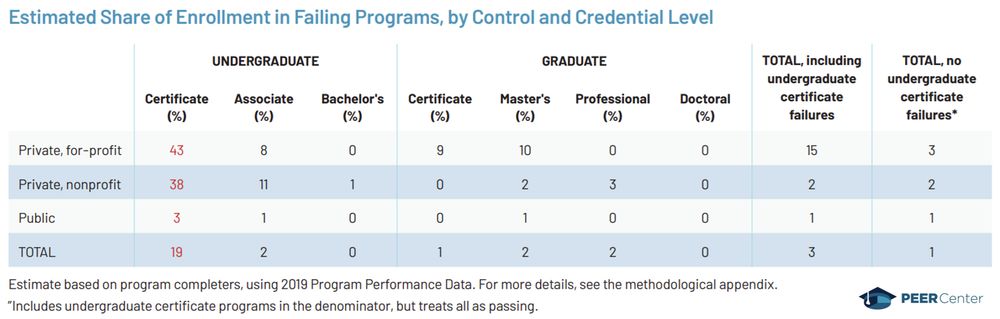

➡️ Provide radically improved transparency

➡️ Maintain an earnings test for certificates, a debt-based test

➡️ Release already-collected data

More: www.american.edu/spa/peer/rec...

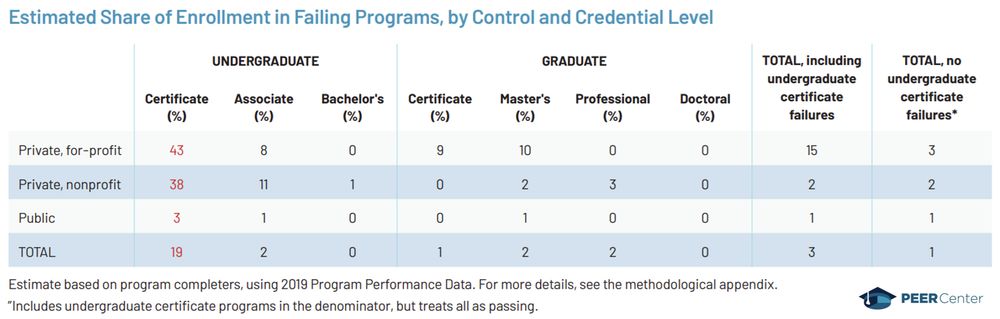

➡️ Provide radically improved transparency

➡️ Maintain an earnings test for certificates, a debt-based test

➡️ Release already-collected data

More: www.american.edu/spa/peer/rec...

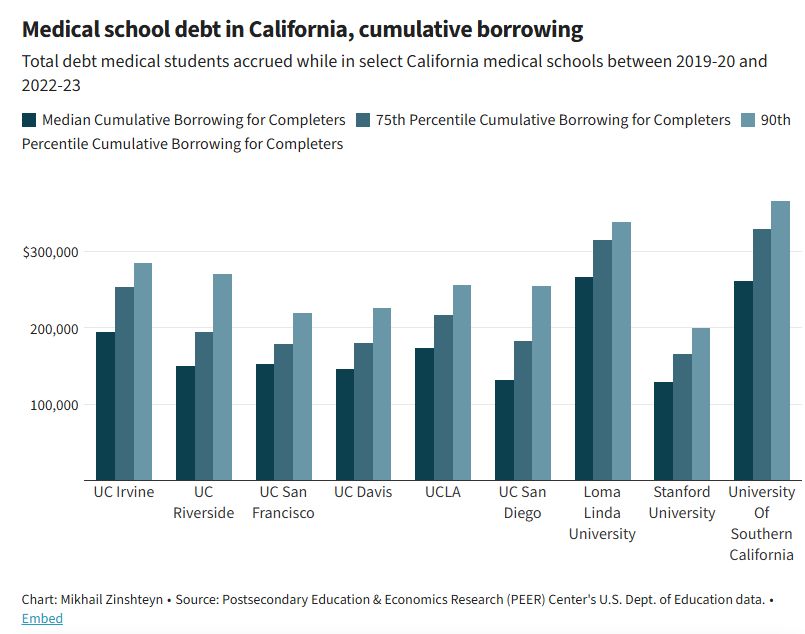

➡️ Health degrees account for nearly half of grad borrowing

➡️ High-debt fields typically have high median earnings

➡️ Typical borrowing varies, across schools and within programs

www.american.edu/spa/peer/upl...

➡️ Health degrees account for nearly half of grad borrowing

➡️ High-debt fields typically have high median earnings

➡️ Typical borrowing varies, across schools and within programs

www.american.edu/spa/peer/upl...