Tweets not investment advice

Meanwhile, the supply side has faced one headwind after another. From the largest producers (as below) in the world to smaller developers, supply disruptions remain widespread.

inbusiness.kz/ru/news/krup...

Meanwhile, the supply side has faced one headwind after another. From the largest producers (as below) in the world to smaller developers, supply disruptions remain widespread.

inbusiness.kz/ru/news/krup...

"The Trump administration is considering several executive orders aimed at speeding up the construction of nuclear power plants to help meet rising electricity demand"

www.nytimes.com/2025/05/09/c...

"The Trump administration is considering several executive orders aimed at speeding up the construction of nuclear power plants to help meet rising electricity demand"

www.nytimes.com/2025/05/09/c...

That and much more in this week's newsletter report, including two new portfolio positions

That and much more in this week's newsletter report, including two new portfolio positions

Cameco is leading the way and they could stand to benefit greatly from an AP-1000 buildout program in the country.

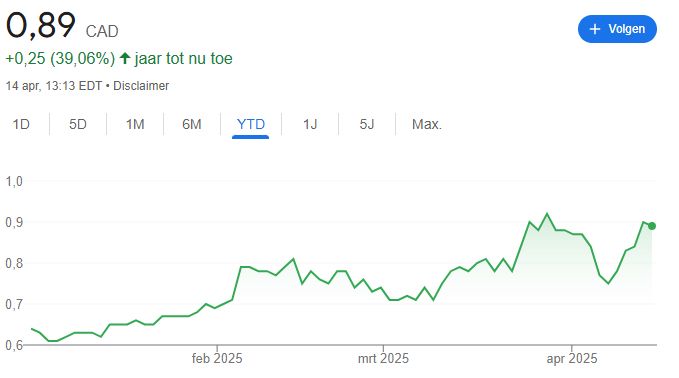

The call options we bought on the Codex in Q1 have more than doubled 📈 (link in my bio)

Cameco is leading the way and they could stand to benefit greatly from an AP-1000 buildout program in the country.

The call options we bought on the Codex in Q1 have more than doubled 📈 (link in my bio)

The long term trajectory remains firmly upward and to the right

The long term trajectory remains firmly upward and to the right

That's not the case in the presentation today and it's clear that the current pricing environment is 'not good enough' for those tier 2 assets. This rings true for other companies as well, which mutes supply.

That's not the case in the presentation today and it's clear that the current pricing environment is 'not good enough' for those tier 2 assets. This rings true for other companies as well, which mutes supply.

#Gold and #silver have been doing very well however and have carried the Codex portfolio YTD. We had some big winners, including 130% profit on AG calls. Link in bio ⤵️

www.patreon.com/posts/124114...

www.patreon.com/posts/124114...

This 'tariff tantrum, episode 3' caused uranium equities to drop on all previous occasions, however today those appears to be remarkably resilient.

This 'tariff tantrum, episode 3' caused uranium equities to drop on all previous occasions, however today those appears to be remarkably resilient.

However, they usually move in something of a cohort. Some come to the table earlier, some are later, but in a replacement rate and inventory restocking cycle, we will see a lot move at once and price will rise.

However, they usually move in something of a cohort. Some come to the table earlier, some are later, but in a replacement rate and inventory restocking cycle, we will see a lot move at once and price will rise.

With India's ambitious nuclear power goals, they will need long term security of uranium supply

More pounds will be staying in the east, prepare accordingly

With India's ambitious nuclear power goals, they will need long term security of uranium supply

More pounds will be staying in the east, prepare accordingly