I lost hundreds of thousands

But I cracked the code and made my first Million

If you’re starting with a small account, this is the exact blueprint I wish I had on Day 1

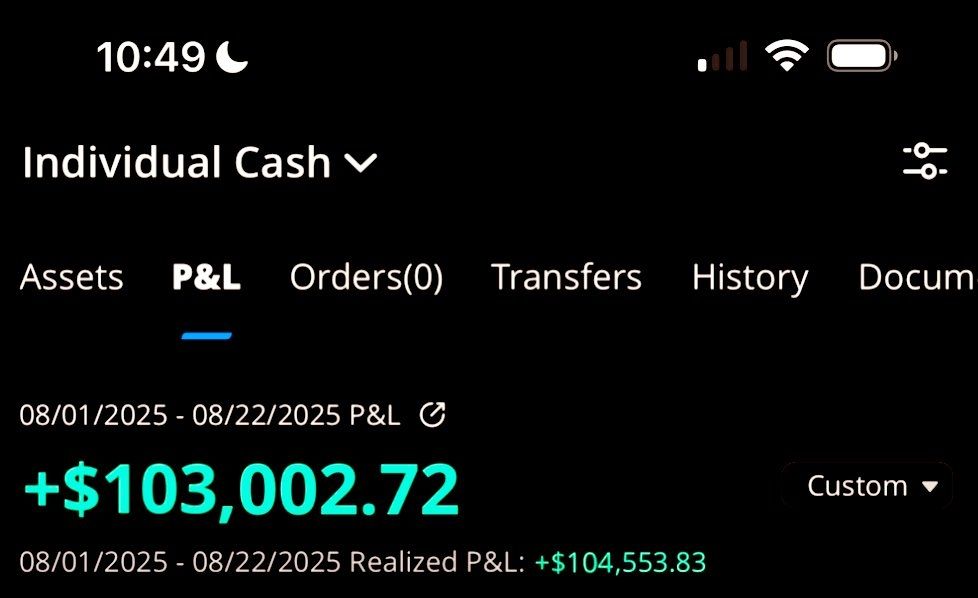

It gave me my first $100K year trading

Steal it in 2 minutes & RT to help traders

I lost hundreds of thousands

But I cracked the code and made my first Million

If you’re starting with a small account, this is the exact blueprint I wish I had on Day 1

It gave me my first $100K year trading

Steal it in 2 minutes & RT to help traders

The gap between two-year and 30-year Treasury yields is near its widest since early 2022.

At the same time, the US Dollar index is near its lowest in over 3 years.

Investors appear to be dumping US assets.

The gap between two-year and 30-year Treasury yields is near its widest since early 2022.

At the same time, the US Dollar index is near its lowest in over 3 years.

Investors appear to be dumping US assets.

The BLS is set to revise DOWN US job numbers by 550,000-950,000 for 12 months ending March 2025 on September 9, according to Goldman Sachs estimates.

That’d be the biggest 12-month downward revision in 15 YEARS.

Total cut over 2 years would reach 1.5M jobs.

The BLS is set to revise DOWN US job numbers by 550,000-950,000 for 12 months ending March 2025 on September 9, according to Goldman Sachs estimates.

That’d be the biggest 12-month downward revision in 15 YEARS.

Total cut over 2 years would reach 1.5M jobs.

At the same time, 49% said Emerging Markets are undervalued

Almost every professional investor on this planet believes the US stock market is OVERVALUED.

At the same time, 49% said Emerging Markets are undervalued

Almost every professional investor on this planet believes the US stock market is OVERVALUED.

The geometric average of 4 long-term valuation metrics for the S&P 500 has hit 163%, an ALL-TIME HIGH.

This is more than 3 standard deviations ABOVE the mean.

By comparison, the 2000 Dot-Com Bubble peaked at just 126%.

The geometric average of 4 long-term valuation metrics for the S&P 500 has hit 163%, an ALL-TIME HIGH.

This is more than 3 standard deviations ABOVE the mean.

By comparison, the 2000 Dot-Com Bubble peaked at just 126%.

US long leveraged ETFs have seen $5.9 BILLION in net OUTFLOWS over the last 2 weeks, the most in at least 20 months.

These funds have seen outflows in 16 out of the last 18 weeks.

Time for a market pullback?

US long leveraged ETFs have seen $5.9 BILLION in net OUTFLOWS over the last 2 weeks, the most in at least 20 months.

These funds have seen outflows in 16 out of the last 18 weeks.

Time for a market pullback?

The BLS collects ~90,000 price quotes each month across 200 categories to calculate CPI.

Normally, about 10% of prices are estimated when data is missing.

Now ~32% are MADE UP, based on assumptions, not real prices, double the share seen in the 2020 Crisis.

The BLS collects ~90,000 price quotes each month across 200 categories to calculate CPI.

Normally, about 10% of prices are estimated when data is missing.

Now ~32% are MADE UP, based on assumptions, not real prices, double the share seen in the 2020 Crisis.

The extra yield that investors receive for owning investment-grade corporate bonds instead of Treasuries FELL to

just 73 basis points, the lowest since 1998, according to Bloomberg.

MARKETS ARE HISTORICALLY EXPENSIVE

The extra yield that investors receive for owning investment-grade corporate bonds instead of Treasuries FELL to

just 73 basis points, the lowest since 1998, according to Bloomberg.

MARKETS ARE HISTORICALLY EXPENSIVE

Renter households are surging as homeowner growth stalls.

This shift (and whether or not it continues) matters for any company tied to US housing....

Renter households are surging as homeowner growth stalls.

This shift (and whether or not it continues) matters for any company tied to US housing....

Our internal data shows households moving between metro areas spiked in 2021 and has fallen by 29% since.

Our internal data shows households moving between metro areas spiked in 2021 and has fallen by 29% since.

Worth Reviewing With Charts Attached:

1) March 13th 2024

2) March 27th 2024

3) July 3rd 2024

4) December 11th 2024

Worth Reviewing With Charts Attached:

1) March 13th 2024

2) March 27th 2024

3) July 3rd 2024

4) December 11th 2024

If I can do it, anyone can , but it takes finding a process that works for you and staying disciplined until it becomes second nature!

If I can do it, anyone can , but it takes finding a process that works for you and staying disciplined until it becomes second nature!