https://www.relearningeconomics.com

I propose a post-Keynesian, system-dynamics alternative to the New Keynesian DSGE model, one that produces business cycles and financial instability endogenously, without rational expectations or microfoundations.

dx.doi.org/10.2139/ssrn...

🧵1/8

I propose a post-Keynesian, system-dynamics alternative to the New Keynesian DSGE model, one that produces business cycles and financial instability endogenously, without rational expectations or microfoundations.

dx.doi.org/10.2139/ssrn...

🧵1/8

If the corrective action is delayed, because of slow information, slow adjustment, or rigid institutions, the system can overshoot or undershoot its target.

That creates oscillations.

🧵8/10

If the corrective action is delayed, because of slow information, slow adjustment, or rigid institutions, the system can overshoot or undershoot its target.

That creates oscillations.

🧵8/10

They work to bring the system back toward some target or desired state.

If the system drifts away from that target, the negative loop kicks in to correct it.

🧵6/10

They work to bring the system back toward some target or desired state.

If the system drifts away from that target, the negative loop kicks in to correct it.

🧵6/10

Left unchecked, they can push a system into unstable or undesirable states, the classic vicious or virtuous circle.

🧵5/10

Left unchecked, they can push a system into unstable or undesirable states, the classic vicious or virtuous circle.

🧵5/10

Examples:

• People create more people

• Money makes more money

• Capital equipment can produce more capital

• Knowledge accumulates into more knowledge

🧵4/10

Examples:

• People create more people

• Money makes more money

• Capital equipment can produce more capital

• Knowledge accumulates into more knowledge

🧵4/10

🧵3/10

🧵3/10

The information that flows back from these stocks (directly or indirectly) controls the system's flows, which then change the stocks again.

That circular causality is what creates loops.

🧵2/10

The information that flows back from these stocks (directly or indirectly) controls the system's flows, which then change the stocks again.

That circular causality is what creates loops.

🧵2/10

They sit inside webs of interacting feedback loops.

Feedback is simply information about what’s happening in the system’s stocks, fed back to influence its flows.

🧵1/10

They sit inside webs of interacting feedback loops.

Feedback is simply information about what’s happening in the system’s stocks, fed back to influence its flows.

🧵1/10

(fred.stlouisfed.org/graph/?g=qKZG#0 )

(fred.stlouisfed.org/graph/?g=qKZG#0 )

-William E. Simon

Gazette-Times, Corvallis, OR (1975)

-William E. Simon

Gazette-Times, Corvallis, OR (1975)

-Keyu Jin

The New China Playbook: Beyond Socialism & Capitalism (2023)

-Keyu Jin

The New China Playbook: Beyond Socialism & Capitalism (2023)

