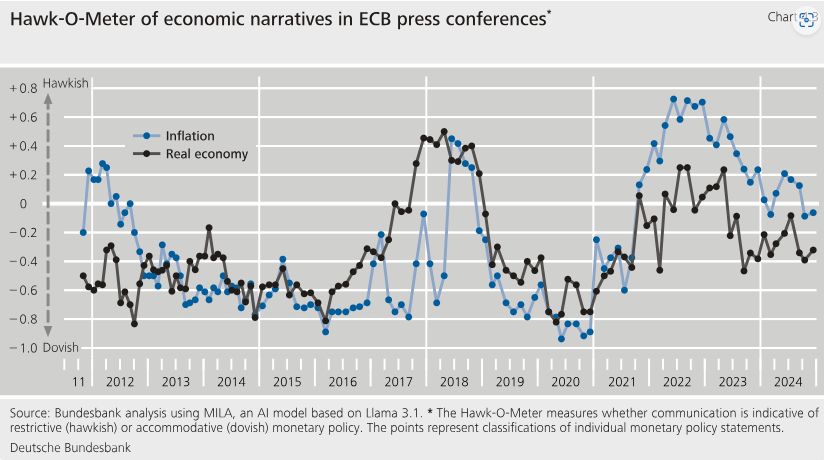

We introduce MILA—a new AI-driven solution for analyzing central bank communication.

MILA operates on individual sentences by using the macro and in-document context. 1/n

We introduce MILA—a new AI-driven solution for analyzing central bank communication.

MILA operates on individual sentences by using the macro and in-document context. 1/n

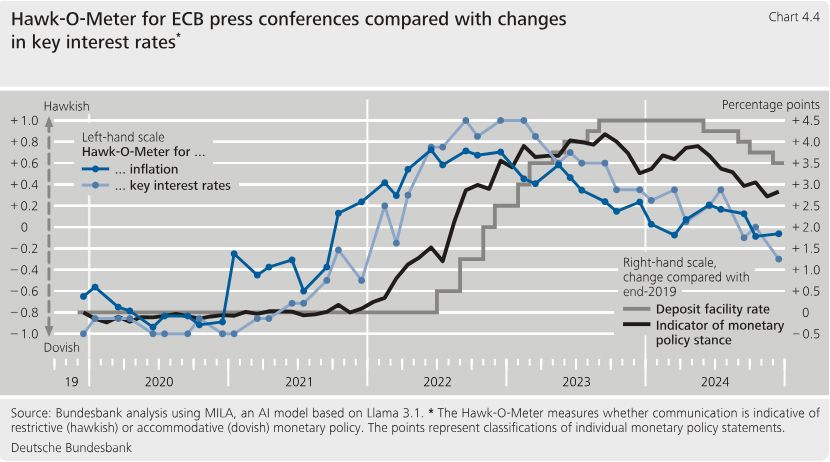

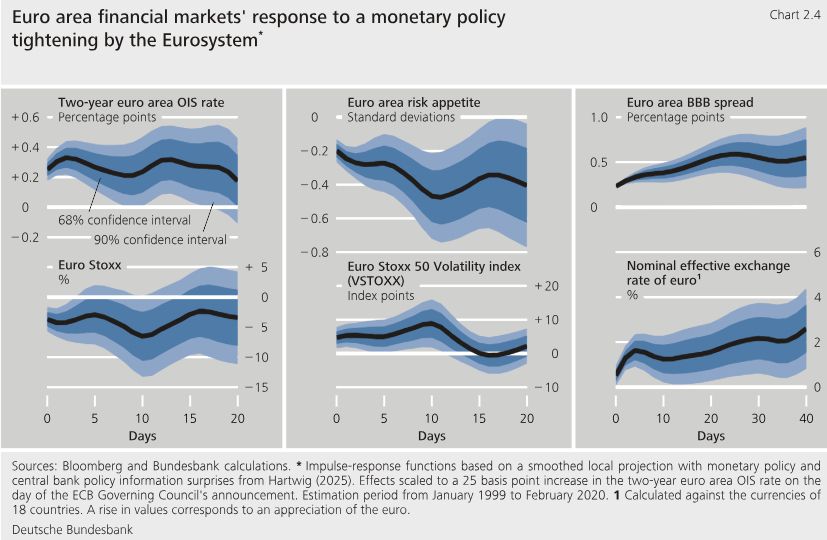

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

In our latest @bundesbank.de report, we present the proxy monetary policy rate, which combines information from the risk-free yield curve and risk assets. 1\ #EconSky @plieberk.bsky.social

