#finance #trading #investing

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months. It is visible in industrial production, employment, real income, and ot…

#finance #trading #investing

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months. It is visible in industrial production, employment, real income, and ot…

#finance #trading #investing

VIX futures and ETPs are widely used instruments for both volatility speculation and hedging, making a clear understanding of their behavior essential for these pur…

#finance #trading #investing

VIX futures and ETPs are widely used instruments for both volatility speculation and hedging, making a clear understanding of their behavior essential for these pur…

#finance #trading #investing

Most research in portfolio management focuses on alpha generation; however, another critical component of portfolio construction is position sizing. In this edition, w…

#finance #trading #investing

Most research in portfolio management focuses on alpha generation; however, another critical component of portfolio construction is position sizing. In this edition, w…

#finance #trading #investing

In these days of big data, machine learning, and AI, many researchers are showing growing interest in sophisticated models for stock price prediction or to r…

#finance #trading #investing

In these days of big data, machine learning, and AI, many researchers are showing growing interest in sophisticated models for stock price prediction or to r…

#finance #trading #investing

Commodity derivatives are financial instruments whose value is based on an underlying commodity. These derivatives can be used for hedging purposes or for spec…

#finance #trading #investing

Commodity derivatives are financial instruments whose value is based on an underlying commodity. These derivatives can be used for hedging purposes or for spec…

#finance #trading #investing

It is well known that put options are often overpriced, especially in equities. The literature is filled with papers explaining this phenomenon. However, most research still rel…

#finance #trading #investing

It is well known that put options are often overpriced, especially in equities. The literature is filled with papers explaining this phenomenon. However, most research still rel…

#finance #trading #investing

Correlation is a statistical measure of the relationship between two variables. In trading, correlation is used to identify relationships between different securities. For ex…

#finance #trading #investing

Correlation is a statistical measure of the relationship between two variables. In trading, correlation is used to identify relationships between different securities. For ex…

#finance #trading #investing

The option wheel strategy is a systematic approach that combines selling cash-secured puts and covered calls. The process begins by selling puts on a stock the investor is …

#finance #trading #investing

The option wheel strategy is a systematic approach that combines selling cash-secured puts and covered calls. The process begins by selling puts on a stock the investor is …

#finance #trading #investing

The implied volatility surface is a fundamental building block in modern financial markets, as it underpins the pricing of both vanilla and exot…

#finance #trading #investing

The implied volatility surface is a fundamental building block in modern financial markets, as it underpins the pricing of both vanilla and exot…

#finance #trading #investing

There are several popular options strategies frequently discussed in the trading and investing literature, as well as on social media. In a previous news…

#finance #trading #investing

There are several popular options strategies frequently discussed in the trading and investing literature, as well as on social media. In a previous news…

#finance #trading #investing

Artificial intelligence (AI) is advancing rapidly, and traders and investors are finding ways to leverage this progress to gain an additional edge. Refere…

#finance #trading #investing

Artificial intelligence (AI) is advancing rapidly, and traders and investors are finding ways to leverage this progress to gain an additional edge. Refere…

#finance #trading #investing

High-frequency trading (HFT) is a type of algorithmic trading that uses computer programs to place orders at very fast speeds. High-frequency traders use sophisticated algorithm…

#finance #trading #investing

High-frequency trading (HFT) is a type of algorithmic trading that uses computer programs to place orders at very fast speeds. High-frequency traders use sophisticated algorithm…

#finance #trading #investing

Options are powerful tools. They serve not only as an effective instrument for risk management and speculation, but they also provide valuable information about the …

#finance #trading #investing

Options are powerful tools. They serve not only as an effective instrument for risk management and speculation, but they also provide valuable information about the …

#finance #trading #investing

In the financial market, seasonality refers to systematic return patterns that recur at specific calendar intervals. It has been studied extensively in …

#finance #trading #investing

In the financial market, seasonality refers to systematic return patterns that recur at specific calendar intervals. It has been studied extensively in …

