The Onion got this letter from one of our subscribers in Alaska. She works with dementia patients and decided to leave a copy in the car for each one.

This email made my year. Read it and you'll see what I mean. People are good.

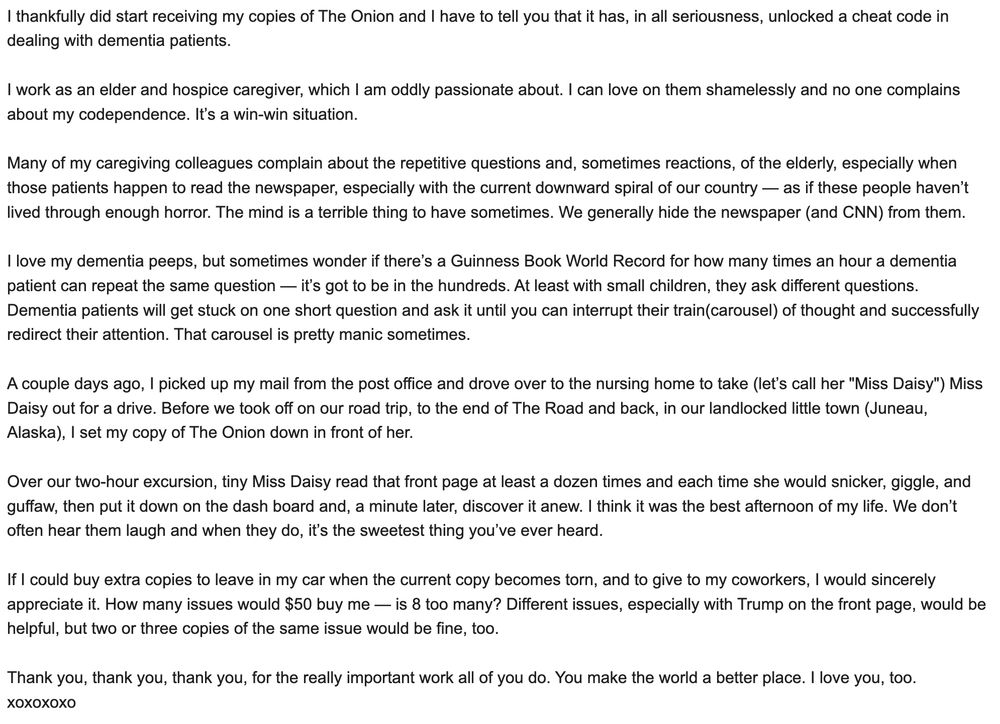

The Onion got this letter from one of our subscribers in Alaska. She works with dementia patients and decided to leave a copy in the car for each one.

This email made my year. Read it and you'll see what I mean. People are good.

Our latest analysis looked at 8 years of data from 59 banks in the US, EU and UK.

www.risk.net/risk-quantum...

Our latest analysis looked at 8 years of data from 59 banks in the US, EU and UK.

www.risk.net/risk-quantum...

This time, we analysed Groupe BPCE, which saw CVA capital charges more than double following the switch to the basic approach.

www.risk.net/risk-quantum...

This time, we analysed Groupe BPCE, which saw CVA capital charges more than double following the switch to the basic approach.

www.risk.net/risk-quantum...

BNP Paribas's operational risk capital charges up 60% as the bank retired its internal model and adopted the new standardised approach prescribed by the framework.

www.risk.net/risk-quantum...

BNP Paribas's operational risk capital charges up 60% as the bank retired its internal model and adopted the new standardised approach prescribed by the framework.

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

www.harvard.edu/president/ne...

www.harvard.edu/president/ne...

The accounting treatment matters because it'll determine how much of the recent price slump will feed through to banks’ balance sheets.

The accounting treatment matters because it'll determine how much of the recent price slump will feed through to banks’ balance sheets.

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

*AMAZON'S CANCELLED ORDERS AFFECT MULITPLE PRODUCTS, VENDORS

www.risk.net/risk-quantum...

www.risk.net/risk-quantum...

www.risk.net/markets/7961...

www.risk.net/markets/7961...

DANG

www.risk.net/regulation/7...

DANG

www.risk.net/regulation/7...