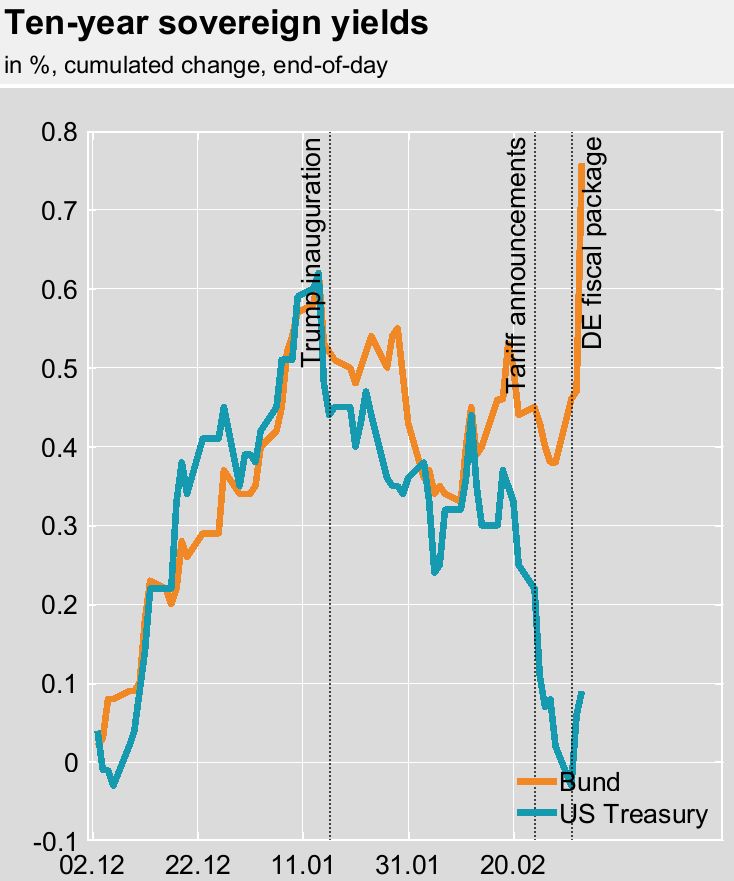

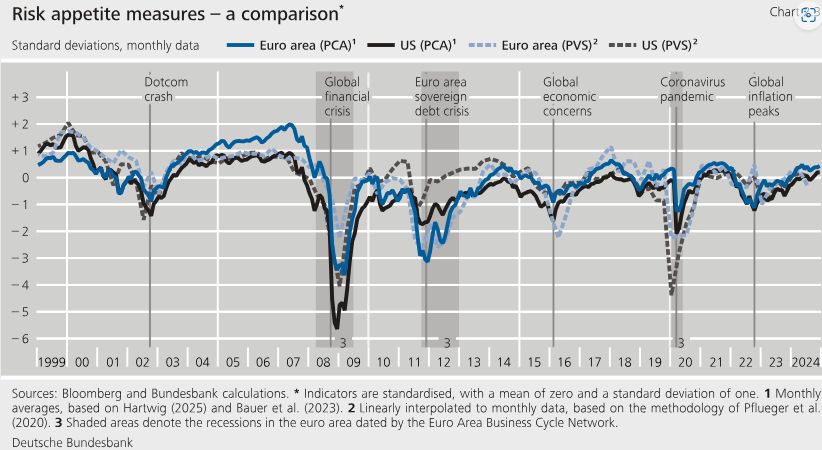

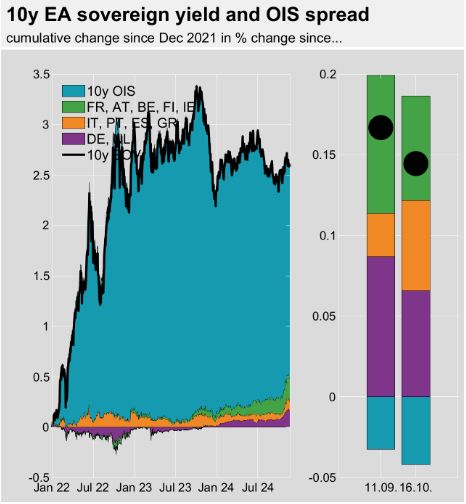

- Euro area macro drives euro yields aka Bunds up

- US macro drives these yields down.

- Euro area macro drives euro yields aka Bunds up

- US macro drives these yields down.

