Share The Wealth

@sharethewealthuk.bsky.social

160 followers

180 following

48 posts

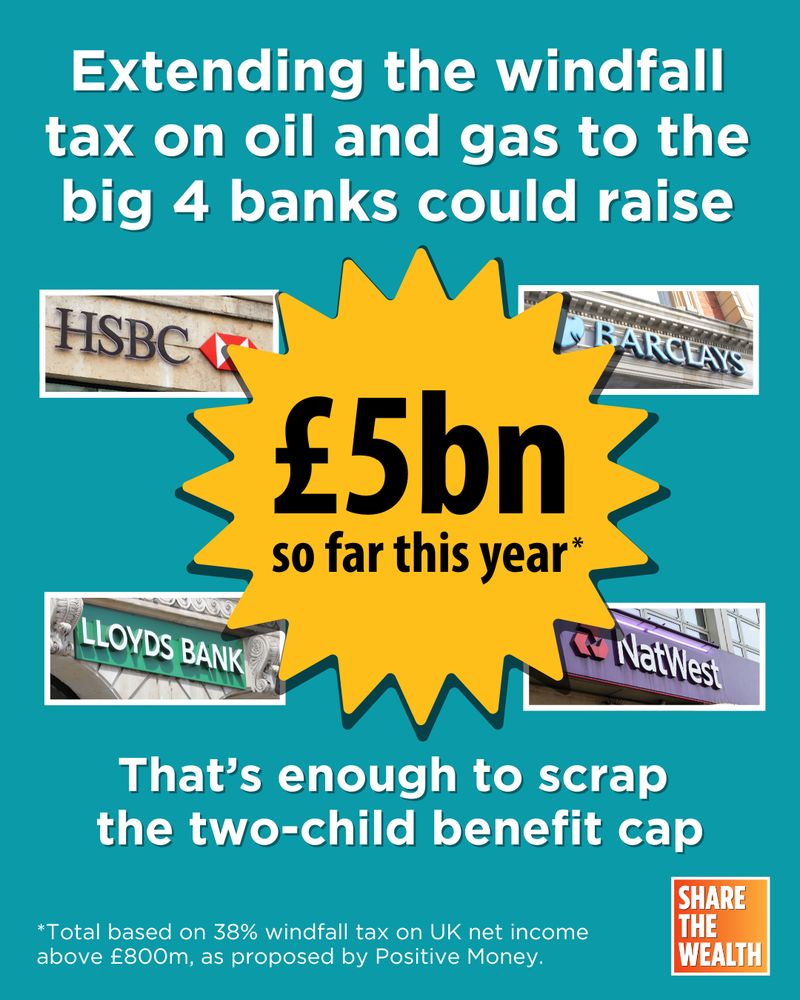

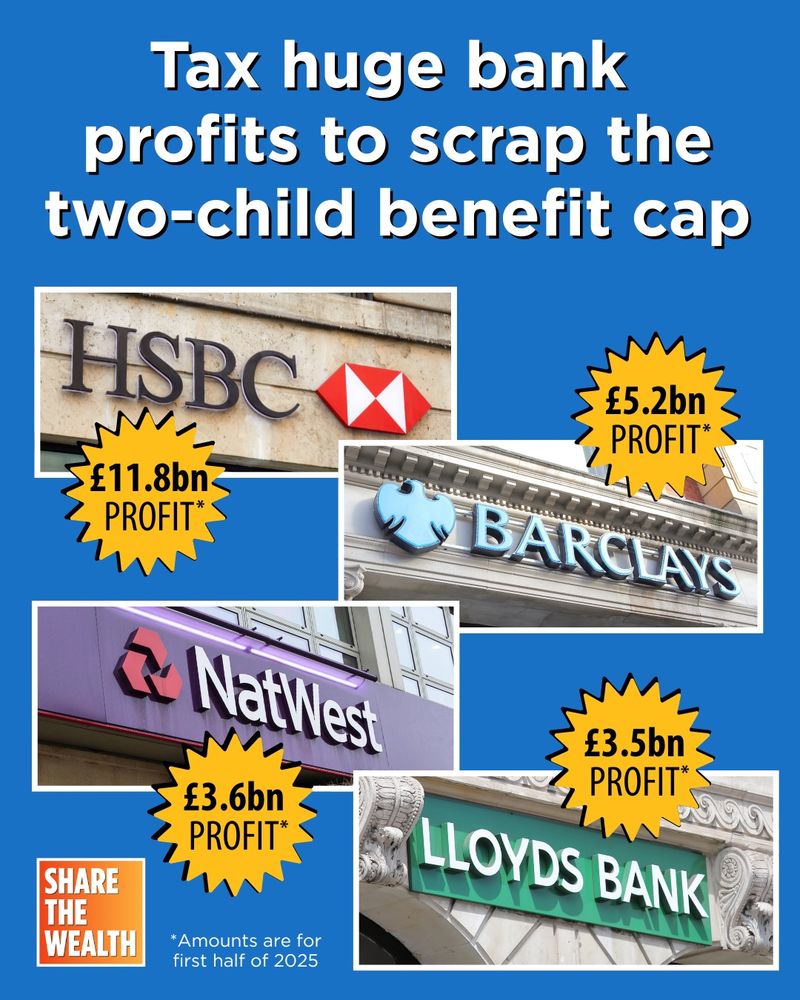

We expose the extreme wealth of the super-rich and the profiteering of big corporations. https://sharethewealth.org.uk/

Posts

Media

Videos

Starter Packs