केंद्रीय बजट 2025: नई व्यवस्था के तहत 12 लाख रुपये तक की इनकम पर कोई टैक्स नहीं

www.newsfeedindia.in/2025/02/unio...

#UnionBudget2025 #IncomeTax #TaxReforms #NewTaxRegime #Finance #Budget2025 #NirmalaSitharaman #ModiGovernment #EconomicGrowth

www.newsfeedindia.in/2025/02/unio...

#UnionBudget2025 #IncomeTax #TaxReforms #NewTaxRegime #Finance #Budget2025 #NirmalaSitharaman #ModiGovernment #EconomicGrowth

केंद्रीय बजट 2025: नई व्यवस्था के तहत 12 लाख रुपये तक की इनकम पर कोई टैक्स नहीं

No income tax up to Rs 12 lakh under the new regime; revised slabs & new tax code to simplify compliance. #UnionBudget2025

www.newsfeedindia.in

February 1, 2025 at 7:49 AM

Everybody can reply

Union Budget 2025-26 - How Much Income Tax Rebate Is Available Under Section 87A in New Tax Regime? yespunjab.com?p=96257

#UnionBudget2025 #IncomeTax #Section87A #TaxRebate #NewTaxRegime #BudgetUpdates #FinanceNews #TaxBenefits #IndianEconomy #Budget2025

#UnionBudget2025 #IncomeTax #Section87A #TaxRebate #NewTaxRegime #BudgetUpdates #FinanceNews #TaxBenefits #IndianEconomy #Budget2025

Union Budget 2025-26 - How Much Income Tax Rebate Is Available Under Section 87A in New Tax Regime? - Yes Punjab News

Union Budget 2025-26 raises tax-free income to ₹12 lakh, increases the 87A rebate, and revises tax slabs, offering major relief to salaried individuals and taxpayers.

yespunjab.com

February 22, 2025 at 9:15 AM

Everybody can reply

FM Sitharaman introduces new Income Tax Bill in Lok Sabha yespunjab.com?p=93230

#NirmalaSitharaman #IncomeTaxBill #LokSabha #TaxReform #FinanceMinister #IndianEconomy #Budget2025 #NewTaxRegime #TaxUpdates #ParliamentSession

#NirmalaSitharaman #IncomeTaxBill #LokSabha #TaxReform #FinanceMinister #IndianEconomy #Budget2025 #NewTaxRegime #TaxUpdates #ParliamentSession

FM Sitharaman introduces new Income Tax Bill in Lok Sabha - Yes Punjab News

Finance Minister Nirmala Sitharaman introduces the Income Tax Bill 2025 to simplify tax laws, reduce legal disputes, and modernize India’s tax framework.

yespunjab.com

February 13, 2025 at 11:00 AM

Everybody can reply

Master the Art of Tax Calculation! 💰📊 Learn how to compute your taxes under the new income tax regime and plan your finances wisely! ✅

.

.

.

#IncomeTax #TaxPlanning #FinanceTips #TaxCalculation #MoneyMatters #SmartInvesting #NewTaxRegime #FinancialLiteracy #SaveMoney #TaxSaver

.

.

.

#IncomeTax #TaxPlanning #FinanceTips #TaxCalculation #MoneyMatters #SmartInvesting #NewTaxRegime #FinancialLiteracy #SaveMoney #TaxSaver

February 3, 2025 at 1:40 PM

Everybody can reply

#UnionBudget2025 #Budget2025 #IndiaBudget2025 #BudgetHighlights2025 #FinanceMinisterBudget2025 #BudgetExpectations2025 #NewTaxRegime #TaxReform #TaxSystem #IncomeTax #TaxPolicy #TaxPayers #TaxRelief #TaxSavings #TaxReform2025 #SimplifiedTax

February 1, 2025 at 7:19 AM

Everybody can reply

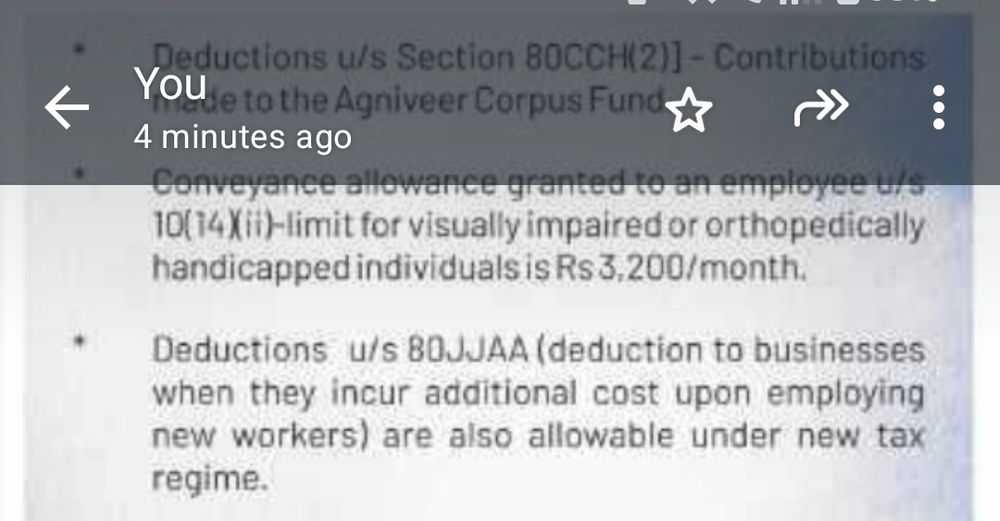

Deduction/Exemption available in new Tax Regime.

1. Standard deduction Rs 75000 for salaried Individuals.

2. Rebate under sec 87A - Rs 60,000

3. Employers contribute to NPS - 14% of salary.

4. Contribution made to Agniveer scheme.

#NewTaxRegime #Deductionundernewregime #AgniveerScheme #80jja

1. Standard deduction Rs 75000 for salaried Individuals.

2. Rebate under sec 87A - Rs 60,000

3. Employers contribute to NPS - 14% of salary.

4. Contribution made to Agniveer scheme.

#NewTaxRegime #Deductionundernewregime #AgniveerScheme #80jja

October 10, 2025 at 5:03 AM

Everybody can reply

Union Budget 2025 - 2026

#NewTaxRegime #TaxReform #IncomeTax #TaxChanges #TaxBenefits #TaxSavings #TaxReforms2025 #IncomeTaxRegime #TaxPayers #TaxSimplification #TaxPolicy

#NewTaxRegime #TaxReform #IncomeTax #TaxChanges #TaxBenefits #TaxSavings #TaxReforms2025 #IncomeTaxRegime #TaxPayers #TaxSimplification #TaxPolicy

February 1, 2025 at 7:21 AM

Everybody can reply