Bunds: hold my beer. 🍺

Bunds: hold my beer. 🍺

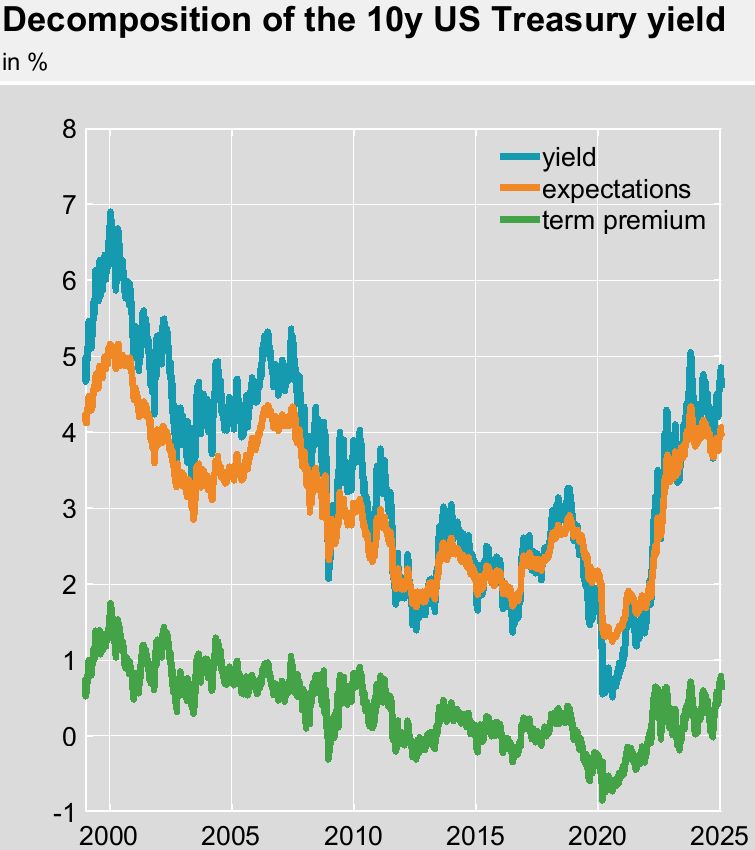

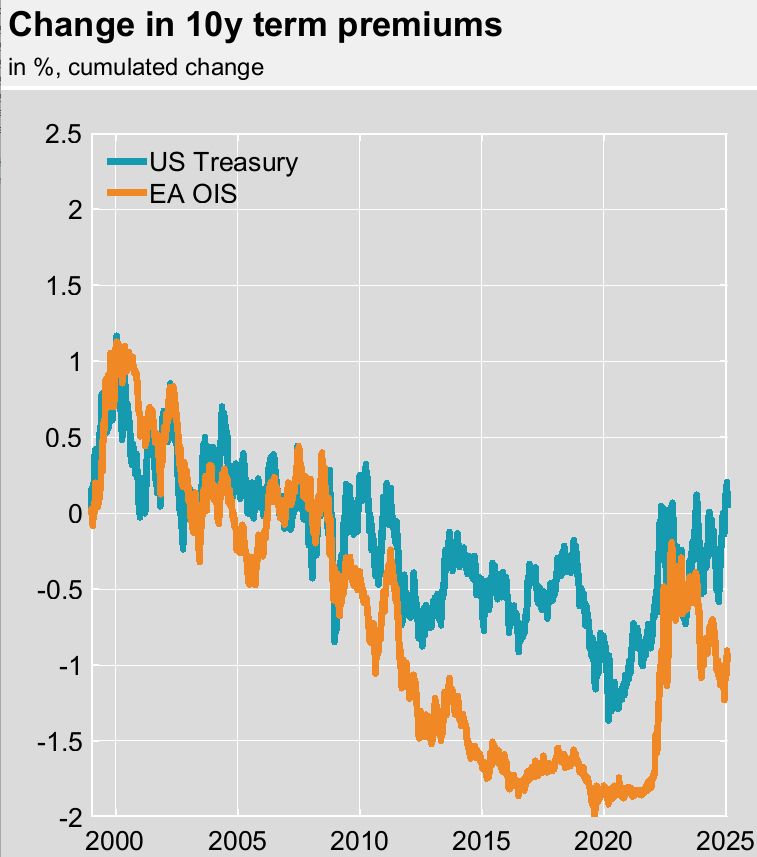

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

➡️99-12: strong co-movement

➡️12-20: EA term premium collapses relative to US

➡️22-24: de-compression more pronounced in EA

➡️since mid-24: degree of US term premium rise is only partly matched by EA

