The Chicago Fed Financial Conditions Index in Oct 2025 came in at -0.55, down from -0.54 the prior month.Negative values indicate financial conditions that are looser than average. #econsky

On 03 Oct the Nominal Emerging Market USD Index stood at 131.8096. Relative to a month ago, this is approx. a decrease of -0.3%. Relative to a year ago, USD is about -0.25% lower. The index is weighted against a broad subset of emerging market currencies #exchangerates #econsky

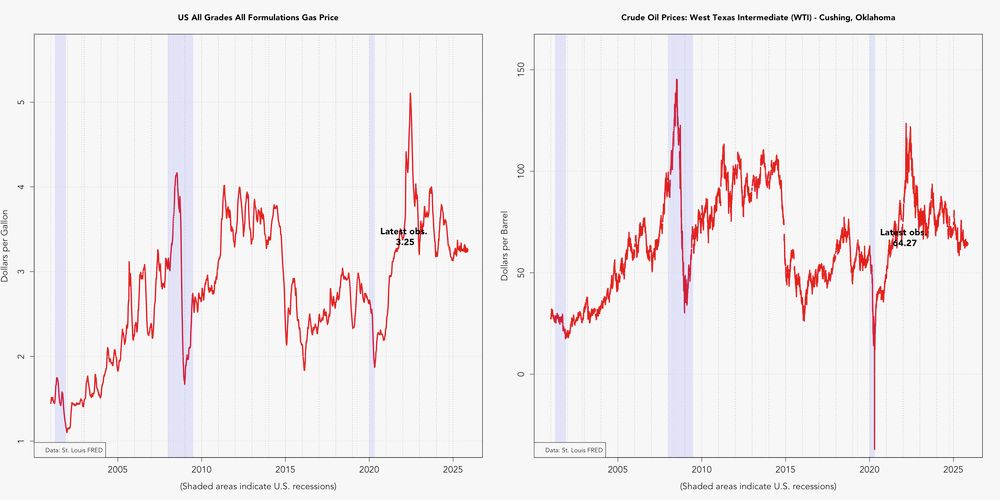

7-day weighted av. for Diesel currently at $3.71, down -4.3 cents from last week. Diesel engines in trucks, trains, boats, and barges transport nearly all products people consume. Relative to 12 months ago, this is a $0.13 increase. #econsky

7-day weighted av. price for gas currently at $3.25, up 0.5 cents from last week. Relative to 12 months ago, this is a -1 cent decrease. #inflation #econsky

Banking and Finance Job Postings on Indeed in the United States at 95.8of the pre-pandemic baseline of 100% #econsky #indeed

How will dramatically lower energy consumption affect relative pricing of crypto currencies? Since the 'merge' on Sept. 15, 20222 Ethereum has gained approx. 218.69% in value, while Bitcoin has gained approx. 534% #crypto #econsky

On 03 October the Nominal Broad U.S. Dollar Index stood at 120.5163. Relative to a month ago, this is approx. a decrease of -0.07%. Relative to a year ago, USD is about -1.58% lower. The index is weighted against a broad group of trading partners #exchangerate #usd #econsky

Total Assets for all Commercial Banks have increased from 24405.5961 last week to 24483.9399 on 24 September. Relative to a year ago, this represents an increase of about 4.38%. Evolution of the main asset categories shown in the chart below #commercialbanks #assets #econsky

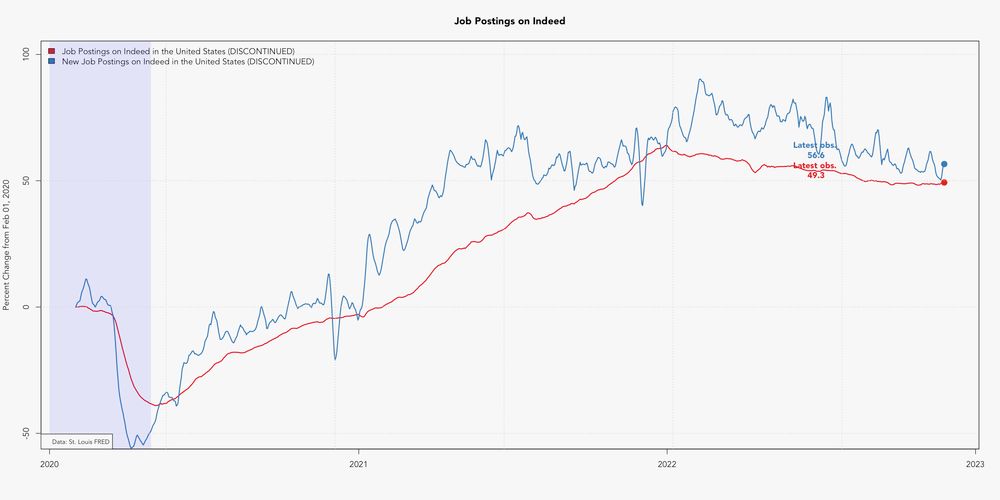

High-frequency labor market update: On 25 November postings on job site Indeed were 49.3% above their pre-pandemic level. New job postings, defined as on Indeed for seven days or less, are 56.6% above their pre-pandemic level #jobs @indeed #econsky

