Low and, most of all, middle income adults are the MOST opposed to adding tariffs.

High earners are less bothered. This group has thrived lately despite elevated inflation, potentially reducing their tariff concerns.

Low and, most of all, middle income adults are the MOST opposed to adding tariffs.

High earners are less bothered. This group has thrived lately despite elevated inflation, potentially reducing their tariff concerns.

1) Inflation was low for yrs heading into '18; much higher this time

2) Ppl think these tariffs will cost more

1) Inflation was low for yrs heading into '18; much higher this time

2) Ppl think these tariffs will cost more

pro.morningconsult.com/analysis/tar...

pro.morningconsult.com/analysis/tar...

We published our new State of the Global Consumer report last week, for the first time showcasing our very own intl consumer spending data across all 15 countries we cover!

That's monthly, apples-to-apples, category-level spending data!!

We published our new State of the Global Consumer report last week, for the first time showcasing our very own intl consumer spending data across all 15 countries we cover!

That's monthly, apples-to-apples, category-level spending data!!

But from late summer thru mid-Nov, we are finally seeing improvement in consumer health scores - with <$50k group showing the most progress!

But from late summer thru mid-Nov, we are finally seeing improvement in consumer health scores - with <$50k group showing the most progress!

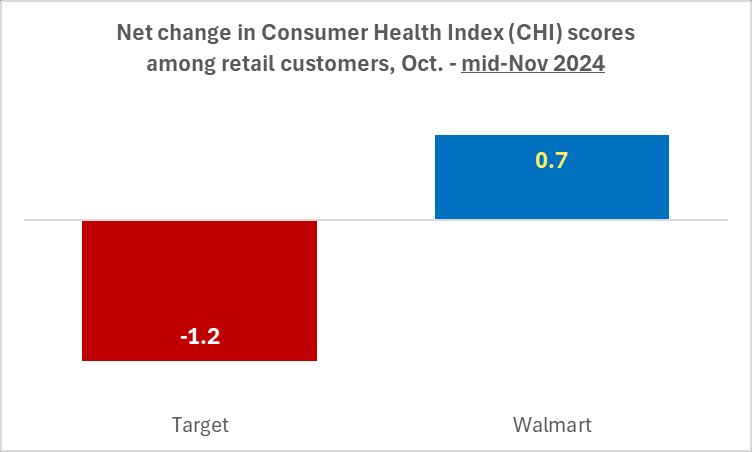

Turns out there were some conflicting demand patterns among these retailers customers, foreshadowing their earnings outcomes!

Turns out there were some conflicting demand patterns among these retailers customers, foreshadowing their earnings outcomes!

Consumer demand appears to be picking up thru mid Nov (chart runs thru Nov. 16)--and it's not just driven by the post-election sentiment bump either...

Consumer demand appears to be picking up thru mid Nov (chart runs thru Nov. 16)--and it's not just driven by the post-election sentiment bump either...