tyba.ai

Strategic pricing of AS vs energy is key — and helped us capture $1200/MWh week 1 🔗 www.tyba.ai/resources/gu...

Strategic pricing of AS vs energy is key — and helped us capture $1200/MWh week 1 🔗 www.tyba.ai/resources/gu...

Case study: bit.ly/4rlNYSC

Case study: bit.ly/4rlNYSC

Register >> zoom.us/webinar/regi...

#energysky

Register >> zoom.us/webinar/regi...

#energysky

#energysky #🔋

#energysky #🔋

📉 Avg RT energy prices only exceeded $500/MWh in 3 intervals

🔋 Top earners net $6.19/kW-mo, median earned $2.13

⭐ Top performer captured 90% of their DA TB2, median caught 46%

Deep dive >> bit.ly/3Vmh6dK

📉 Avg RT energy prices only exceeded $500/MWh in 3 intervals

🔋 Top earners net $6.19/kW-mo, median earned $2.13

⭐ Top performer captured 90% of their DA TB2, median caught 46%

Deep dive >> bit.ly/3Vmh6dK

⬆️ DA cleared $65-200/MWh higher than RT

↕️ Biggest spread was on 8/12: load forecast was high (83GW+) & wind forecast was low (~7GW)

ERCOT was bracing for scarcity that didn't materialized - and many operators are missing DA opportunities.

⬆️ DA cleared $65-200/MWh higher than RT

↕️ Biggest spread was on 8/12: load forecast was high (83GW+) & wind forecast was low (~7GW)

ERCOT was bracing for scarcity that didn't materialized - and many operators are missing DA opportunities.

AS comprised the majority of revenue (58%)

The most successful operators were dynamic – able to capture RT price spikes when they materialized (looking at you, May 16th), but prioritized AS when it made sense.

#energysky

AS comprised the majority of revenue (58%)

The most successful operators were dynamic – able to capture RT price spikes when they materialized (looking at you, May 16th), but prioritized AS when it made sense.

#energysky

📍 2,400 locations

🗺️ 7 ISOs

🔋 Simulated participation in DA, RT, and AS markets under varied market conditions

📈 Identified where batteries provide the greatest ROI

www.businesswire.com/news/home/20...

#energysky #storage

📍 2,400 locations

🗺️ 7 ISOs

🔋 Simulated participation in DA, RT, and AS markets under varied market conditions

📈 Identified where batteries provide the greatest ROI

www.businesswire.com/news/home/20...

#energysky #storage

A reduction in new supply only leads to an increase in electricity prices... which means generation and storage assets increase in value. #energysky

www.tyba.ai/resources/in...

A reduction in new supply only leads to an increase in electricity prices... which means generation and storage assets increase in value. #energysky

www.tyba.ai/resources/in...

📈 Top 20 earners avg $4.75/kW, capturing 89% of DA TB2 and 64% of RT TB2

🔋 Top 20 performers (by TB2 capture) avg $4.39/kW, capturing 99% of DA TB2 and 71% of RT TB2

🕝 RT energy comprised 50% of fleet revenue (up from 43% in Q1 and 26% in 2024)

#energysky

📈 Top 20 earners avg $4.75/kW, capturing 89% of DA TB2 and 64% of RT TB2

🔋 Top 20 performers (by TB2 capture) avg $4.39/kW, capturing 99% of DA TB2 and 71% of RT TB2

🕝 RT energy comprised 50% of fleet revenue (up from 43% in Q1 and 26% in 2024)

#energysky

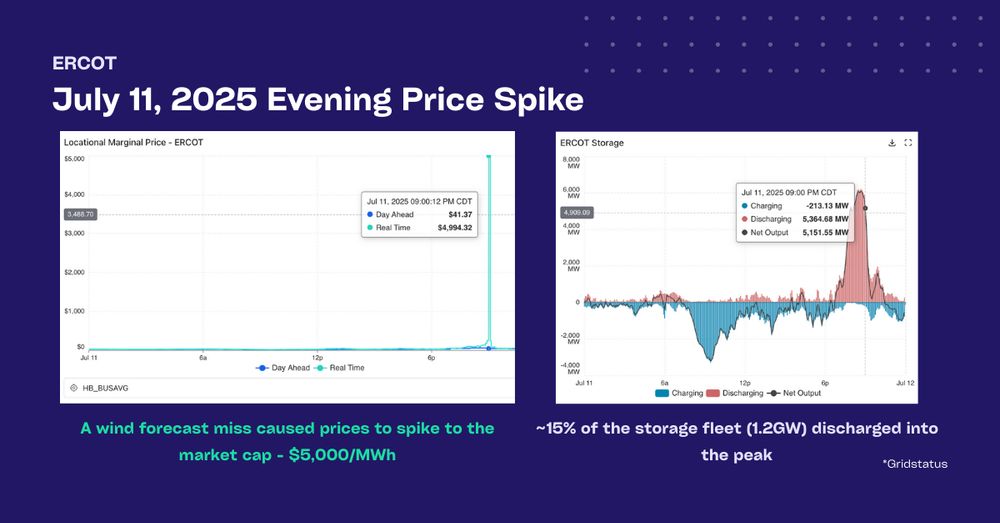

Caused by a wind miss (4-5 GW wind generation miss vs. DA forecasted P50 value), #ERCOT needed to quickly replace the capacity - RT energy prices shot up the market cap ($5K).

