Thomas Drechsel

@tdecon.bsky.social

780 followers

320 following

15 posts

German macroeconomist. Assistant professor at the University of Maryland. PhD from the London School of Economics.

https://econweb.umd.edu/~drechsel/

Posts

Media

Videos

Starter Packs

Thomas Drechsel

@tdecon.bsky.social

· Apr 23

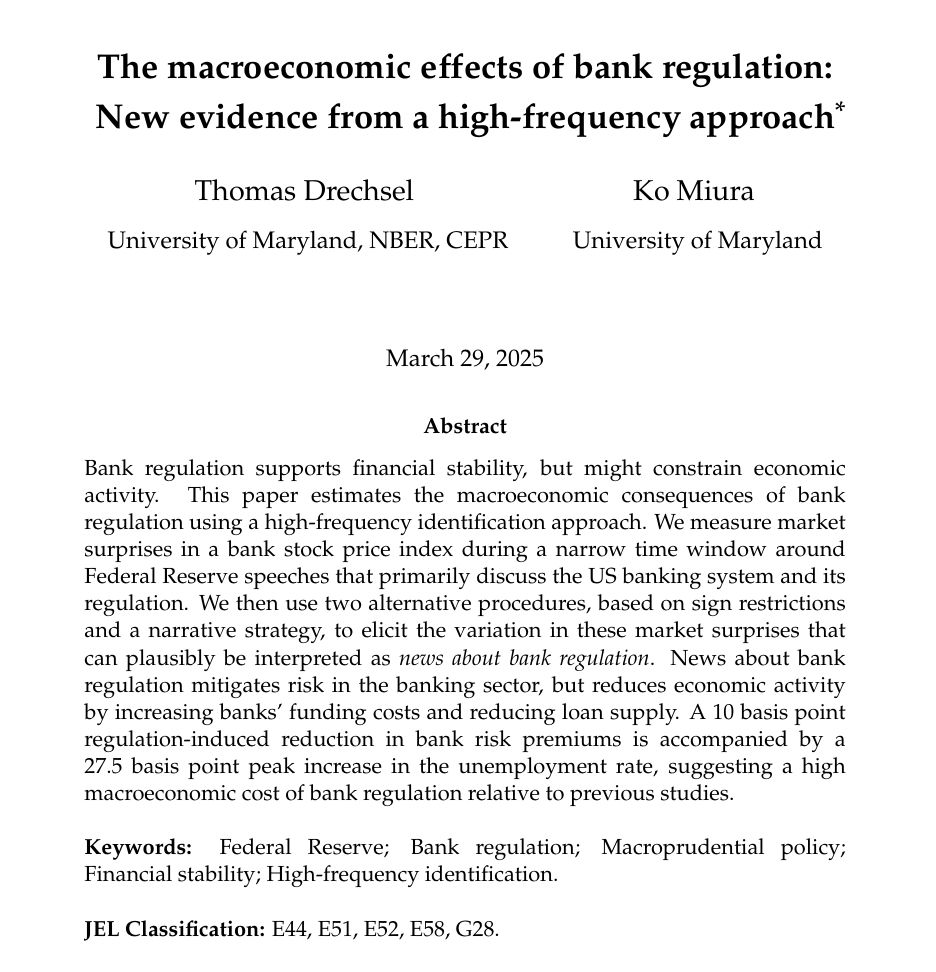

Thomas Drechsel

@tdecon.bsky.social

· Feb 26

Thomas Drechsel

@tdecon.bsky.social

· Feb 20

Thomas Drechsel

@tdecon.bsky.social

· Nov 20

Job Market Candidates 2024-2025 | ECON l Department of Economics l University of Maryland

Coordinators Luminita Stevens Placement Director (301) 405-3515 [email protected] Pablo Ottonello Placement Director (301) 405-7842 [email protected] Nolan Pope Placement Director (801) 995-9184 [email protected] Orpha Jewell Coordinator

www.econ.umd.edu

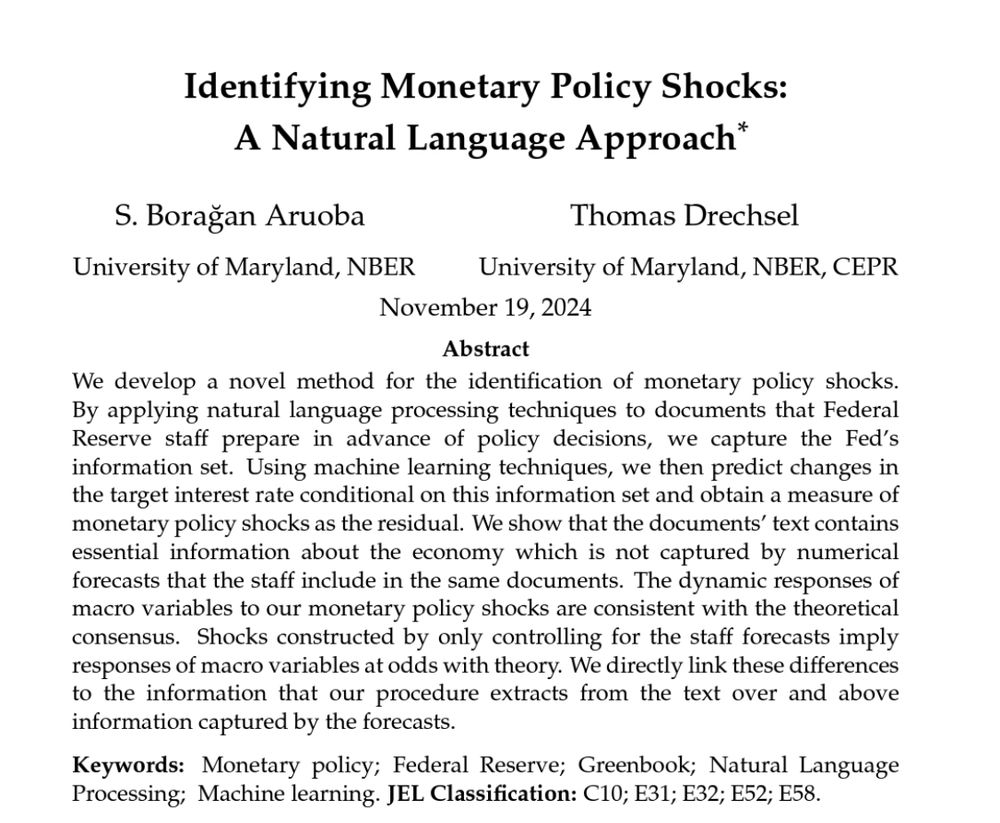

Thomas Drechsel

@tdecon.bsky.social

· Nov 19

Thomas Drechsel

@tdecon.bsky.social

· Nov 14