Harvir Dhillon

@harvirdhillon.bsky.social

310 followers

130 following

420 posts

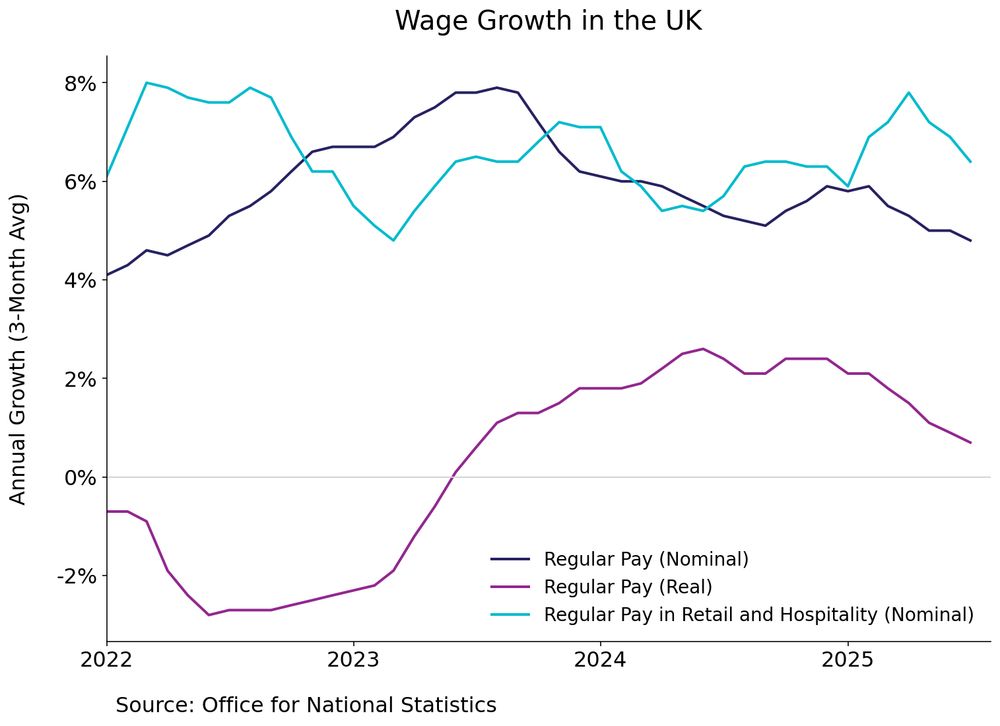

Economist at the British Retail Consortium 🛍️

UK macro, retail and #costofliving 📈👨🏽💻🇬🇧

Opinions my own etc

Formerly Experian

Leicestershire, United Kingdom 🦊

Posts

Media

Videos

Starter Packs

Harvir Dhillon

@harvirdhillon.bsky.social

· Aug 26

Harvir Dhillon

@harvirdhillon.bsky.social

· Aug 26