Posts

Media

Videos

Starter Packs

Reposted

pedroserodio.com

@pedroserodio.com

· Jun 19

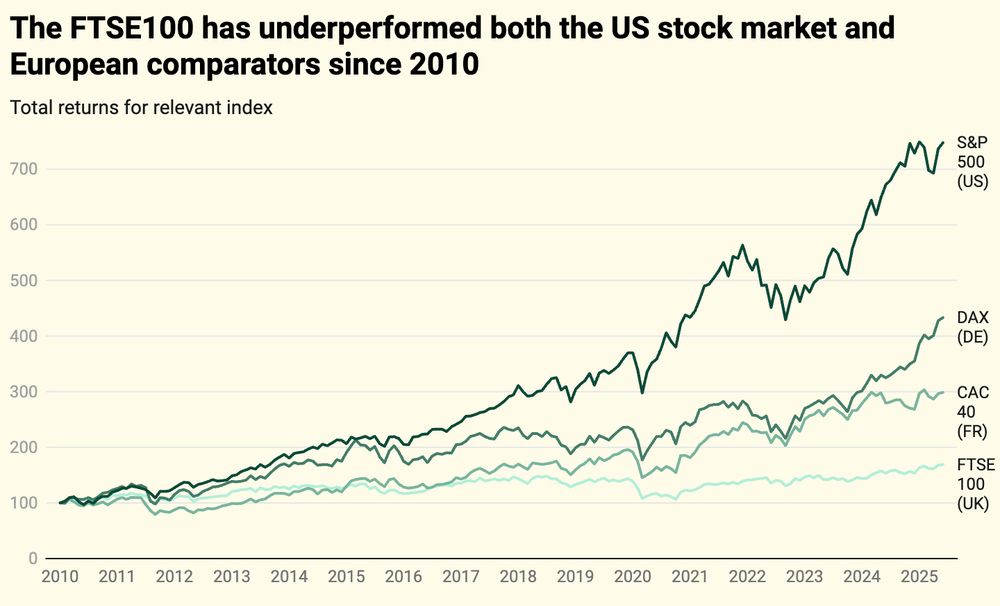

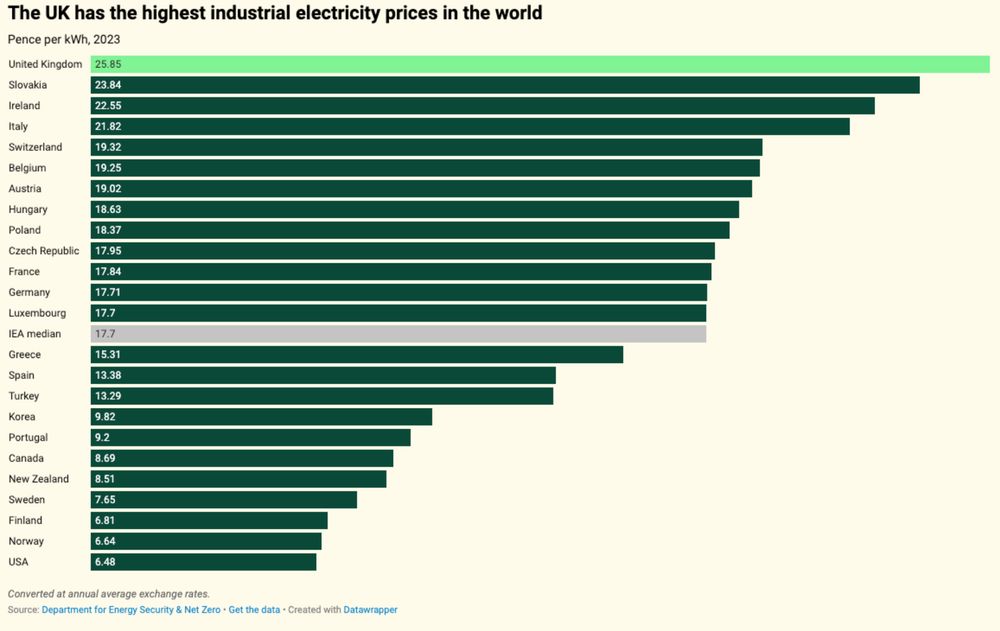

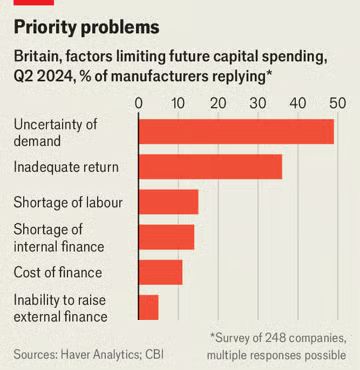

ISA & pension reform: Why forced investment is not real investment

Compelling British households to invest in British assets risks undermining their pensions without improving the economy. Creating real investment opportunities requires addressing the barriers curren...

britishprogress.org

pedroserodio.com

@pedroserodio.com

· Jun 19

pedroserodio.com

@pedroserodio.com

· Jun 19

pedroserodio.com

@pedroserodio.com

· Jun 19

pedroserodio.com

@pedroserodio.com

· Jun 19

pedroserodio.com

@pedroserodio.com

· Jun 19

pedroserodio.com

@pedroserodio.com

· Jun 19

Reposted

pedroserodio.com

@pedroserodio.com

· Apr 3

pedroserodio.com

@pedroserodio.com

· Apr 3

pedroserodio.com

@pedroserodio.com

· Apr 3

Reposted