Mathias Larsen

@mathiaslarsen.bsky.social

190 followers

190 following

16 posts

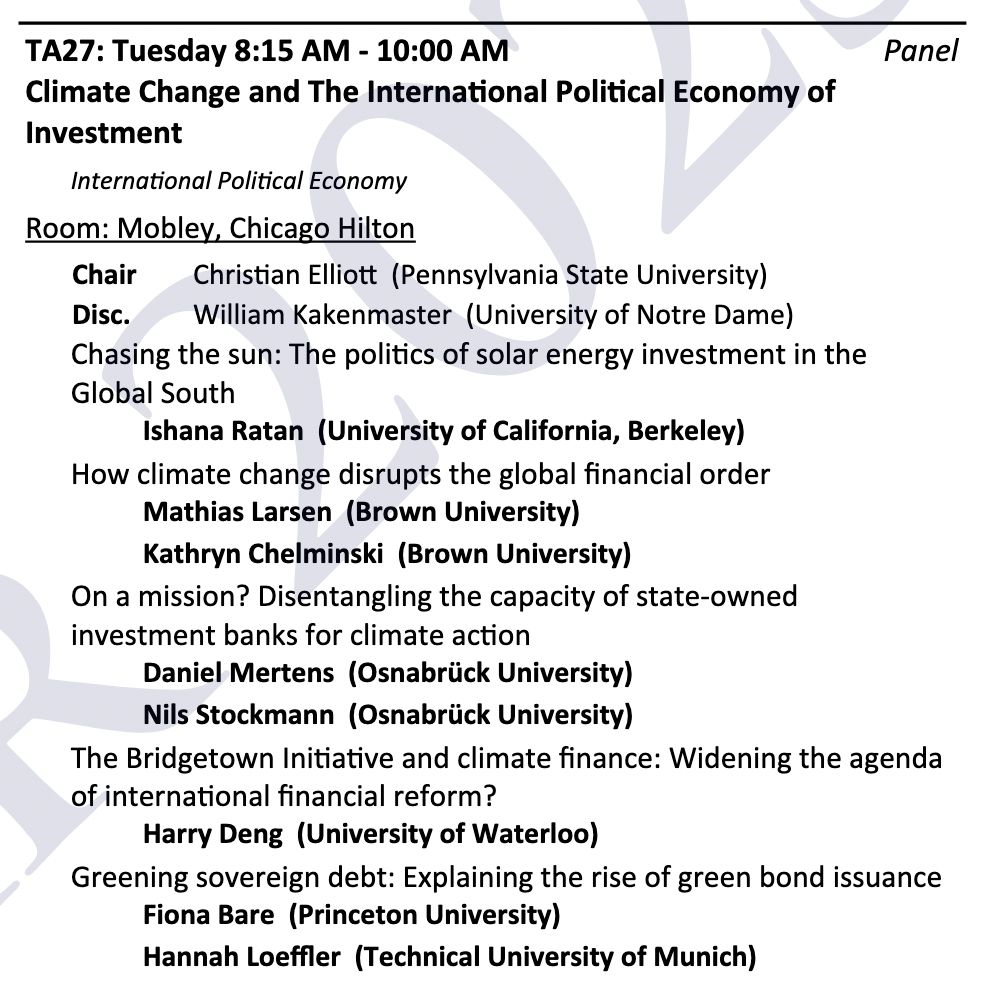

Postdoc at Brown University's Watson Institute. Working on the political economy of financing green transition in China and other global South countries

Posts

Media

Videos

Starter Packs

Reposted by Mathias Larsen

Mathias Larsen

@mathiaslarsen.bsky.social

· Jul 15

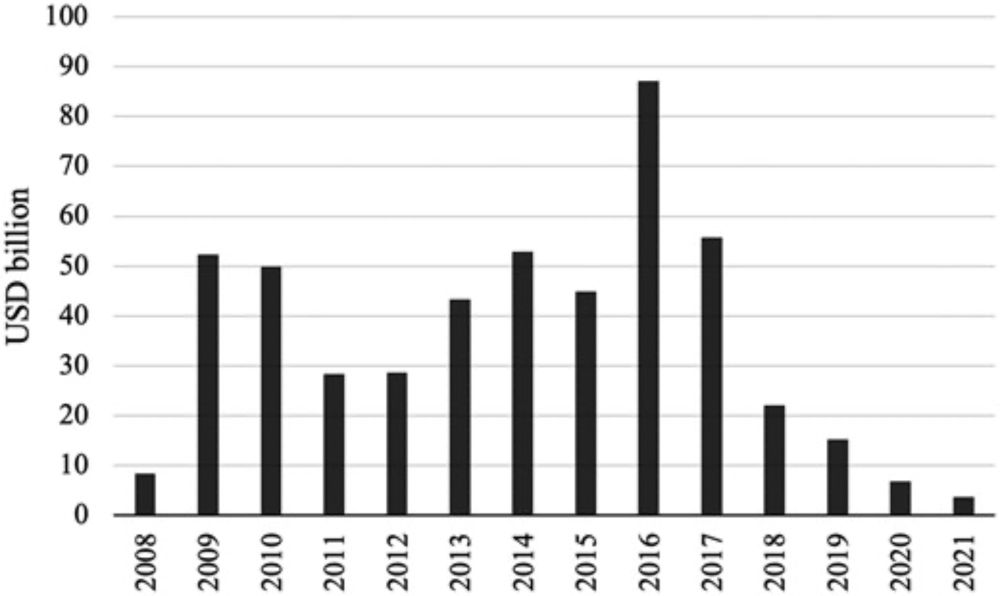

The archetype of a ‘big green state’? What China tells us about green macrofinancial regimes

Driven by the urgency of the climate crisis, political economists are debating how the state can best ensure financing for a green transition. Providing a conceptual scaffolding for discussing diff...

doi.org

Mathias Larsen

@mathiaslarsen.bsky.social

· Jun 30

What other countries can learn from how China financed a green transformation

China's green transformation has come about more from financing green than greening finance, write <strong>Calvin Quek</strong> and <strong>Mathias Larsen</strong>

www.environmental-finance.com

Mathias Larsen

@mathiaslarsen.bsky.social

· May 31

Reposted by Mathias Larsen