Stephen Kinsella

@stephenstroud.bsky.social

5.4K followers

460 following

4.4K posts

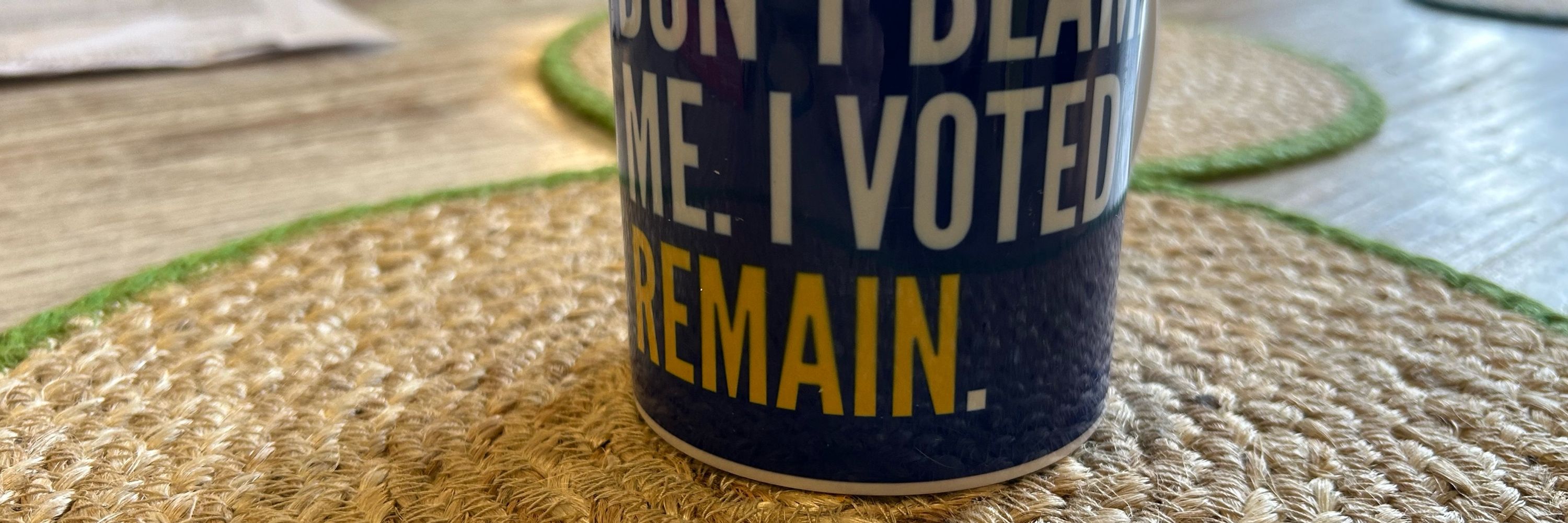

Ex EU Antitrust Lawyer

Chair: Laura Kinsella Foundation, Law For Change, Clean Up The Internet and Press Justice Project;

Board member: Hacked Off and Reprieve;

Director, Stroud Book Festival

Member, UK Trade and Business Commission

Posts

Media

Videos

Starter Packs