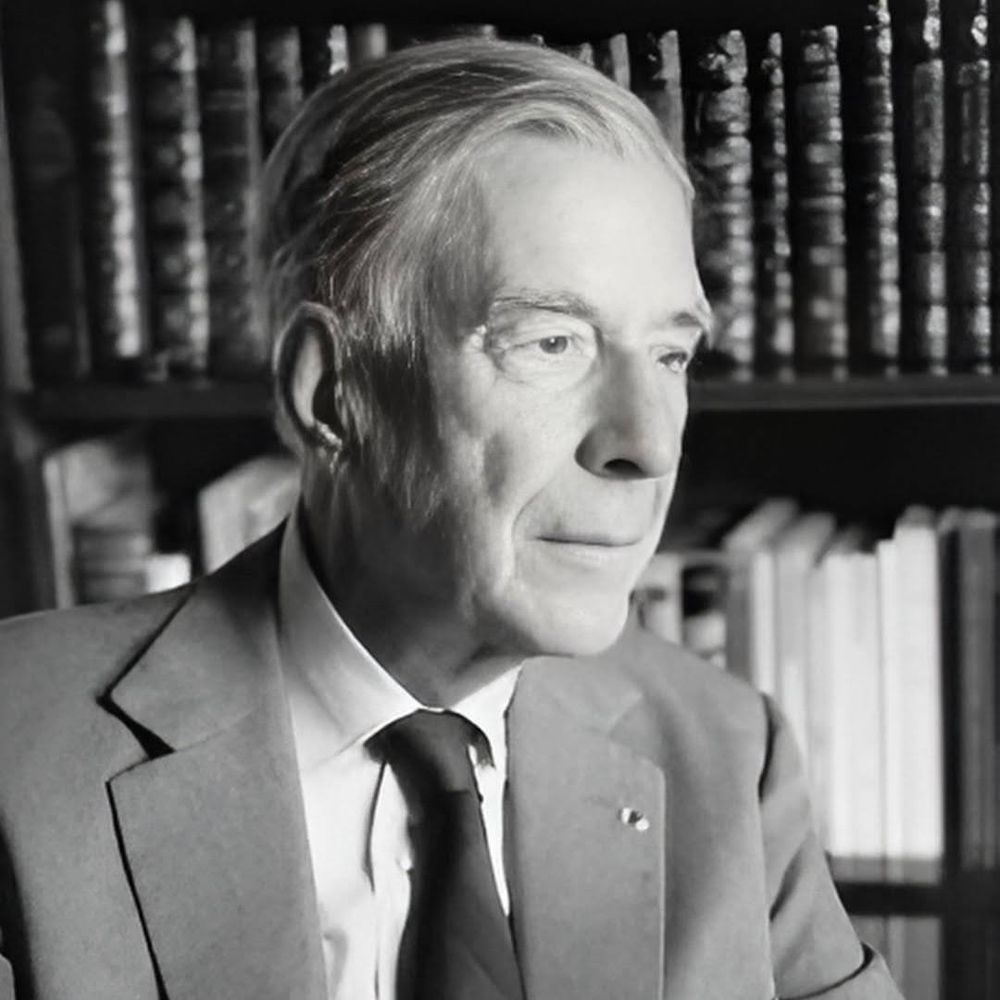

-Robert Solow

AEA Panel Discussion (1966)

-Robert Solow

AEA Panel Discussion (1966)

But mainstream economics still teaches that banks are intermediaries, loans come from savings, and governments can run out of money.

None of that sh#t holds up.

🧵1/12

But mainstream economics still teaches that banks are intermediaries, loans come from savings, and governments can run out of money.

None of that sh#t holds up.

🧵1/12

Modeling with it is like designing a unicorn and then asking why real horses don’t have horns.

Might as well just start with the horse.

Modeling with it is like designing a unicorn and then asking why real horses don’t have horns.

Might as well just start with the horse.

History tells a different story, The biggest crashes follow private debt booms , when households & firms load up on credit faster than incomes grow.

🧵1/8

History tells a different story, The biggest crashes follow private debt booms , when households & firms load up on credit faster than incomes grow.

🧵1/8

-Lawrence J. Peter

-Lawrence J. Peter

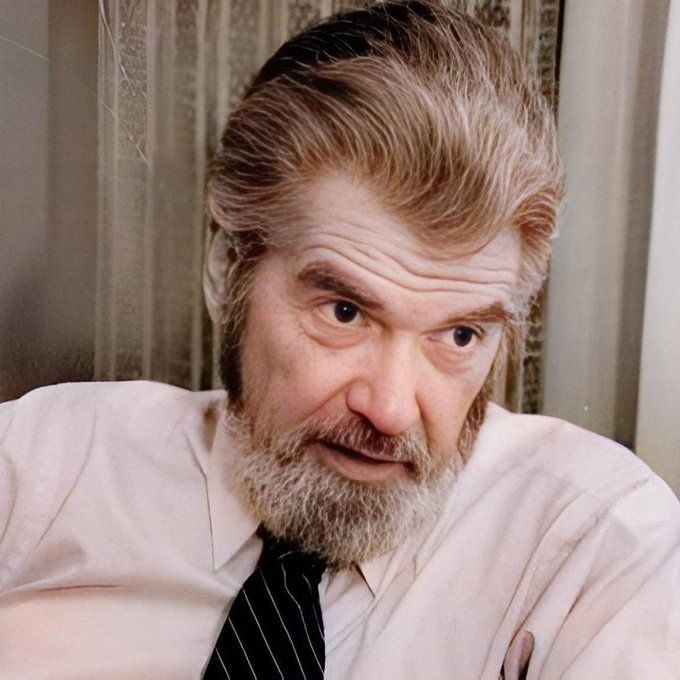

-Steve Keen

-Steve Keen

-Friedrich Hayek

-Friedrich Hayek

-David Graeber

-David Graeber

-Michael Hudson

-Michael Hudson

-Stephanie Kelton

-Stephanie Kelton

-John Kenneth Galbraith

-John Kenneth Galbraith