Corporate Bond Market Update: Using data as of 03 October, Moody's Seasoned Aaa Corporate Bond Yield for bonds with 20+ years maturity is at 5.18% for the AAA (down -0.07p.p. from the prior week). The BAA is at 5.79%. #econsky

Bitcoin at $123496.62; Ethereum at $4513.89. Bitcoin is about 11.1% up from a month ago, and about 95% up from a year ago. Ethereum is about 4.8% up from a month ago and about 82% up from a year ago. #crypto #econsky

Reposted by: Philipp Maier, Melissa Sweet

Breaking News: The Nobel Prize in Physiology or Medicine was awarded to Mary Brunkow, Fred Ramsdell and Shimon Sakaguchi for their work on immune systems.

Nobel Prize in Physiology or Medicine Is Awarded for Work in Peripheral Immune Tolerance

Mary E. Brunkow, Fred Ramsdell and Shimon Sakaguchi were awarded the prize on Monday.

nyti.ms

Comparing the evolution of job posting on Indeed for Germany and the UK since the pandemic. All posting indexed to 100% on Feb. 1, 2020 #econsky #indeed

At the end of this week, the GDPNow forecast from the Altanta Fed for Q3 2025 stands at at 3.84%. GDPNow is a nowcasting model for GDP growth projecting 13 GDP subcomponents with monthly source data, a factor model and a BVAR. #econsky

The average rate on a U.S. 30-Year Fixed Rate Conforming #mortgage on 02 October was at 6.253%. Relative to the prior week, the rate has fallen by about -0.03 p.p. #mortgagerates #econsky

Banks' Balance Sheets Post-Pandemic Fueled by Higher Cash and Treasuries/Agencies Holdings #BankLending #econsky

#Auto Inventory-to-sales ratio at 1.426 in Aug 2025, down -0.08 from prior month. Historically, dealers typically hold over 2 months of #inventory. #econsky

Domestic Auto Inventory at 217.092K units in Aug 2025, down -5.08K units from prior month #econsky

#Vehicle sales for Aug 2025 at 16.402M units, down -0.07M units from prior month #econsky

5Y Breakeven Inflation Rate at 2.37%, down from 2.42% last week; 10Y Breakeven Inflation at 2.34%. Breakeven inflation uses the difference between Constant Maturity and Inflation-Indexed Constant Maturity Treasuries to calculate market expectations #inflation #econsky.

10Y #Treasury is at 4.1%, down from 4.12% last week. How are shorter-term interest rates contributing to the change in the yield curve? #interest #econsky https://tinyurl.com/m7pdyyyf

The U.S. Dollars to U.K. Pound Sterling Spot Exchange Rate stood at 1.3404 USD/GBP last week (26 September). Relative to a month ago, this is -0.8% lower. Relative to a year ago, the exchange rate has risen by 0.1% #exchangerate #gbp #usd #econsky

Last week (26 September) the U.S. Dollars to Euro Exchange Rate was 1.1692 USD/EUR. Relative to a month ago, this is a decrease of approx. 0%. Relative to a year ago, the exchange rate is about 4.8% higher. #exchangerate #eur #usd #econsky

Average US 30-Year Fixed Rate Mortgage last week at 6.34%, up 0.04 p.p. from prior week. 5/1 ARM at 6.1% #mortgage #househunters #econsky

Manufacturers' New Orders for Durable Goods rose by 2.93% in Aug 2025; for Nondurable Goods new orders rose by 0.25% #econsky

Emerging Market Update: Longer-term view of currency movements since the start of the post-pandemic monetary tightening cycle. All currencies indexed to 100 on March 16 (date of the first Fed rate hike); latest data point is 26 Sep #fx #emergingmarkets #econsky

Bitcoin at $119028.01; Ethereum at $4366.3. Bitcoin is about 6.5% up from a month ago, and about 92% up from a year ago. Ethereum is about -1.9% down from a month ago and about 79% up from a year ago. #crypto #econsky

Visualizing currency movements of key US trading partners since the start of the post-pandemic monetary tightening cycle. All currencies indexed to 100 on March 16 (date of the first Fed rate hike); latest data point is 26 Sep #fx #econsky

Uncertainty Update: VIX at 16.28; 7-day average of the Economic Policy Uncertainty Index at 378, up 39.9 from the prior week #vix #MarketVolatility #econsky https://tinyurl.com/3bvx9f5m