#EconSky

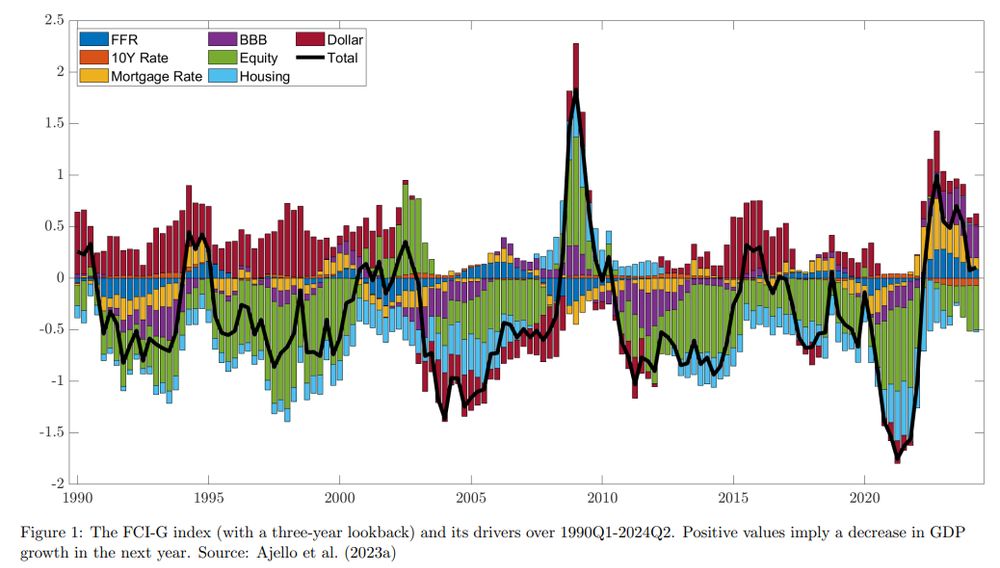

➡️Financial conditions may be loose with high stock valuations and compressed risk spreads

➡️For the economy these conditions matter

➡️By targeting financial conditions, Fed may reduce output volatility

➡️Financial conditions may be loose with high stock valuations and compressed risk spreads

