softwareiq.io

These companies exhibit (near) similar unit economics to top-tier SaaS list, while trading at 50%+ discount on an EV/Sales basis. Further each of the companies stand to benefit from AI

These companies exhibit (near) similar unit economics to top-tier SaaS list, while trading at 50%+ discount on an EV/Sales basis. Further each of the companies stand to benefit from AI

Many companies revisiting the tariff lows, while top companies remain highly valued despite mid-twenty - 30 growth rates.

Many companies revisiting the tariff lows, while top companies remain highly valued despite mid-twenty - 30 growth rates.

$FIG @figma.com

$FIG @figma.com

softwareiq.io

softwareiq.io

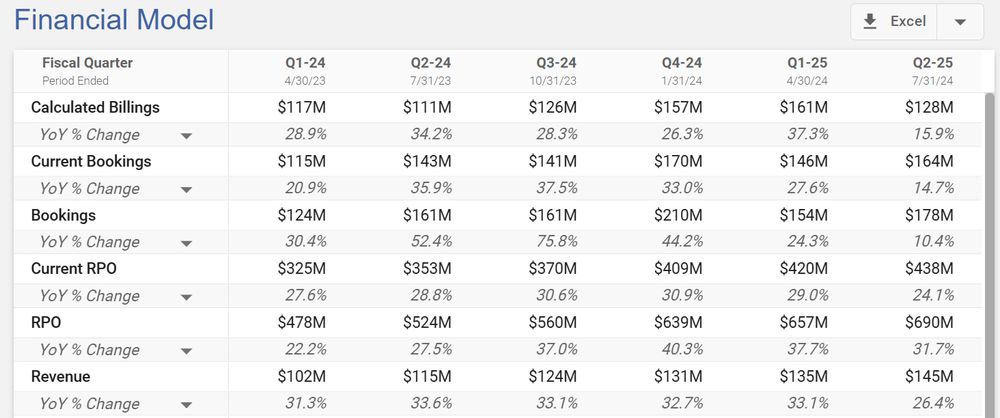

ServiceNow Bookings and billings showed rebound from Q4. Disclosure ceased for customers >$1M suggest further deceleration (now disclosed +$5M plus)

ServiceNow Bookings and billings showed rebound from Q4. Disclosure ceased for customers >$1M suggest further deceleration (now disclosed +$5M plus)

Bookings trends solid going into a critical Q4 with Jan 31st reports beginning next week...

Bookings trends solid going into a critical Q4 with Jan 31st reports beginning next week...

Infrastructure and vertical software continue to see multiples expand. Vertical software valuations are approaching 2021 highs.

Infrastructure and vertical software continue to see multiples expand. Vertical software valuations are approaching 2021 highs.

This valuation maintains Databricks #2 in our coverage in valuation and ARR behind OpenAI.

This valuation maintains Databricks #2 in our coverage in valuation and ARR behind OpenAI.

Sign up for your free account now and start exploring today!

www.softwareiq.io/news

Sign up for your free account now and start exploring today!

www.softwareiq.io/news

Valuation (EV/GM NTM) is at a discount relative to peers/growth profile.

Valuation (EV/GM NTM) is at a discount relative to peers/growth profile.

Cloud grew $19.6M sequentially in the prior year. RPO built substantially in Q2 though the majority of the business is not booked in backlog. Customer count growth slowing.

Cloud grew $19.6M sequentially in the prior year. RPO built substantially in Q2 though the majority of the business is not booked in backlog. Customer count growth slowing.

“.. Below are some of the Software companies that have announced new ‘agent’ products and their relative performance since then.”

“.. Below are some of the Software companies that have announced new ‘agent’ products and their relative performance since then.”