Substack: https://spgoals.substack.com

'24/25 revenue was €978.3mn. But excluding player sales it grew 15% to €877mn.

Winning the Bundesliga and Club World Cup prize money were major drivers alongside merchandise and sponsorships.

EBITDA grew 11% also due to minor wage bill decrease.

'24/25 revenue was €978.3mn. But excluding player sales it grew 15% to €877mn.

Winning the Bundesliga and Club World Cup prize money were major drivers alongside merchandise and sponsorships.

EBITDA grew 11% also due to minor wage bill decrease.

But that's only €70mn more than #MUFC and has the #UCL win and some CWC money in (c.€60mn+ boost).

Meaning other rev was down, some from Ligue 1 TV money but not spectacular.

www.psg.fr/content/le-p...

But that's only €70mn more than #MUFC and has the #UCL win and some CWC money in (c.€60mn+ boost).

Meaning other rev was down, some from Ligue 1 TV money but not spectacular.

www.psg.fr/content/le-p...

£80mn non-transfer receivables increase gives ability to spend on players going forward.

Risks aplenty, Men’s first team needs to improve to realise this planning.

If it doesn’t work it strengthens INEOS’ hand.

Full report: bit.ly/47UEmqy

£80mn non-transfer receivables increase gives ability to spend on players going forward.

Risks aplenty, Men’s first team needs to improve to realise this planning.

If it doesn’t work it strengthens INEOS’ hand.

Full report: bit.ly/47UEmqy

Full report: bit.ly/42sY216

Full report: bit.ly/42sY216

Report: bit.ly/3JKfpUD

Report: bit.ly/3JKfpUD

Report: bit.ly/47oiGTy

Report: bit.ly/47oiGTy

Report: bit.ly/3JKR9BM

Report: bit.ly/3JKR9BM

But a high squad cost ratio (c.87%) still needs work. More big sales likely needed to make up the shortfall.

Full report: bit.ly/45V0Wgh

But a high squad cost ratio (c.87%) still needs work. More big sales likely needed to make up the shortfall.

Full report: bit.ly/45V0Wgh

bit.ly/47bp1BN

I see a world where the Club can fund a stadium and increase the no. of tickets for regular matchgoers, allow them to partially fund and guide stadium development and leverage lucrative Hospitality seats

bit.ly/47bp1BN

I see a world where the Club can fund a stadium and increase the no. of tickets for regular matchgoers, allow them to partially fund and guide stadium development and leverage lucrative Hospitality seats

bit.ly/4fwicwA

#CFC have freed up £55mn UCL List A headroom but need another £32.5mn to register new signings. Garnacho means they probably need £50n

Nkunku+Jackson is c.£43mn of that. But thereafter we may see some unhappy players.

bit.ly/4fwicwA

#CFC have freed up £55mn UCL List A headroom but need another £32.5mn to register new signings. Garnacho means they probably need £50n

Nkunku+Jackson is c.£43mn of that. But thereafter we may see some unhappy players.

Substack: bit.ly/44jIdv3

• Fraser potentially joining #MUFC academy - helped build #CFC academy with Neil Bath

• Specialises in dom and intl scouting & development

• Since '05 CFC academy generated c.£700mn fees

• Forward thinking in evolving academy operations

Substack: bit.ly/44jIdv3

• Fraser potentially joining #MUFC academy - helped build #CFC academy with Neil Bath