➡️For the economy these conditions matter

➡️By targeting financial conditions, Fed may reduce output volatility

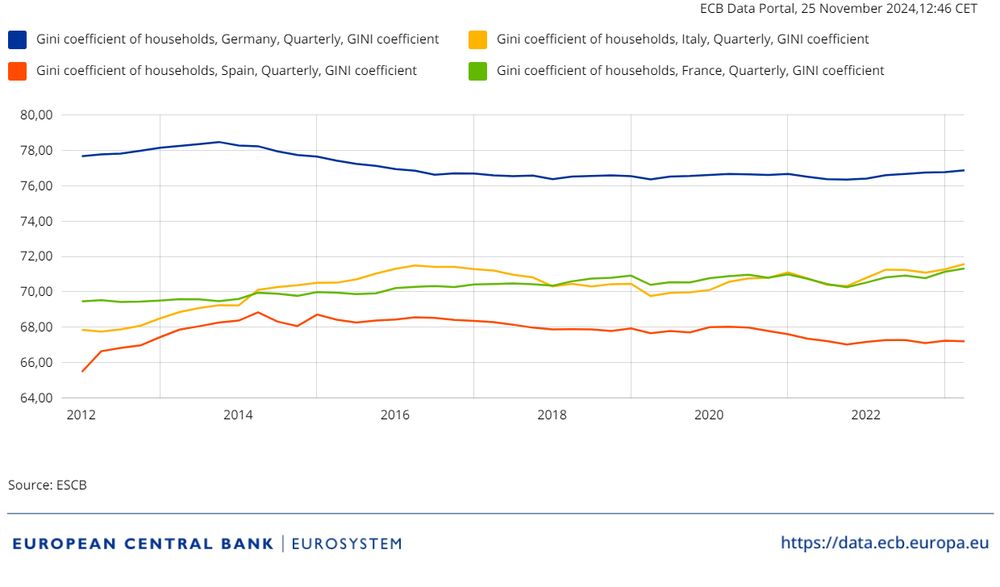

➡️still impressed by this quite new and highly valuable quarterly data set

➡️still impressed by the evolution of key metrics

here: median net wealth at the country level 1/3

➡️still impressed by this quite new and highly valuable quarterly data set

➡️still impressed by the evolution of key metrics

here: median net wealth at the country level 1/3

bsky.app/profile/flxg...

bsky.app/profile/flxg...

Source: publikationen.bundesbank.de/publikatione...

Source: publikationen.bundesbank.de/publikatione...

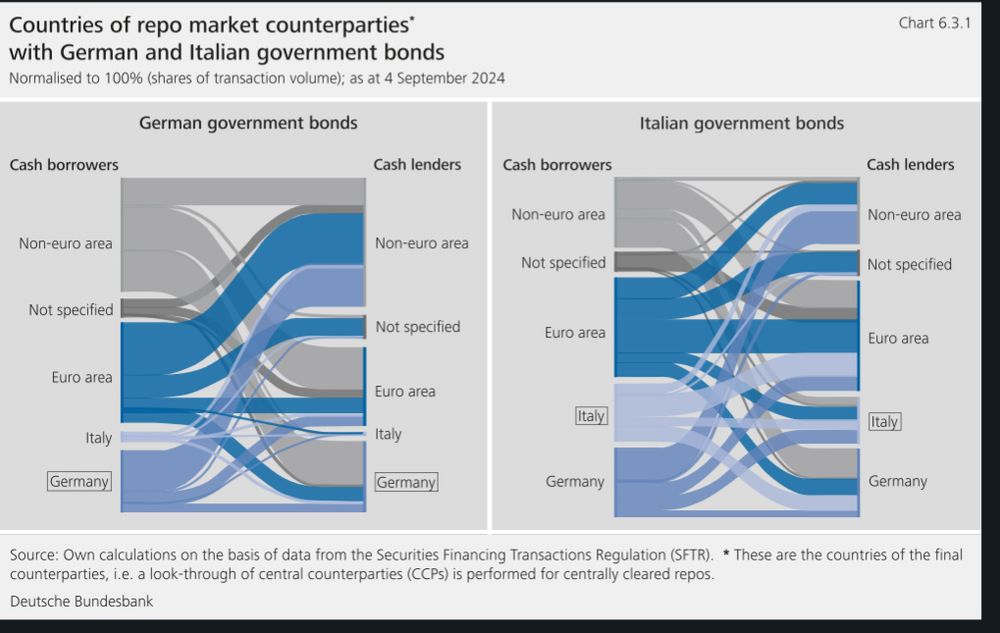

By contrast, repos with German government bonds often involve counterparties outside the euro area.

Source: publikationen.bundesbank.de/publikatione...

By contrast, repos with German government bonds often involve counterparties outside the euro area.

Source: publikationen.bundesbank.de/publikatione...