#finance #trading #investing

The VIX is an index that measures the volatility of the S&P 500. It is often referred to as the “fear index” because it spikes when investors are…

#finance #trading #investing

The VIX is an index that measures the volatility of the S&P 500. It is often referred to as the “fear index” because it spikes when investors are…

#finance #trading #investing

Pairs trading, or statistical arbitrage, is one of the oldest quantitative trading strategies, and it is still employed today. Over the years, it has expanded from c…

#finance #trading #investing

Pairs trading, or statistical arbitrage, is one of the oldest quantitative trading strategies, and it is still employed today. Over the years, it has expanded from c…

#finance #trading #investing

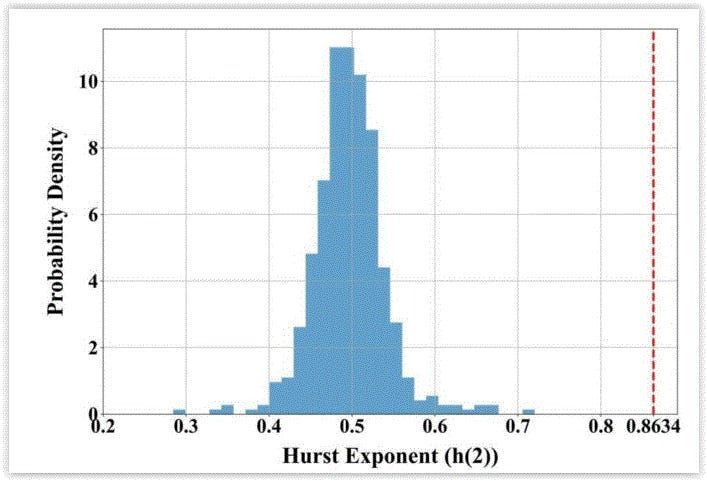

Fractal Market Hypothesis is an alternative framework that models financial markets through long-memory and multi-scale dynamics. There is a growing trend in the industry to …

#finance #trading #investing

Fractal Market Hypothesis is an alternative framework that models financial markets through long-memory and multi-scale dynamics. There is a growing trend in the industry to …

#finance #trading #investing

An Exchange Traded Fund (ETF) is a fund that tracks an index, sector, or basket of assets just like a traditional mutual fund, but trades like a stock on an exchange. ETF…

#finance #trading #investing

An Exchange Traded Fund (ETF) is a fund that tracks an index, sector, or basket of assets just like a traditional mutual fund, but trades like a stock on an exchange. ETF…

#finance #trading #investing

Volatility is an important measure of market uncertainty and risk. For decades, realized volatility has been computed from the squared returns. Recent research…

#finance #trading #investing

Volatility is an important measure of market uncertainty and risk. For decades, realized volatility has been computed from the squared returns. Recent research…

#finance #trading #investing

The volatility term structure is the relationship between implied volatility and time to expiration. The term structure is important because it provides information about …

#finance #trading #investing

The volatility term structure is the relationship between implied volatility and time to expiration. The term structure is important because it provides information about …

#finance #trading #investing

As cryptocurrencies become mainstream, researchers have begun examining their statistical properties, particularly volatility, which represents the…

#finance #trading #investing

As cryptocurrencies become mainstream, researchers have begun examining their statistical properties, particularly volatility, which represents the…

#finance #trading #investing

The Black-Sholes-Merton model is a mathematical model for pricing financial options. The model is used to calculate the theoretical value of an option, which is the am…

#finance #trading #investing

The Black-Sholes-Merton model is a mathematical model for pricing financial options. The model is used to calculate the theoretical value of an option, which is the am…

#finance #trading #investing

Probabilistic AI is a branch of artificial intelligence that models uncertainty explicitly, allowing systems to reason and make predictions even when data is inc…

#finance #trading #investing

Probabilistic AI is a branch of artificial intelligence that models uncertainty explicitly, allowing systems to reason and make predictions even when data is inc…