Lalitha Try

@lalithatry.bsky.social

1.5K followers

500 following

100 posts

Economist at the Resolution Foundation working on improving living standards and reducing poverty

Posts

Media

Videos

Starter Packs

Reposted by Lalitha Try

Reposted by Lalitha Try

Reposted by Lalitha Try

Reposted by Lalitha Try

Lalitha Try

@lalithatry.bsky.social

· Aug 20

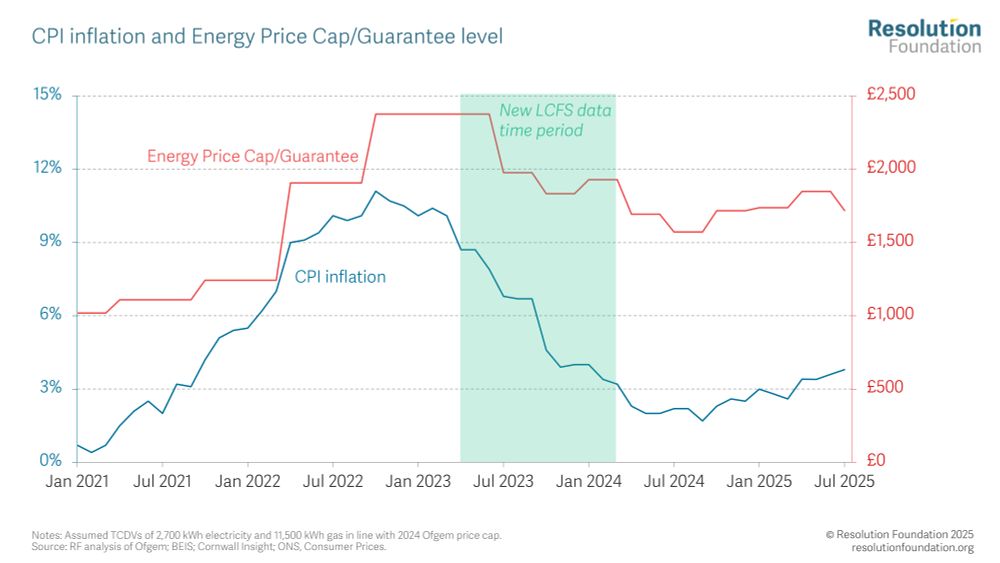

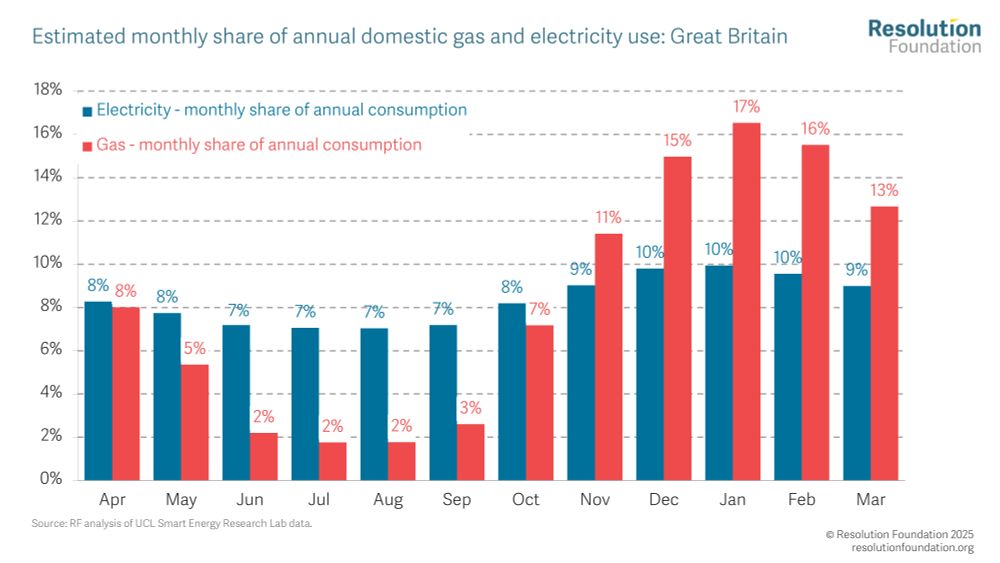

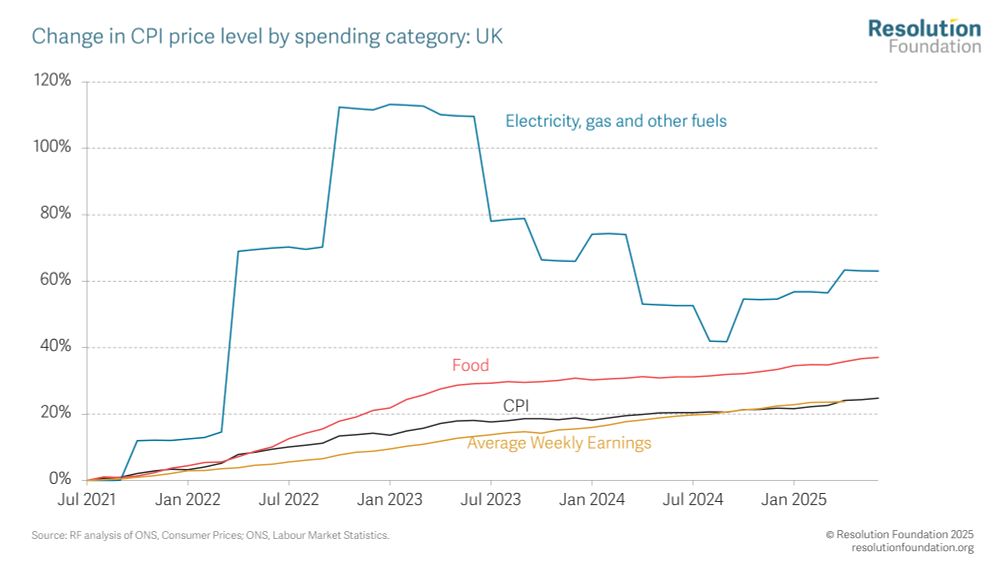

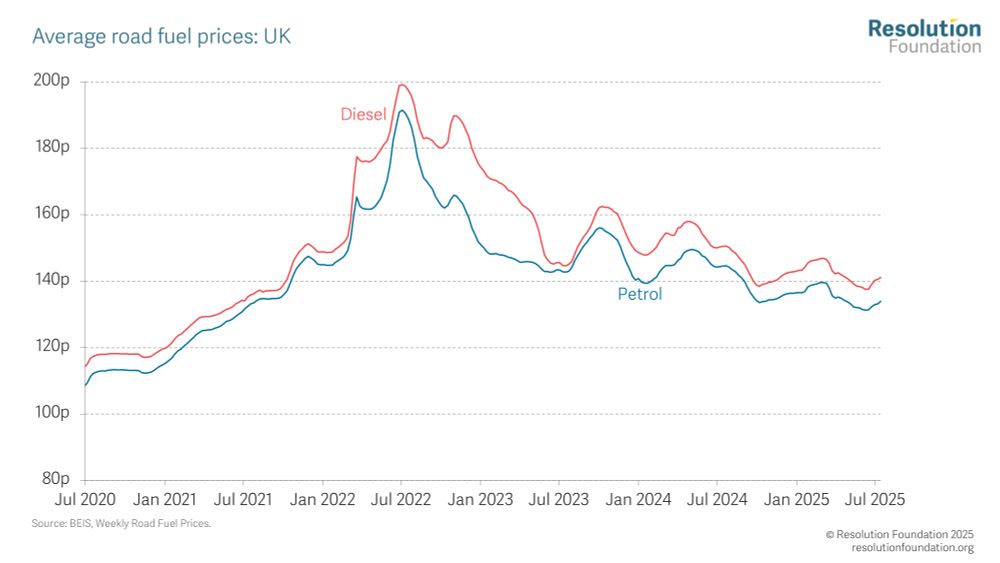

The bare necessities • Resolution Foundation

This briefing note examines how prices have changed over time in three key areas of spending: energy, food and transport. We also propose policy changes that can make essential costs more affordable f...

www.resolutionfoundation.org

Lalitha Try

@lalithatry.bsky.social

· Jul 16

The bare necessities • Resolution Foundation

This briefing note examines how prices have changed over time in three key areas of spending: energy, food and transport. We also propose policy changes that can make essential costs more affordable f...

www.resolutionfoundation.org