’s not the focus of their current plans. They aren’t looking to acquire recurring revenues. The industry is...

...das im Geschäftsbericht zu erklären, bleibt dadurch jedoch unangetastet. Für mich ist das Thema Badwill nicht Teil der $TPG.DE Story.

Eine bessere Unternehmensentwicklung als geplant, so wie es das Unternehmen beschreibt, wäre auch kein measurement period...

Eine bessere Unternehmensentwicklung als geplant, so wie es das Unternehmen beschreibt, wäre auch kein measurement period...

February 16, 2025 at 10:12 AM

...das im Geschäftsbericht zu erklären, bleibt dadurch jedoch unangetastet. Für mich ist das Thema Badwill nicht Teil der $TPG.DE Story.

Eine bessere Unternehmensentwicklung als geplant, so wie es das Unternehmen beschreibt, wäre auch kein measurement period...

Eine bessere Unternehmensentwicklung als geplant, so wie es das Unternehmen beschreibt, wäre auch kein measurement period...

Zum Thema Platform Group möchte ich direkt zur Veröffentlichung einen Nachtrag liefern.

Die Buchung des "Other comprenhensive income" würde dann Sinn ergeben, wenn die Earnouts mit Equity abgedeckt werden.

Dazu...

Die Buchung des "Other comprenhensive income" würde dann Sinn ergeben, wenn die Earnouts mit Equity abgedeckt werden.

Dazu...

February 16, 2025 at 10:12 AM

Zum Thema Platform Group möchte ich direkt zur Veröffentlichung einen Nachtrag liefern.

Die Buchung des "Other comprenhensive income" würde dann Sinn ergeben, wenn die Earnouts mit Equity abgedeckt werden.

Dazu...

Die Buchung des "Other comprenhensive income" würde dann Sinn ergeben, wenn die Earnouts mit Equity abgedeckt werden.

Dazu...

Btw. der deutsche Report von $TPG.DE hat andere Zahlen als der englische. Die Zahlen sind trotzdem falsch...

Habe ich in der Form wirklich selten gesehen.

Habe ich in der Form wirklich selten gesehen.

February 15, 2025 at 4:03 PM

Btw. der deutsche Report von $TPG.DE hat andere Zahlen als der englische. Die Zahlen sind trotzdem falsch...

Habe ich in der Form wirklich selten gesehen.

Habe ich in der Form wirklich selten gesehen.

1/2 Schon vorab ein Zusatz zu den Themen, die im Podcast zu #$TPG.DE angesprochen werden, der morgen veröffentlicht wird.

Hier scheint wirklich sehr unsauber gearbeitet zu werden.

Gelb markiert: Falsch übertragene Zahlen

Grün markiert: Zahlen ergeben -1.298. Equity daher zu niedrig...

Hier scheint wirklich sehr unsauber gearbeitet zu werden.

Gelb markiert: Falsch übertragene Zahlen

Grün markiert: Zahlen ergeben -1.298. Equity daher zu niedrig...

February 15, 2025 at 3:26 PM

1/2 Schon vorab ein Zusatz zu den Themen, die im Podcast zu #$TPG.DE angesprochen werden, der morgen veröffentlicht wird.

Hier scheint wirklich sehr unsauber gearbeitet zu werden.

Gelb markiert: Falsch übertragene Zahlen

Grün markiert: Zahlen ergeben -1.298. Equity daher zu niedrig...

Hier scheint wirklich sehr unsauber gearbeitet zu werden.

Gelb markiert: Falsch übertragene Zahlen

Grün markiert: Zahlen ergeben -1.298. Equity daher zu niedrig...