Peter Matejic

@statspeter.bsky.social

1.4K followers

1.3K following

88 posts

Chief Analyst, Insights and Analysis, at the Joseph Rowntree Foundation working to solve UK Poverty

Posts

Media

Videos

Starter Packs

Peter Matejic

@statspeter.bsky.social

· Aug 14

Peter Matejic

@statspeter.bsky.social

· Aug 14

Peter Matejic

@statspeter.bsky.social

· Aug 6

Peter Matejic

@statspeter.bsky.social

· Aug 6

Peter Matejic

@statspeter.bsky.social

· Aug 6

Peter Matejic

@statspeter.bsky.social

· Jul 25

Peter Matejic

@statspeter.bsky.social

· Jul 25

Peter Matejic

@statspeter.bsky.social

· Jul 25

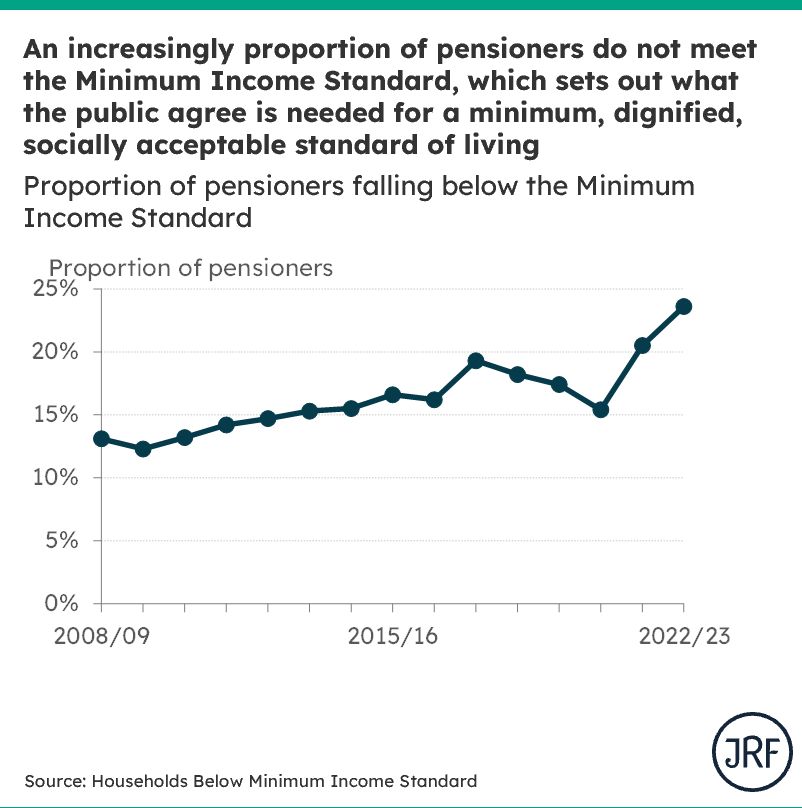

A Minimum Income Standard for the United Kingdom in 2024

The Minimum Income Standard provides a vision of the living standards that we, as a society, agree everyone in the UK should be able to achieve. This report sets out what households need to reach it i...

www.jrf.org.uk

Peter Matejic

@statspeter.bsky.social

· Jul 25

Starmer's missed milestone? The outlook for living standards at the Spring Statement

While on average all families are forecast to see a fall in living standards this Government, families on the lowest incomes are set to bear the brunt of the pain.

www.jrf.org.uk

Peter Matejic

@statspeter.bsky.social

· Jul 25

Peter Matejic

@statspeter.bsky.social

· Jul 24

Pensioner Poverty: challenges and mitigations - Committees - UK Parliament

Are pension age benefits and the State Pension enough to stop pensioners from falling into poverty? We are looking at the state of pensioner poverty in the UK. Which groups are most affected? Wh...

committees.parliament.uk

Peter Matejic

@statspeter.bsky.social

· Jul 24

Peter Matejic

@statspeter.bsky.social

· Jul 24