• Specialises in dom and intl scouting & development

• Since '05 CFC academy generated c.£700mn fees

• Forward thinking in evolving academy operations

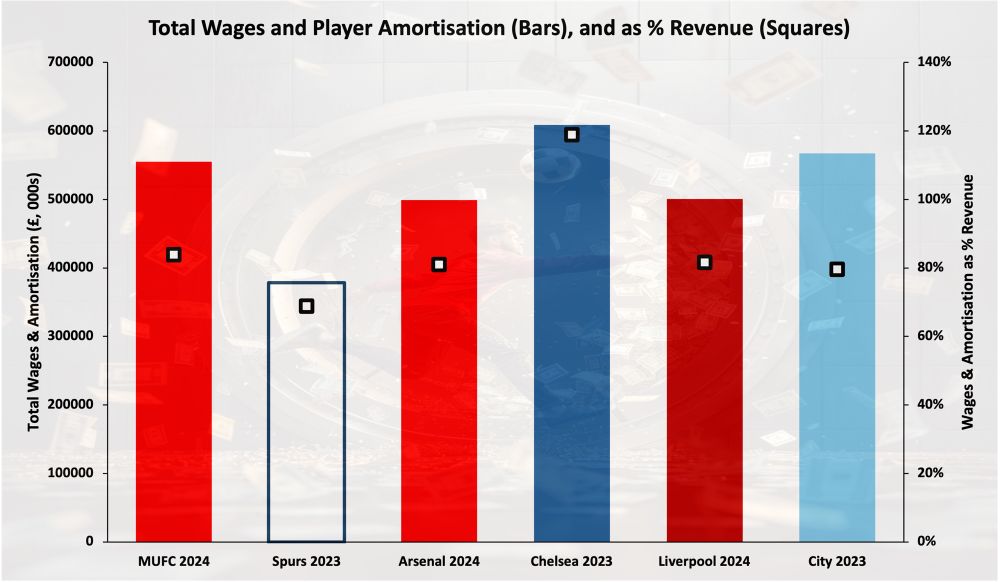

Interesting stuff on Amorim, financial model & direction from here

Reminder chart on EBITDA (profit) margin and free cash flow below

Interesting stuff on Amorim, financial model & direction from here

Reminder chart on EBITDA (profit) margin and free cash flow below

United now have a further vehicle for to fund a new stadium, on better than market terms.

INEOS owned shares give more flexibility for future full ownership options without harming MUFC.

Working capital buffer less likely given £282mn losses in 4 years.

United now have a further vehicle for to fund a new stadium, on better than market terms.

INEOS owned shares give more flexibility for future full ownership options without harming MUFC.

Working capital buffer less likely given £282mn losses in 4 years.

Years of mismanagement, SJR plugging cash gap, fans paying the price #StopExploitingLoyalty

W/o Jim’s $100mn by year end they’d be short on cash

So need to pull every lever but continued poor on pitch performance means they can't use sponsorships like before

Years of mismanagement, SJR plugging cash gap, fans paying the price #StopExploitingLoyalty

W/o Jim’s $100mn by year end they’d be short on cash

So need to pull every lever but continued poor on pitch performance means they can't use sponsorships like before

1. Still phase 1 of squad overhaul, any coach still dealing with that. There will be pain before gain.

2. Amorim is an out and out football person, media duties comment is Mourinho-esque. On the football leadership to back him on it.

3. Not a fan of Ed Sheeran

1. Still phase 1 of squad overhaul, any coach still dealing with that. There will be pain before gain.

2. Amorim is an out and out football person, media duties comment is Mourinho-esque. On the football leadership to back him on it.

3. Not a fan of Ed Sheeran

More tickets, Food & Beverage, better Hospitality and sponsorships. 19k more seats could mean c.£25mn matchday revs. Emirates deal is £50mn/yr until 2028 and incl. Shirt & Stadium rights. If it increases by £10mn/ yr (like before) only another £4mn rev/yr is needed cover interest costs.

More tickets, Food & Beverage, better Hospitality and sponsorships. 19k more seats could mean c.£25mn matchday revs. Emirates deal is £50mn/yr until 2028 and incl. Shirt & Stadium rights. If it increases by £10mn/ yr (like before) only another £4mn rev/yr is needed cover interest costs.

Costs to build or develop stadiums don't go into P&L compliance but if liabilities (debts) are greater than assets then UEFA need to see an improving balance sheet position annually. This means more profit is needed - for #Arsenal not to be inhibited they need £40mn+ /yr from the expansion.

Costs to build or develop stadiums don't go into P&L compliance but if liabilities (debts) are greater than assets then UEFA need to see an improving balance sheet position annually. This means more profit is needed - for #Arsenal not to be inhibited they need £40mn+ /yr from the expansion.

“Cost per seat” could be up to £20k (Spurs, Everton and #MUFC yardsticks) implying total costs of £386mn. Arsenal financials are sound and the Kroenke’s experience in stadium development could see better interest rates for debt funding (10% interest rate = £38.6mn interest cost)

“Cost per seat” could be up to £20k (Spurs, Everton and #MUFC yardsticks) implying total costs of £386mn. Arsenal financials are sound and the Kroenke’s experience in stadium development could see better interest rates for debt funding (10% interest rate = £38.6mn interest cost)