www.jamesmahmudrice.info

For a more detailed discussion, see:

bsky.app/profile/jame...

For a more detailed discussion, see:

bsky.app/profile/jame...

doi.org/10.1007/s125...

rdcu.be/cylFh (full-text, view-only)

doi.org/10.1007/s125...

rdcu.be/cylFh (full-text, view-only)

"People receive benefits from the state as a child. They attend childcare paid for by government subsidies and they get a free (public) or subsidised (private) education."

"People receive benefits from the state as a child. They attend childcare paid for by government subsidies and they get a free (public) or subsidised (private) education."

It's by David Iliff (license: creativecommons.org/licenses/by-...).

It's by David Iliff (license: creativecommons.org/licenses/by-...).

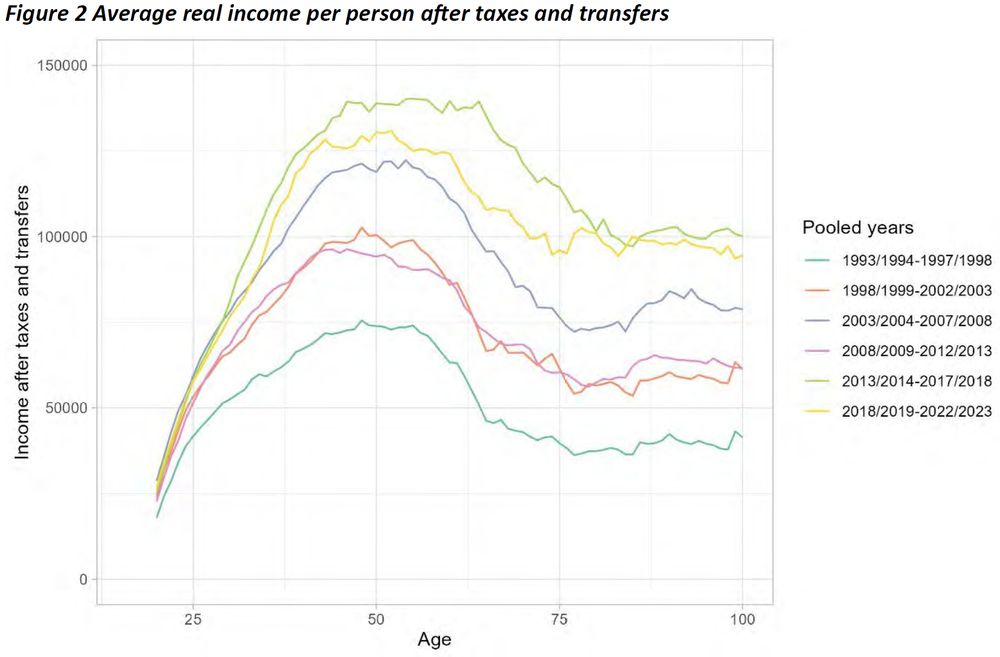

Study's findings on post-tax income, 2018/19-2022/23:

Mid-career working age Australians: $125K

Australians over 60: less than this

Australians over 75: $100K (20% less)

Study's findings on post-tax income, 2018/19-2022/23:

Mid-career working age Australians: $125K

Australians over 60: less than this

Australians over 75: $100K (20% less)

The figure does not cover the entire life cycle, because public transfers received by children (like school education) are grouped together with those received by their working-age parents.

The figure does not cover the entire life cycle, because public transfers received by children (like school education) are grouped together with those received by their working-age parents.

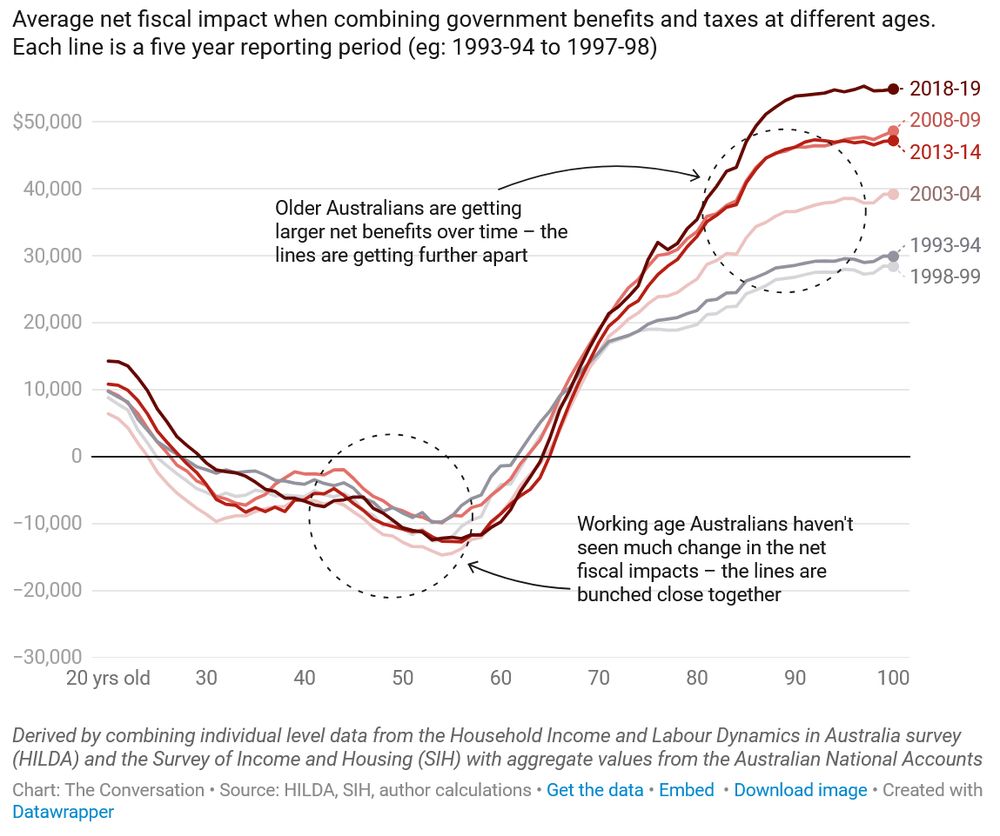

Here is the figure from Rice et al.

Here is the figure from Rice et al.

Rice et al, 2021

doi.org/10.1007/s125...

rdcu.be/cylFh (full-text, view-only)

Measuring the changing size of intergenerational transfers in the Australian tax and transfer system

Varela et al, 2025

crawford.anu.edu.au/content-cent...

Rice et al, 2021

doi.org/10.1007/s125...

rdcu.be/cylFh (full-text, view-only)

Measuring the changing size of intergenerational transfers in the Australian tax and transfer system

Varela et al, 2025

crawford.anu.edu.au/content-cent...