Troy Teslike

@troyteslike.bsky.social

1.7K followers

4 following

260 posts

Tesla Delivery Estimates: Data-driven & free. Early access on Patreon.

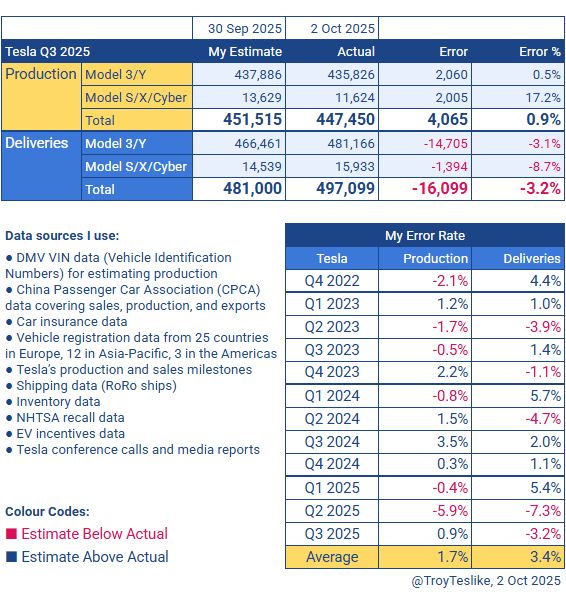

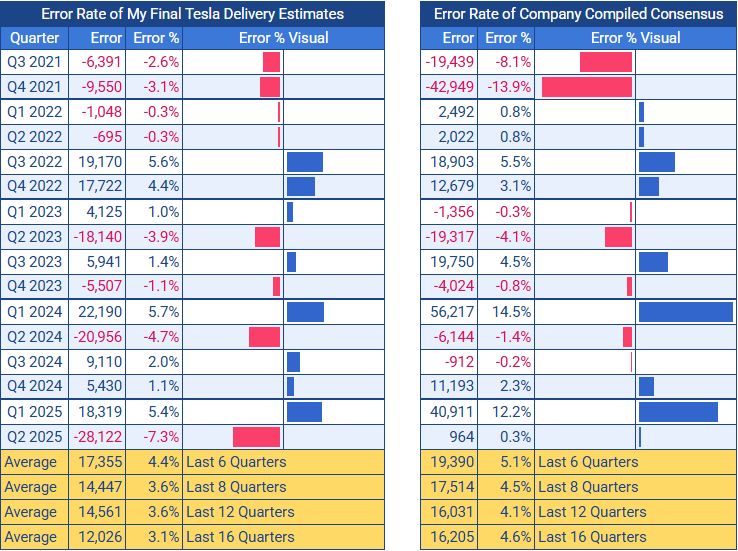

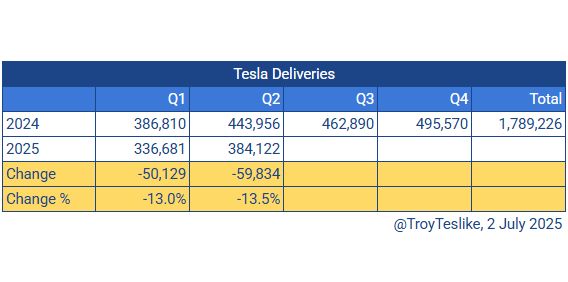

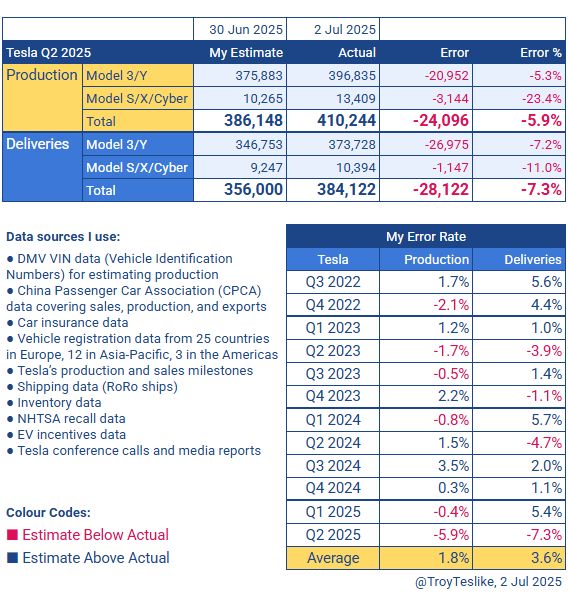

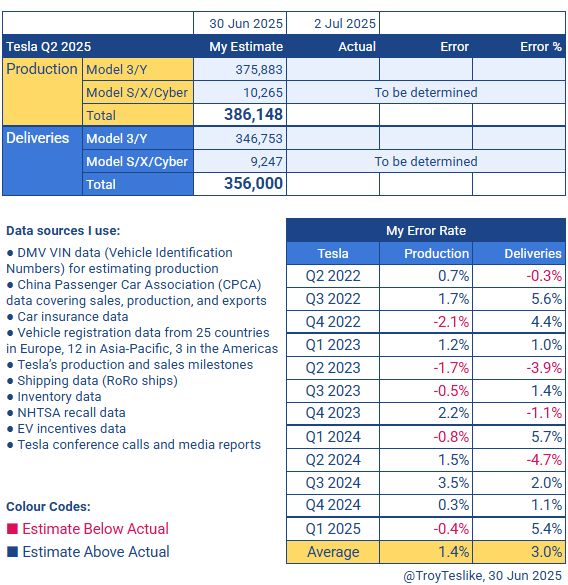

My average error rate is 1.4% for Tesla's production and 3.0% for deliveries.

Posts

Media

Videos

Starter Packs

Troy Teslike

@troyteslike.bsky.social

· Aug 30

Troy Teslike

@troyteslike.bsky.social

· Jul 23

Troy Teslike

@troyteslike.bsky.social

· Jul 17

Troy Teslike

@troyteslike.bsky.social

· Jul 4

Troy Teslike

@troyteslike.bsky.social

· Jul 4

