Shift: Action for Pension Wealth & Planet Health

@shiftaction.bsky.social

450 followers

1.1K following

350 posts

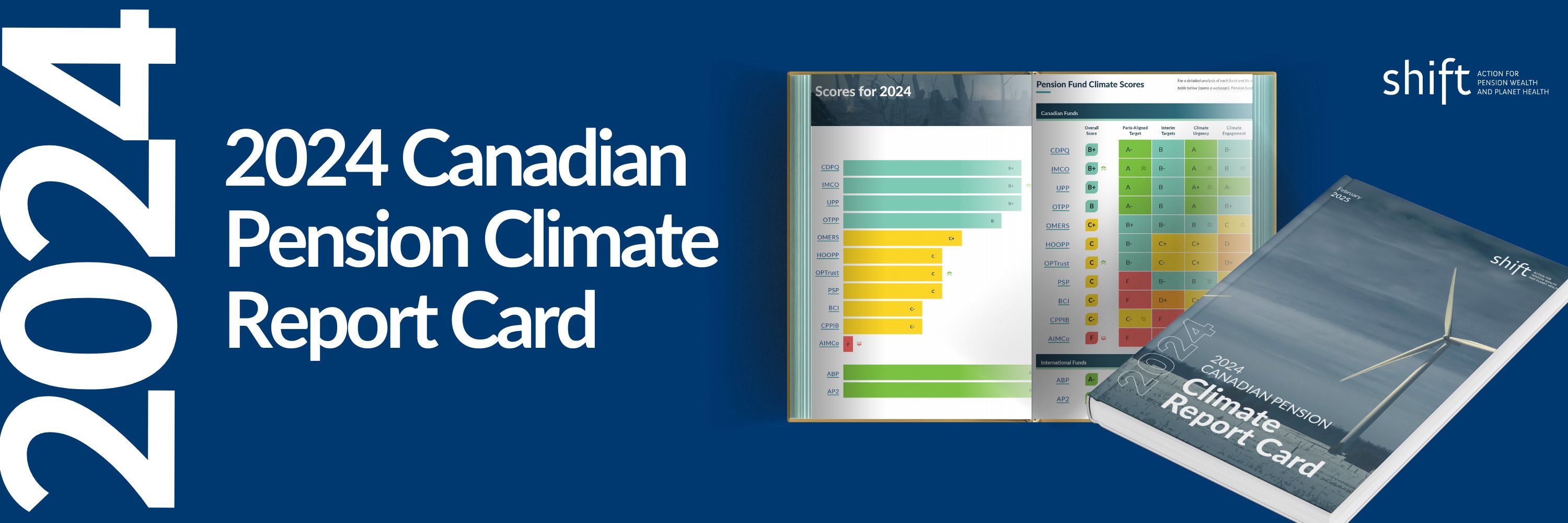

Working to protect pensions & the climate by bringing together beneficiaries & their pension funds to engage on the climate crisis. Project of Makeway.

www.shiftaction.ca

Posts

Media

Videos

Starter Packs

Reposted by Shift: Action for Pension Wealth & Planet Health

The Energy Mix

@theenergymix.com

· Aug 29

Regulator’s Blind Spots Have Pension Funds ‘Sleepwalking Into Climate Crisis’, Shift Warns

With Canadian pension funds due to see their financial returns fall up to 50 of 60% by 2040 if average global warming reaches 3.7°C, the office that who oversees the financial health of the country’s ...

www.theenergymix.com