Caused by a wind miss (4-5 GW wind generation miss vs. DA forecasted P50 value), #ERCOT needed to quickly replace the capacity - RT energy prices shot up the market cap ($5K).

Energy storage is fast becoming the grid’s most valuable resource — but realizing its full potential depends on:

⚡ Software to navigate market and grid complexity in real time

🎨 ISO and market design that unlocks and values its flexibility

Energy storage is fast becoming the grid’s most valuable resource — but realizing its full potential depends on:

⚡ Software to navigate market and grid complexity in real time

🎨 ISO and market design that unlocks and values its flexibility

High prices were driven by RTORPA, an adder that pays if you're online with headroom to discharge. Batteries with SoC and no AS obligations get the full value of the adder. #energysky

High prices were driven by RTORPA, an adder that pays if you're online with headroom to discharge. Batteries with SoC and no AS obligations get the full value of the adder. #energysky

💵 Top earner net $16.06/kW, >3x median

📈 Top performer captured 99% of their DA TB2, ~2x median

💡 64%+ fleet revenue was made in energy products

Deep dive: www.tyba.ai/resources/ca...

#energysky

💵 Top earner net $16.06/kW, >3x median

📈 Top performer captured 99% of their DA TB2, ~2x median

💡 64%+ fleet revenue was made in energy products

Deep dive: www.tyba.ai/resources/ca...

#energysky

What to know:

⚡ NJ aims to contract 1GW of transmission-scale storage

📅 Winners will get a fixed $/MW-yr rate for 15-yrs

💲 Selection mainly based on bid price, consideration for community benefits

🔋 4-hr discharge, must COD within 30 months

What to know:

⚡ NJ aims to contract 1GW of transmission-scale storage

📅 Winners will get a fixed $/MW-yr rate for 15-yrs

💲 Selection mainly based on bid price, consideration for community benefits

🔋 4-hr discharge, must COD within 30 months

At a glance:

📈 Top revenue generators earned $6.26/kW — over 3x the fleet median

🎯 Top performers captured 115% of its DA TB2, while the median came in around 48%

March 2025 breakdown ⬇️

At a glance:

📈 Top revenue generators earned $6.26/kW — over 3x the fleet median

🎯 Top performers captured 115% of its DA TB2, while the median came in around 48%

March 2025 breakdown ⬇️

www.tyba.ai/resources/gu...

www.tyba.ai/resources/gu...

🔋 Seeking projects ranging in size from 40MW–1GW

💵 Projects will earn fixed annual payments per Clean Peak Energy Certificate (CPEC)

🙌 Battery owners retain operational control

Full breakdown: www.tyba.ai/resources/gu...

🔋 Seeking projects ranging in size from 40MW–1GW

💵 Projects will earn fixed annual payments per Clean Peak Energy Certificate (CPEC)

🙌 Battery owners retain operational control

Full breakdown: www.tyba.ai/resources/gu...

But DA comes with increased risk.

How are operators managing this risk - or not?

#energysky #🔋

But DA comes with increased risk.

How are operators managing this risk - or not?

#energysky #🔋

Top assets made $88.96/kW (2.5x median), with 65% of revenue from AS.

Winners shifted to energy arb, in keeping with evolving market dynamics.

More in our breakdown: www.tyba.ai/resources/ca...

#energysky #🔋

Top assets made $88.96/kW (2.5x median), with 65% of revenue from AS.

Winners shifted to energy arb, in keeping with evolving market dynamics.

More in our breakdown: www.tyba.ai/resources/ca...

#energysky #🔋

www.tyba.ai/resources/ca...

www.tyba.ai/resources/ca...

#energysky

www.tyba.ai/resources/gu...

#energysky

www.tyba.ai/resources/gu...

#energysky

#energysky

In Nov 2024 top assets made the majority of revenue from RT energy (per ERCOT 60-day disclosure data). Most was concentrated on two key days.

#energysky

In Nov 2024 top assets made the majority of revenue from RT energy (per ERCOT 60-day disclosure data). Most was concentrated on two key days.

#energysky