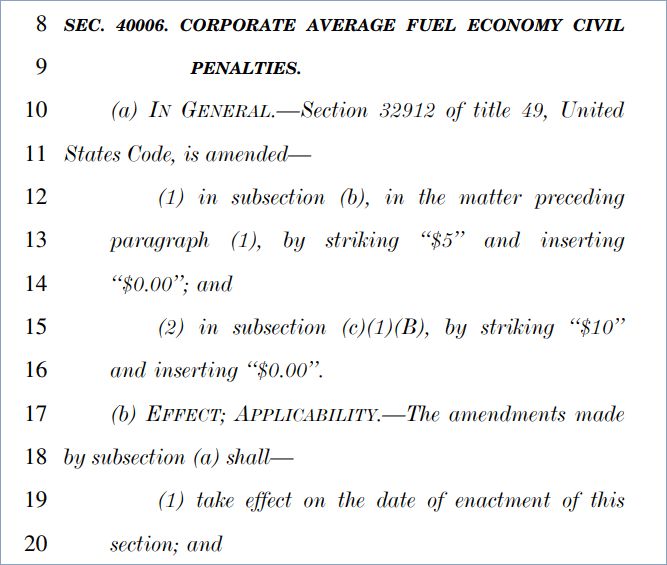

Sawyer Merritt on X: "I just spent hours reviewing the final version of Trump’s “Big Beautiful Bill,” which he will sign into law in the coming days. There's a lot of important stuff related to EVs, renewable energy, and more. Here's everything you need to know: • $7,500 EV credit for new vehicles: https://t.co/CG49KzsQJQ" / X

I just spent hours reviewing the final version of Trump’s “Big Beautiful Bill,” which he will sign into law in the coming days. There's a lot of important stuff related to EVs, renewable energy, and more. Here's everything you need to know: • $7,500 EV credit for new vehicles: https://t.co/CG49KzsQJQ

x.com

Troy Teslike

@troyteslike.bsky.social

· Jun 30