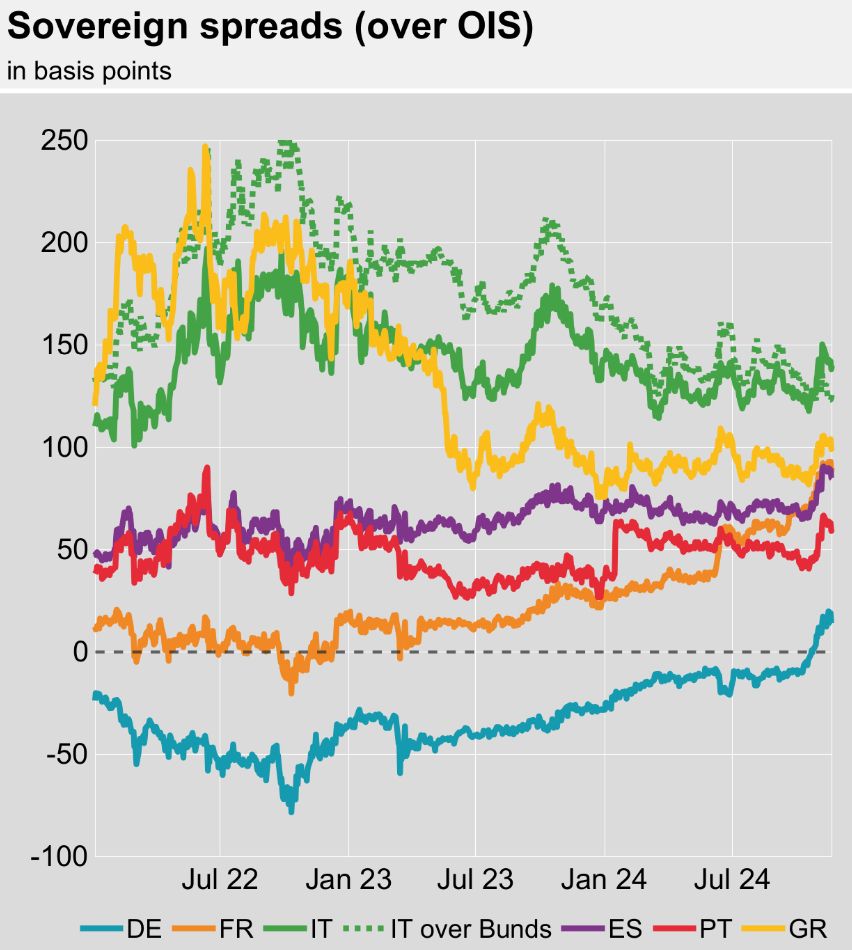

➡️Italian spread over Bunds trading lower than over OIS. This reflects regime change with 𝗕𝘂𝗻𝗱𝘀 𝘀𝗲𝗹𝗹𝗶𝗻𝗴 𝗼𝗳𝗳 𝗮𝗴𝗮𝗶𝗻𝘀𝘁 𝗢𝗜𝗦 recently.

2 𝗶𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁 𝘀𝗵𝗶𝗳𝘁𝘀 𝗶𝗻 𝗘𝗔 𝘀𝗼𝘃𝗲𝗿𝗲𝗶𝗴𝗻 𝘀𝗽𝗿𝗲𝗮𝗱 𝗱𝗿𝗶𝘃𝗲𝗿𝘀.

#Econsky

➡️Italian spread over Bunds trading lower than over OIS. This reflects regime change with 𝗕𝘂𝗻𝗱𝘀 𝘀𝗲𝗹𝗹𝗶𝗻𝗴 𝗼𝗳𝗳 𝗮𝗴𝗮𝗶𝗻𝘀𝘁 𝗢𝗜𝗦 recently.

2 𝗶𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁 𝘀𝗵𝗶𝗳𝘁𝘀 𝗶𝗻 𝗘𝗔 𝘀𝗼𝘃𝗲𝗿𝗲𝗶𝗴𝗻 𝘀𝗽𝗿𝗲𝗮𝗱 𝗱𝗿𝗶𝘃𝗲𝗿𝘀.

#Econsky